I recently spotted this post from Panagiotis Kriaris, who leads business development at Unzer:

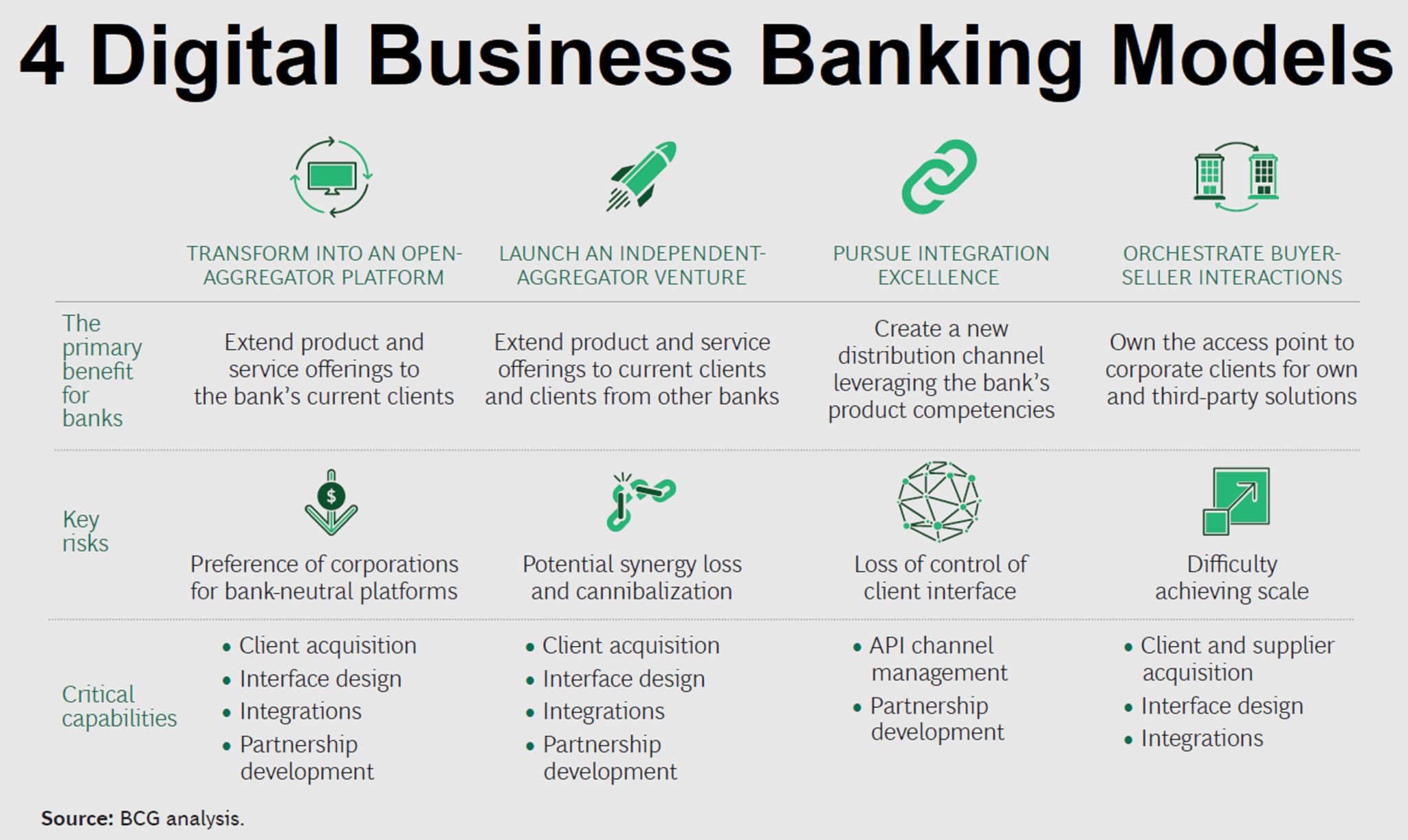

In the era of #APIs, #openbanking and #openfinance, banking has become a totally different game vs what it used to be calling for equally adapted business models. Let’s take a look at #businessbanking and at 4 potential #digital models for banks.

- Transform the online-banking platform into an open-aggregator platform in order to retain control of the client interface while giving clients an extended 360-degree view across multiple banks.

- Develop a non-proprietary market-leading platform that features multibank #aggregation and third-party #ecosystem offerings but run it as an independent initiative.

- Pursue integration excellence: Rather than try to control the client interface, in this option banks could integrate their offerings into third-party systems and compete on product and service quality. Success lies in enabling key products and services with APIs that can be reused across channels in a cost-effective and scalable way.

- Orchestrate buyer-seller interactions: Banks defend the customer interface by offering attractive #payments solutions and by creating a convenient bank-managed buyer-seller ecosystem. Under this model, buyers and suppliers could upload their invoices, integrate payments, and access working-capital solutions. Invoice reconciliation would become significantly easier because both buyer and supplier would be on the same platform.

Adapted from: BCG, Global Payments

It made me think.

It made me think that no bank is playing these lines.

It made me think that no bank is thinking along these lines.

It made me think that no bank wants to be a bit player in a bitcoin world.

It made me think that any bank who strategically tries to follow any of these models will probably fail.

Why?

Because banks have evolved into a massive Rubik’s Cube of parts. They have geographic focus; product focus; segmentation; multiple moving parts; retail, commercial and investment services; differing divisions with differing focus; and so on. Every segment of the cube is connected but needs different management, different focus, different structures, different organisation and different systems.

Banks are not some homogeneous structure that can follow one of four business models; banks are complex structures with different models for each one. The only commonality is that they are all within the digital business model of 21st century banking: front-office apps, middle-office APIs and back-office analytics.

The thing is that anyone who presents a strategic model for a bank based on a singular dimension is offering the wrong solution. You need a multi-dimensional model. A Rubik's model if you like. In fact what Panagiotis’s update made me think is: where is the Rubik’s Cube strategy for a multi-dimensional bank?

Answer: there isn’t one. That’s why becoming a bank CEO today is such a tough job. What you are actually doing is running a group of subsidiaries with different focal points. One of those subsidiaries may well be a bank that aggregates, partners and orchestrates … but that will be just one of your banks.

In effect, you have multiple banks in the stable. This is why no one solution fits-all approach works. You need to adapt dependent upon the focus and the customer.

This kind of makes me smile as, when I write, most of my focus is on payments and retail banking. That’s just one little piece of the pie. The pie is much bigger. There’s B2B, G2B, G2C, B2B2C, G2B2B2C and so no. No one size fits-all. Keep that in mind please.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...