The financial marketplace is becoming incredibly diverse and niche. Instead of universal banks, we now have plug-and-play code. Some would call it an object-oriented market structure. The basics are that no one dominates this structure. Instead, there are boutique players at every level of the stratosphere.

The universal provider is the one with the banking licence, whether incumbent or challenger or neobank. This is because no consumer or corporate wants to veto and vet 1,000 companies. Nevertheless, 1,000 companies may be involved in delivering banking ot that consumer or corporate.

This is what I mean by Banking-as-a-Service (BaaS).

The deliverer of BaaS is a bank. Behind the licence-holding bank, which is needed for trust guarantees, are 1,000 companies who support that licence-holding bank. There are payments specialists, trading specialists, investment market specialists, treasury specialists and more.

This is not something new, as banks have used third parties in their structures in the past. The difference today is that it’s far more diversified and decentralised. Banks will be picking up pieces of code from everywhere. In fact, if you compare the bank twenty years ago to the one that should be in place today, the bank of 2000 would be using IBM, Fiserv, Temenos, FIS and other providers; the bank of 2020 should be using some of those firms, but will have added BaaS providers, API providers for payments and trading, app developers for specific features, dedicated companies to provide data analytic services and more.

This movement from a few third parties to many is the biggest headache for the bank. A bank is a control freak. The more they can do themselves, the more secure they feel. But that business model of controlling the end-to-end value and supply chain is broken. In fact, any bank that tries to control the cycle of end-to-end delivery will fail longer-term, as there will be other players doing it better.

A little like the idea of Stripe partnering with Revolut and eToro, the build your own bank idea is happening. But it’s not customers building it and they’re not building a bank. They’re building an ecosystem of partners to cover all points of need with the best code.

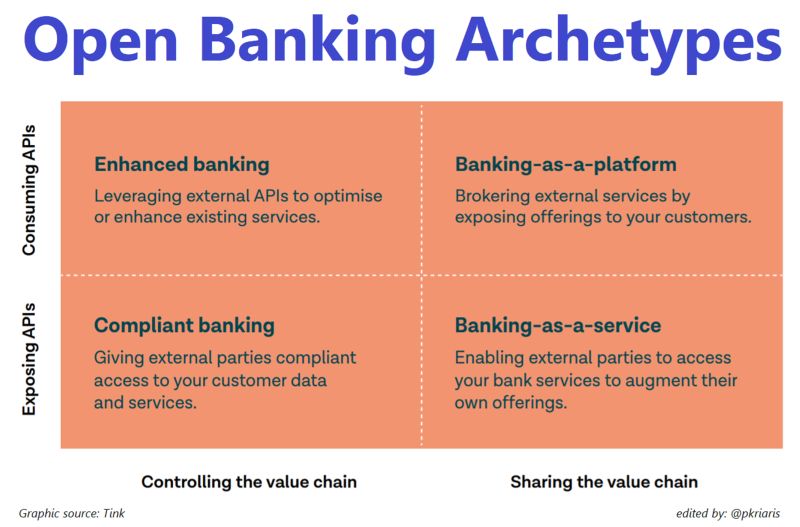

In fact, I like this chart from Tink:

In fact, as Panagiotis Kriaris notes:

“Many banks have seen Open Banking as a regulatory burden, however the truth is that it is their best chance to leverage the enormous potential of the API economy that has taken Financial Services by the storm over the last years.”

Couldn’t agree more (and I’ve been saying this for years). For example, June 2017:

Build or Buy or Build and Die?

I was having a chat with a banking buddy who was expressing his frustration with the fact that their PSD2 developments were not going the way he wanted. He had found a nice little FinTech start-up with a really neat Open API capability which could …

How does a financial curator make money?

After my blog yesterday, about banks having to move from being control freaks in a proprietary operation building everything to becoming collaborative partners in an open marketplace curating everything, I was asked: “how do you make money out of curation?” It’s a good question, as …

To be honest, I’ve been saying it for almost three decades (modular computing, object-oriented, Service Oriented Architecture, etc) ...

... it's just been a long time coming.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...