For years, people have argued that you need branches to serve customers for more complex transactions: to serve people who are uncomfortable with digital access; to serve young people getting their first mortgage; to serve retailers and small businesses with their cash needs; and so on and so forth.

Baloney.

To be honest, I’ve advocated some of these ideas myself, specifically the idea that the more complicated the financial transaction, the more likely someone wants to visit a branch and talk to a human. Turns out I’m wrong, but then I’ve also known that for a while.

Reason 1: you’re nervous about dealing with banks over the internet

Prior to COVID-19, only 15% of consumers had spoken to a bank advisor via video call, but nearly half (46%) said they would be willing to do so when branches reopen, and 35% said they would prefer video calls to face-to-face meetings.

Reason 2: you need face-to-face advice for complex transactions

A survey by personal finance website NerdWallet found that with Britain’s biggest banks closing more than 300 branches this year, 63 per cent of 25 to 44-year-olds are now comfortable getting a mortgage online or via an app, without any human interaction.

Reason 3: you need face-to-face support for cash transactions for small businesses and retailers

The Covid-19 pandemic has accelerated the decline of cash, with the volume of UK payments made using notes and coins plunging by 35 per cent in 2020 compared with the previous year.

This is the reason why banks are closing branches big time.

Key insights noted by the study include a 6.5% decline in bank branches since 2012: This trend would see total number of physical banks nationwide fall to fewer than 16,000 by 2030 and all branches closing by 2034.

Mind you, it’s worth noting that the above study was performed by N26, a digital-first bank originating out of Germany. We have ways of making you bank.

So what are branches for?

Well, I’ve said consistently for many years that it’s not about transactions, service or advice. It’s about marketing. It’s about being present. It’s about being there.

It’s all well and good to say that people don’t need branches and can do all online, but there are still segments of society who:

- don’t trust online

- don’t trust mobile apps

- don’t trust digital

- want to see a human

- need contact and presence

… and more.

This is where we continue to build on the Rubik’s cube of banking.

You have to work out where your core market sits. If I go into a bank branch these days, I often find it full of elderly people – is that your core market? I go into some bank branches that have been renovated and are funky with free WiFi and free coffee – is that your core market? I go into some bank branches and find someone in front of me with bags of coins from a local shop – is that your core market?

It’s just as I said almost fifteen years ago:

Banks only have one channel. They do not have multichannels, call centre channels, internet channels, mobile channels and so forth. They just have an electronic channel [I now call this a ‘digital core’] that underscores and provides the foundation for all end points: mobile, telephone, internet and branch.

In fact, I’m still not advocating that branches and banks are dead. We need branches and banks, yet the real question should be: what do we need branches and banks for?

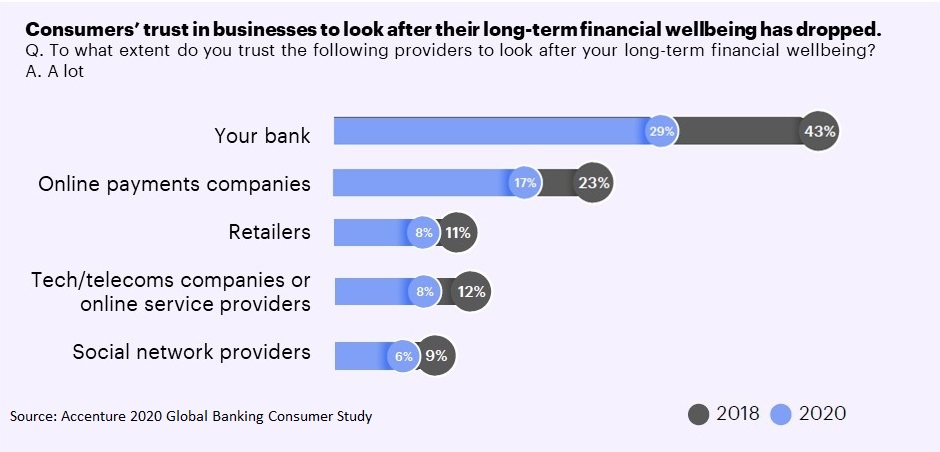

Well, we need banks for storing and exchanging value with trust. The latter part about trust is not that we trust the bank to work in our interests – we don’t …

Source: Accenture

No, we need banks because they are regulated to guarantee they won’t lose our money, unlike the wild west of online schemes and scams. The challenge then is how to guarantee the bank won’t lose our money if we can’t see them?

Invisible banking?

Sounds good until the bank messes up and it needs to be visible so we can ask them to show us the money https://finansernextjs.wpengine.com/2019/12/show-me-the-money/

. Why do you think people queue outside branches whenever there’s a bank headline about possible failings? Because they think that’s where the money is.

So branches are there to provide comfort and trust. It’s marketing. It’s branding. It’s about a physical presence to show you the money. It’s about being there.

So yes, we do need banks and branches. Just a lot less of them.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...