My mate Dave Birch wrote a Forbes piece the other day titled Unbank the Banked.

I thought it was going to be a story about how banks are ejecting thousands of customers due to poor onboarding. Instead Dave wrote about the unbanked don't necessarily need banks. It's a good piece, but there is also the fact that banks are consistently unbanking their customers, by suddenly freezing and closing their bank accounts.

I've watched this for a while. Watching and observing is one thing, but then I experienced the issues myself the other day. An incoming payment from overseas was registered on my account and then removed; an outgoing payment to a crypto exchange was stopped and the bank rang me. On both occasions, due to COVID, it took at least twenty to thirty minutes before anyone at the bank picked up the phone. In total, to resolve both issues, it took almost two hours. What a waste of my time but I’m lucky. At least I got it resolved. It’s better than most …

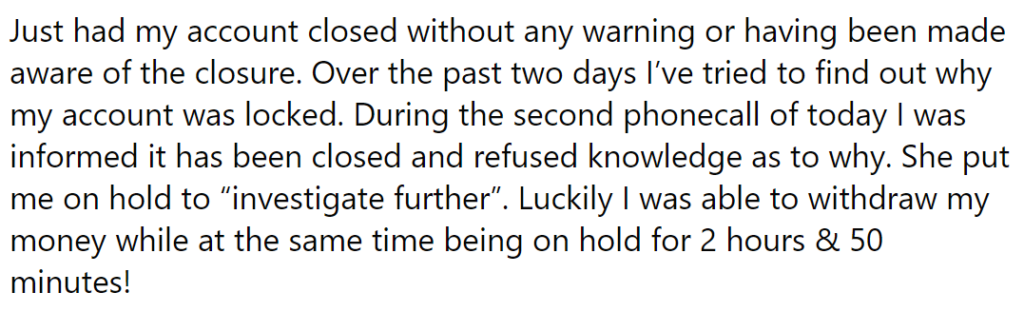

Source: Revolut’s clumsy automated bank compliance results in frozen accounts and lack of customer service

I’ve blogged about this before, but what’s causing this? Who’s forcing freezing?

The banks claim it’s the FCA, the regulator. The regulator has introduced more stringent money laundering rules, so anyone who gets a payment from Russia, bitcoin or a dodgy dealer from around the corner will automatically get shut down.

Source: NatWest closed down my account

But is that true? It appears to be interpretation.

Well, there was a tightening on money laundering rules during the pandemic to avoid scammers and hackers …

Where a firm is collecting information from an existing customer, Regulation 31 of the Money Laundering Regulations (MLRs) requires the account to be closed where the information is not provided. However, in the current situation, we expect firms to make reasonable efforts to collect this information or consider whether there are other ways of being reasonably satisfied with the customer’s identity, before taking a decision to close the account.

But the banks seem to have turned this up to 11 and, as the Spark Angels note:

- a bank that sends me a questionnaire to be filled in, is bottom of my list of priorities;

- a bank that sends me a questionnaire that makes clear they will close my account if I don’t do it, gets my attention.

And the thing is that even with all this crackdown forced by regulators and badly handled by banks, it doesn’t solve the issue.

It doesn’t matter whether you have digital identities, PEP (Politically Exposed Persons) databases, onboarding rules that are onerous and excessive and more. The fact is that if you cannot track and trace that Chris Skinner is opening an account on behalf of Julian Assange, what’s the point? And yet that simple statement illustrates the point. Chris Skinner has bona fide details. He’s onboarded and recognised. But Chris Skinner is funded by Oleg Shevchenko who gets his funds from Julia Austin who gets her funds from Kate Schevlinko who is funded by Julian Assange.

All in all, it seems that the move to digitalisation is creating more issues than solutions for some. This is best illustrated by this balance between control, regulation and service.

According to a report by Handelsblatt, the German financial supervisory authority Bafin is considering restricting the bank’s new business. The reason for this are organisational deficiencies in the fight against money laundering and fraud, which N26 has still not rectified. Among other things, the financial regulator could restrict the acceptance of new customers, it says in the report.

The key for me is that all banks – old and new – are failing customers when they just stop money in their accounts with no explanation. Pull your socks up.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...