I was intrigued by a new report from the IMF entitled: The Impact of Fintech on Central Bank Governance (you can download it for free).

I was particularly intrigued by its opening:

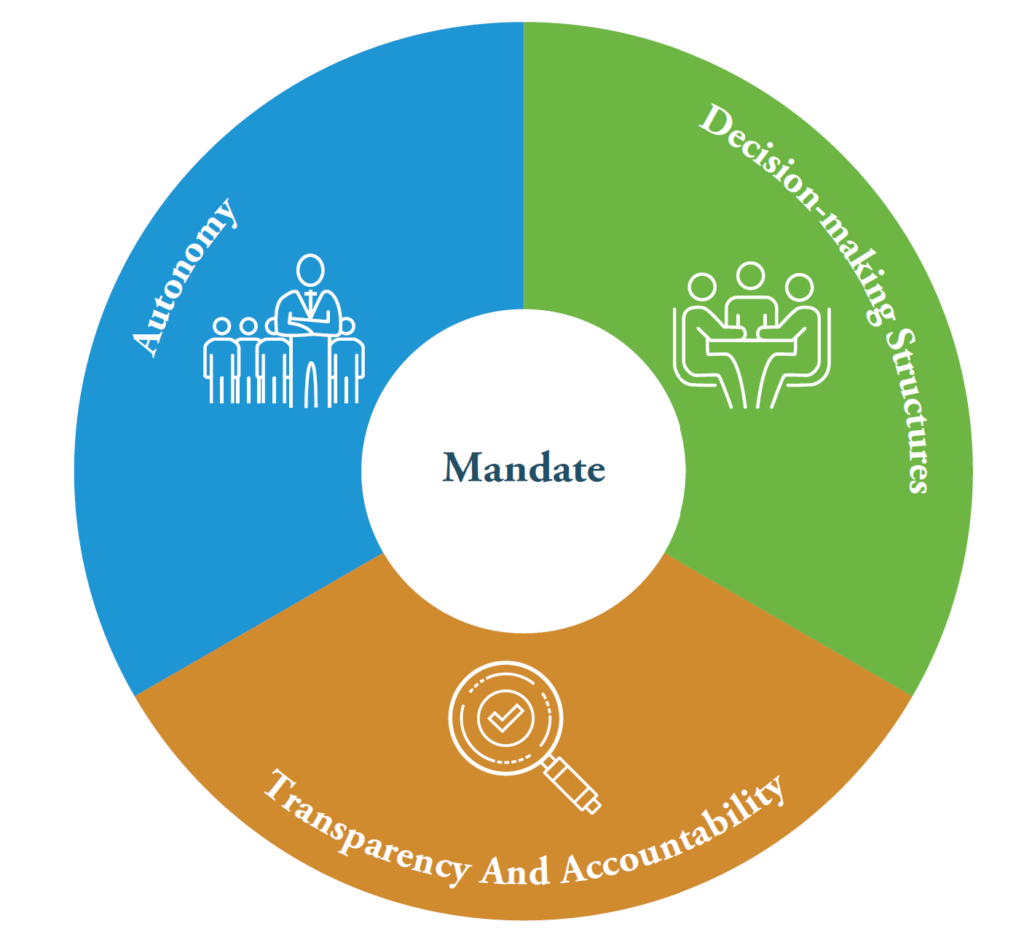

Central bank governance is a concept composed of four constitutive and interrelated components: a central bank’s (i) mandate, comprising its objectives (the “why”), functions (the “what”), and powers (the “how”); (ii) decision-making structures; (iii) autonomy; and (iv) transparency and accountability. The underlying idea is that the mandate shapes the three other components, which, in turn, interact with each other.

Central banks have the mandate from national governments to organise economic activities covering monetary policies, interest rates, lending and more. Cool. But what if they didn’t have the mandate? What if someone else had it?

This is the struggle banks and governments are dealing with today, as banks and governments only operate if they have the backing of the people. That is the mandate. What if the people gave the mandate to someone else? What if the people gave the mandate to the network of the people?

This gets a bit scary, as it’s another red or blue pill moment. What if the mandate is not given to the government?

I wondered about this as I watched the devastating events occurring in Afghanistan. The Taliban have taken over as America withdrew after twenty years. Thousands of people gathered at the airport for evacuation. It’s a terrible moment.

But what if there was a group in Afghanistan – it could even be the Taliban themselves – who ignored what was happening in the physical world and lived virtually. What if there was a clan that lived in basements or attics, who had access to the network. What could the Taliban do about that?

Sure, they could monitor internet traffic and activities across the network, but what if the clan lived on a VPN (Virtual Private Network), and never appeared on the Taliban’s radar? What if they invested in cryptocurrencies and traded through wallets with no tracking or oversight? What if the mandate was theirs and not the governments or faux governments?

Broaden this to scale: can any government keep the mandate in the face of the network?

The answer is yes, but only as long as people move outside the network. But what if they stay inside the network? What if they live a dual life? What if we all become schizophrenic? A real me and a virtual me?

That gets even more scary, but it’s not a dream or nightmare. It is a reality.

I live in reality and you can touch me. I go for meals, pay my taxes, respect authorities, have national IDs and avoid the police.

I also live virtually. You can’t touch me. I don’t need to eat, pay nothing to anyone, respect no-one and my ID is something I created in my head. As for the police … who?

The virtual me lives in another world that I control, and the mandate is mine. The real me lives in this world and the mandate is the governments. The issue for government, particularly during an enforced lockdown, where the real me can do little and the virtual me consumes most of my day, is that the virtual me no longer cares about the real me. Lines are being crossed. We are going somewhere we have never been before. Too many of us are swallowing the red pill. Are we aware of what that means for society, government and the mandate?

Oh, and who owns the mandate?

Answer: The People

FCA says it is ‘not capable’ of supervising crypto exchange Binance

The UK financial regulator has conceded it is “not capable” of properly supervising Binance despite the “significant risk” posed by the cryptocurrency exchange’s products that allow consumers to take supercharged bets. In a supervisory notice two months after starting a crackdown on the exchange, the Financial Conduct Authority repeated its grave concerns over Binance’s governance and products. But it added that Binance’s UK affiliate had “refused” to respond to some of its basic queries, leaving it with few avenues to oversee the sprawling group, which has no fixed headquarters yet offers its services around the world.The statement underscores the scale of the challenge facing authorities in tackling potential risks to consumers buying often unregulated products through nimble cryptocurrency businesses that can often circumvent national bans by giving users access to facilities based overseas.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...