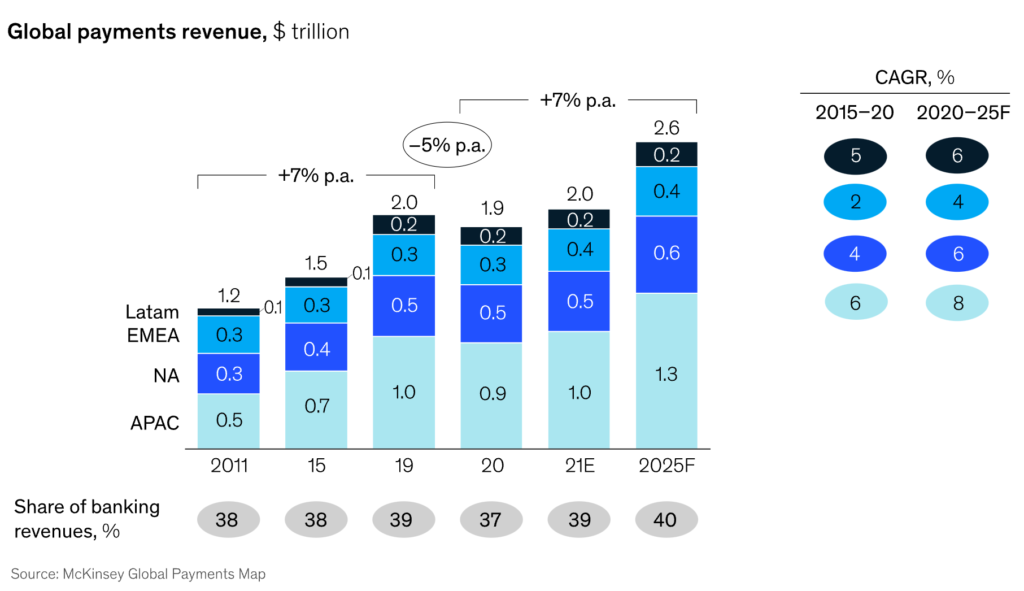

McKinsey estimate that payment processing will generate $2.6 trillion a year in fees by 2025, which raises this stream to 40% of a banks overall revenues.

Whoopy-doo! But why are they forecasting banks have these revenues?

I searched the article, and maybe my search missed something, but I didn’t see FinTech mentioned once, and yet FinTech is targeting payments more than any other area of financial services. Firms like Stripe, Square, Adyen, Tencent and Ant Group are all eating the banker’s lunch in this space.

Stripe, a ten-year old payments API, was valued at $95 billion in March 2021, equivalent to the market capitalisation of four Deutsche Banks! And they aren’t even mentioned in the McKinsey report?

Maybe BCG put it better:

“Our forecasts suggest that payments revenues globally could soar to $1.8 trillion by 2024, from $1.5 trillion in 2019, lifted by the continued transition away from cash, sustained strong growth in e-commerce and electronic transactions, and greater innovation. Incumbents will need to work harder to capture this growth, however. The payments space is becoming more crowded, with an expanding array of non-traditional players jostling with banks and payments service providers to become the issuer, provider, processor, or partner of choice. Shifts that were already happening before the pandemic will force established institutions to pick up the pace of digitization, gain economies of scale, and manage risk in new ways—all while continuing to innovate.”

Interesting.

But what amount of those trillions of dollars that are being taken by start-ups away from banks?

