Some years ago, I regularly talked about bankers being criminals.

It’s not a popular theme with the banking community but, a bit like a genius, bankers walk that line between good and bad. Genius’s walk the line between amazing and mad. It’s a fine line.

Thing is that there are bad bankers. There are bankers that rob and steal and con. Sometimes they are caught, but more often they are not. In fact, their companies make a habit of trying to cover up bad bankers. After all, if a bank is to be trusted, you don’t want to tell customers that their management, traders, tellers and staff have been doing bad things.

This is the way it is.

What happens is that banks sweep bad stains under the carpet, as long as a visitor does not see them. And who would be the visitor? Oh, the regulator.

So, when I got a ping from a PR intern telling me that one bank has paid almost $83 billion in fines over the last twenty years – yes, $83 billion! – my ears pricked up.

$83 billion. That’s a lot money in fines.

In fact, this one bank paid almost $17 billion in 2014 for its bad behaviours. So, bankers do bad things – there are criminals within banks – and then they pay for their misdeeds. But $17 billion in one fine and $83 billion over two decades kind of indicates that the bank is behaving badly.

Who is this bank? Where is it? How do they get away with it? Why are they not just shut down?

Well, it’s that fine line. The fine line between good and bad. The fine line between having millions of customers and lots of government accounts, versus doing good business and giving great returns to shareholders.

Oh, and if you’re that interested, the bank in question is Bank of America.

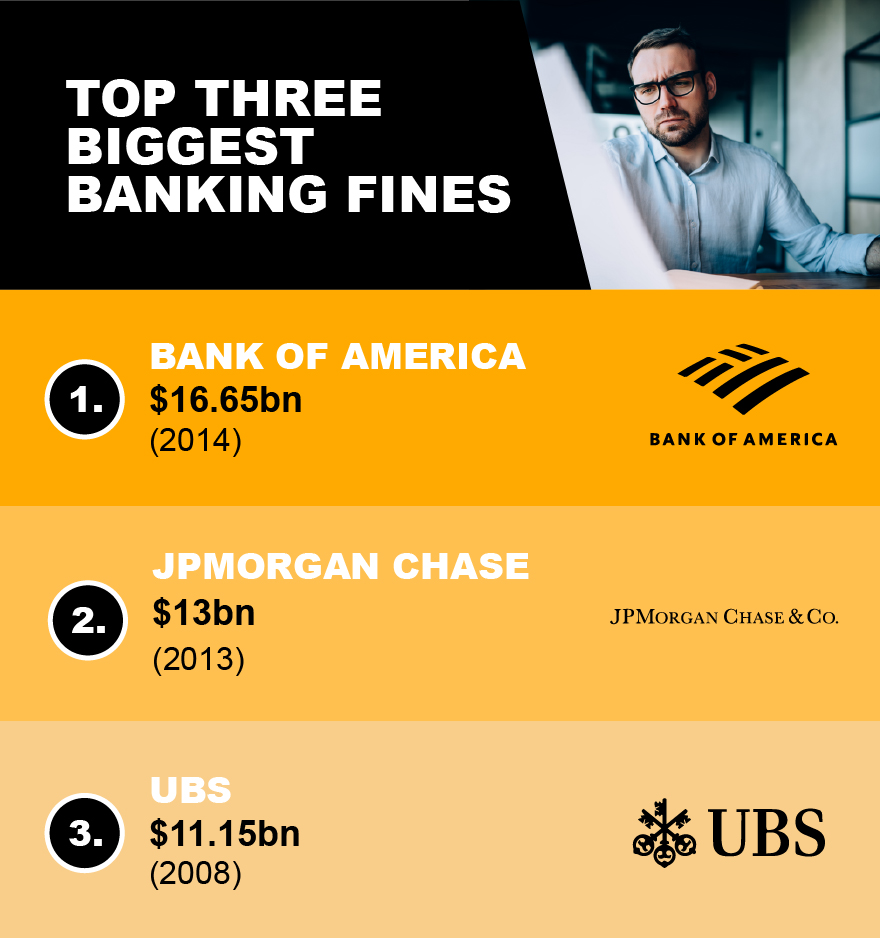

Bank of America - $16.65bn (2014)

The Bank of America actually accounts for half of the top ten biggest fines of all time, but by far the biggest was the one that they incurred in 2014, for knowingly selling toxic mortgages to investors, a big contributor to the financial crisis of the late 2000s. The selling of these mortgages ultimately led to a housing bubble that burst spectacularly, with ramifications for the global economy for years to come, and the bank was fined a then-record $16.65bn.

