There was a good report the other day from Wells Fargo. The headlines:

- Banks spend $200 billion a year on technology, more than any other industry

- 100,000 banking jobs will disappear through automation in the next five years

- Most will be the low-paid roles in the bank that provide administration services

- 1 in 5 workers in branches will be asked to leave

- This would deliver a 9-point improvement on a banks’ efficiency ratio

- “Developers are the new bankers”

Great!

But maybe not if you’re a branch teller.

Such reports remind me of other crass statements by bank leaders about their workforces, with the standout being former Deutsche Bank CEO John Cryan, who announced that all the box ticking, button pushing accountants would be fired.

John Cryan told an audience in Frankfurt: “In our bank we have people doing work like robots. Tomorrow we will have robots behaving like people. It doesn’t matter if we as a bank will participate in these changes or not, it is going to happen.” He also referred to accountants inside the bank who “spend a lot of time basically being an abacus”, who would also be replaced by machines.

That was 2017.

At the same time, Citigroup said 1 in 3 bank jobs would disappear within five years. That would be 2022.

Hmmm …

There’s two things here. One is efficiency and job cuts; the other is the reality.

On point #1, if my bank was saying all admin and accounting jobs would be lost within five years, and 1000’s of us would be made redundant, would I want to work for that company? I’d move pretty darn quick to another role in another place. Maybe I would learn to code in Python or go shelf-stacking at the supermarket.

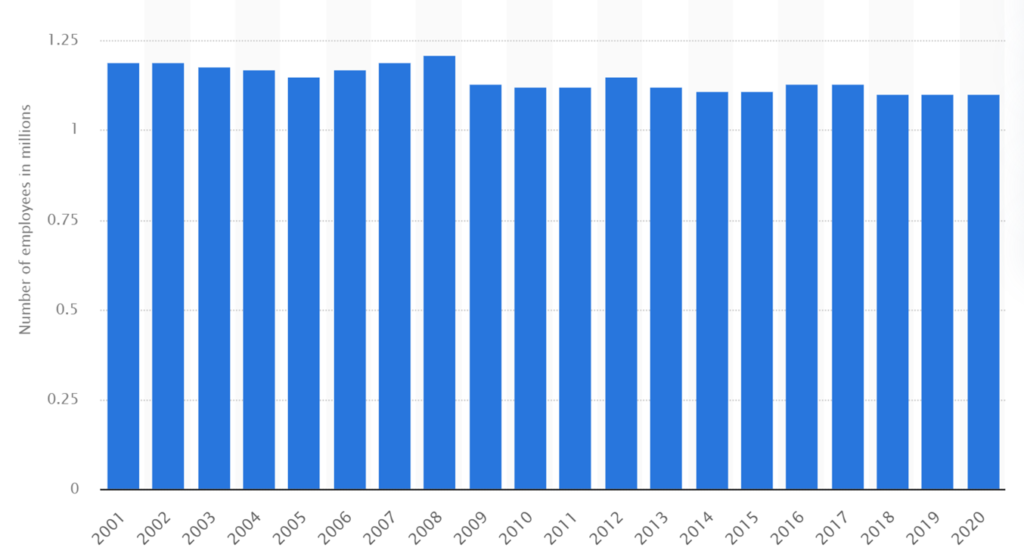

On point #2, there’s the reality. Are there really any job cuts? According to Statista, no.

There may be a shift in job roles, with branch staff moving to development and operations, but there are no job losses of any substance.

What is this?

Banks are obviously disturbing their people to change by threatening job losses. Then, they don’t deliver them. Banks spend more on technology than any other industry, but don’t gain the efficiencies or productivity of such investments.

This point was made by Andy Haldane, the former chief economist of the Bank of England a few years ago. Andy claimed that whatever efficiency gains banks made in technology implementation, the returns were taken by the bank’s leaders as bonuses.

And so the end result is that banks make technology investments with the aim of cutting costs. Sure, they do shed staff but they redistribute them and some managers gain whilst others lose out. Overall however, banks don’t give the gains and cost cuts back to customers, they take them as dividends, bonuses and pay increases.

#Justsaying

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...