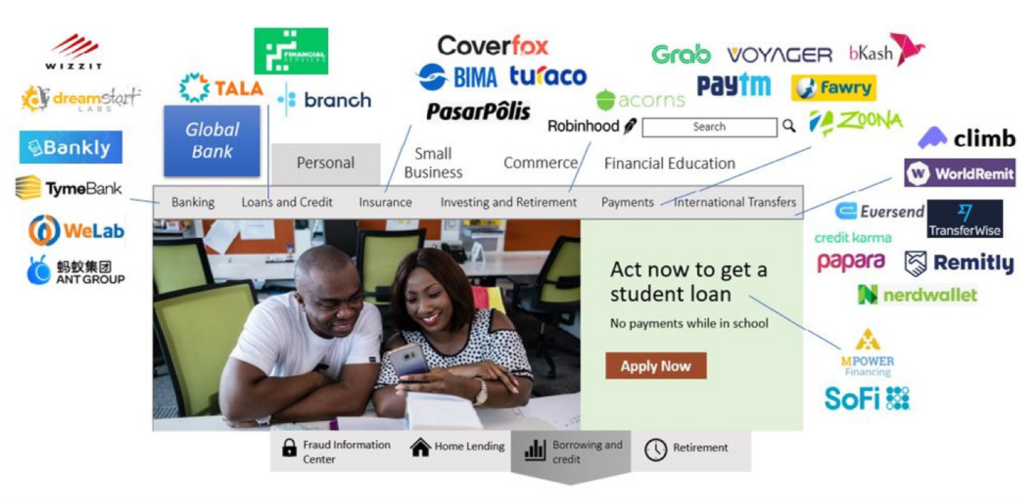

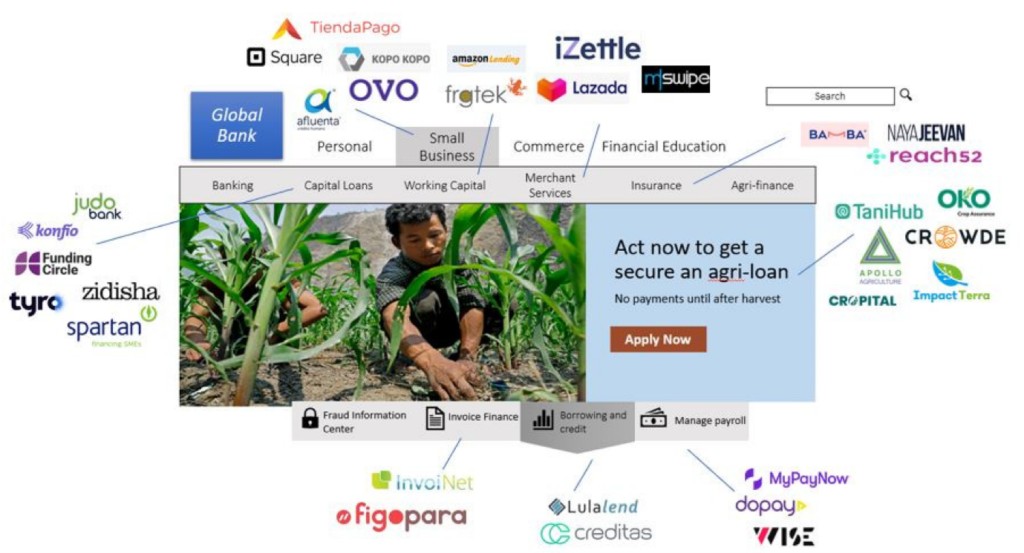

It’s hard to find out. I’ve tried. Nevertheless, bearing in mind the massive attack on banking structures from unbundlers …

Personal Banking

Business Banking

Source: BIS

It is obvious that banks are being attacked by specialists. As I keep saying: companies that do one thing brilliantly well will always beat banks that do 1,000 things average.

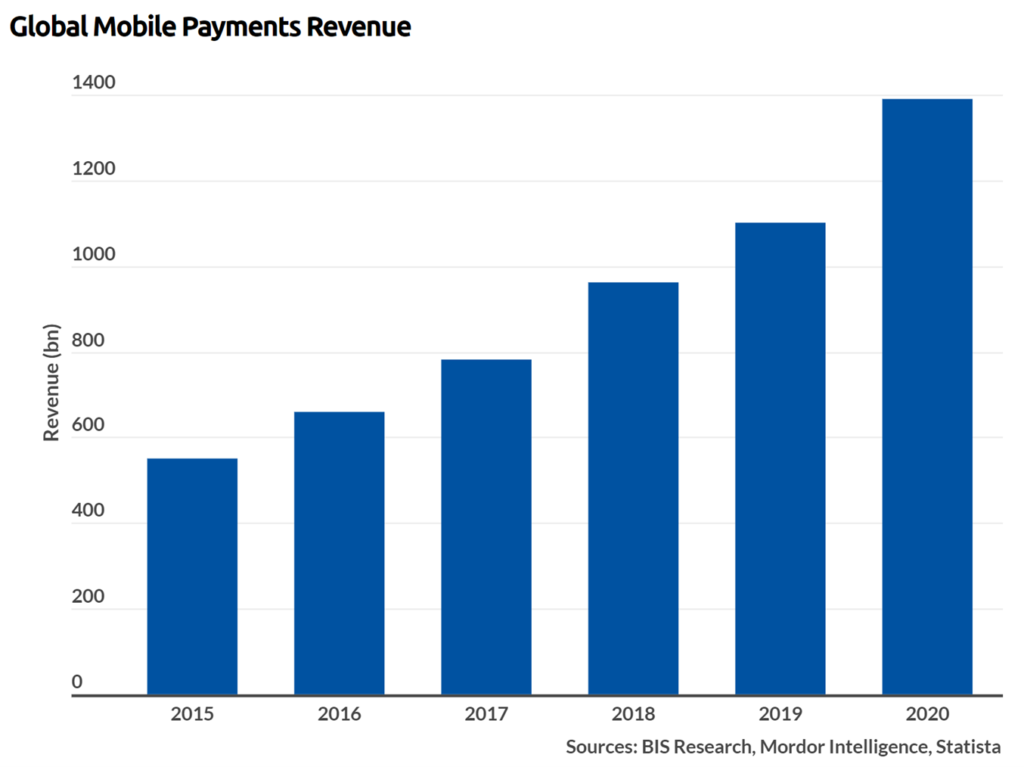

Equally, I cannot trust stats like these …

Source: Statista

… when China processed almost $70 trillion in mobile payments in 2020, according to the same source.

Regardless, I’ll put an estimate out there. My view? At least half of bank revenues for payments processing is being taken by new entrants. The same will happen with lending, savings and investments over time. The banks that are rearchitecting to compete, spending billions on technology internally and acquisitions externally, will just about keep up. The rest? Well …

Source: Saxo Bank staff canteen

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...