JPMorgan Chase - $13bn (2013)

Another of the big US banks, JPMorgan Chase takes second place, with JPMorgan Chase being forced to pay $13bn in 2013, which again was a record fee at the time. Similarly to Bank of America’s mega-fine, it was to do with toxic securities abuses in the time of the financial crisis and was agreed upon after lengthy negotiations with the US Justice Department.

UBS - $11.15bn (2008)

Swiss investment bank UBS was fined $11.15bn for investor protection violation offences, agreeing to buy back $11bn in securities and pay an additional $150m fine. They were found guilty of misrepresenting auction rate securities to investors, concealing the true liquidity risk of the products.

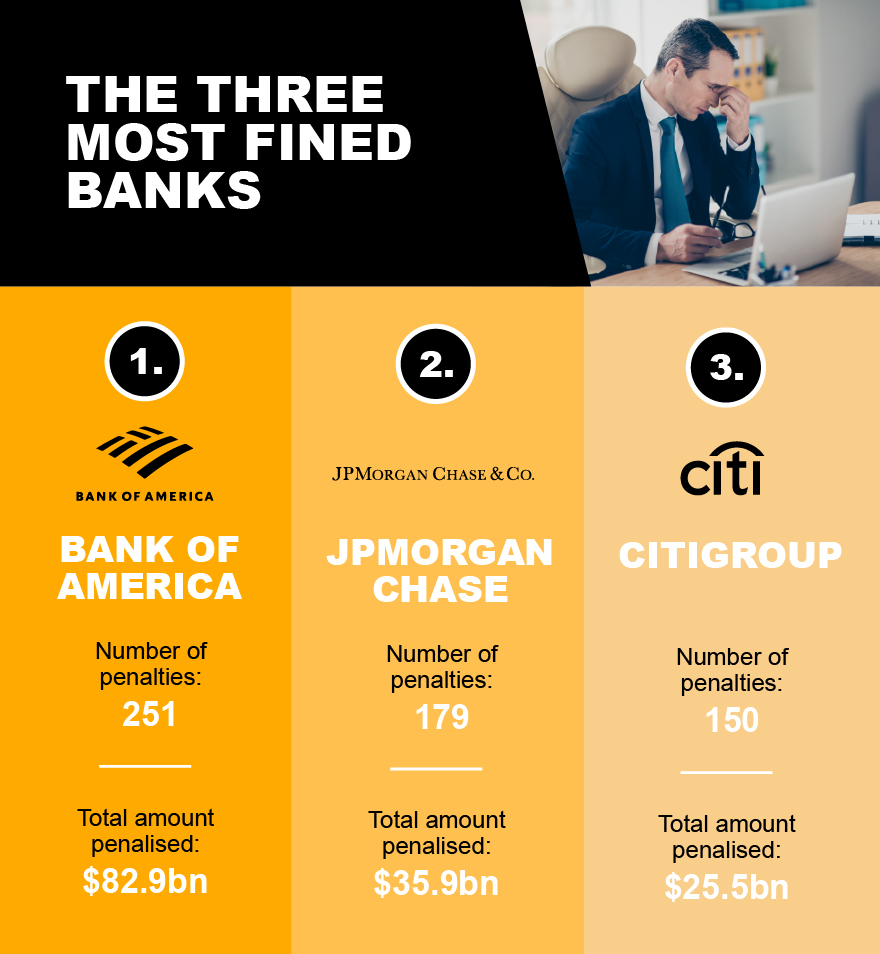

Bank of America - number of penalties: 251 - total amount penalised: $82.9bn

We’ve already seen that the Bank of America has the dubious honour of the largest one-off fine of all financial organizations, but that still only makes up a fairly small percentage of the total amount that they’ve been fined over the years, clocking up a total of over $82bn across 251 different fines over the past 20 years. Many of these fines relate to the 2008 financial crisis and companies that Bank of America bought during this time such as Merrill Lynch and Countrywide.

JPMorgan Chase - number of penalties: 179 - total amount penalised: $35.9bn

As was the case with one-off fines, JPMorgan Chase takes second place behind Bank of America, although by some distance, with fines totalling $35.9bn. The biggest of these was for $13bn in 2013 and one of the most recent was a $250m fine over weak controls in its wealth management division in 2020.

Citigroup - number of penalties: 150 - total amount penalised: $25.5bn

The Citigroup investment bank and financial services corporation has been fined over $25bn across 150 different fines over the years, with the biggest of these being $7.1bn that was bought back in missold securities in 2008. This was closely followed by a $7bn fine with the Justice Department over the group’s role in selling mortgage-backed securities that was paid in 2014.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...