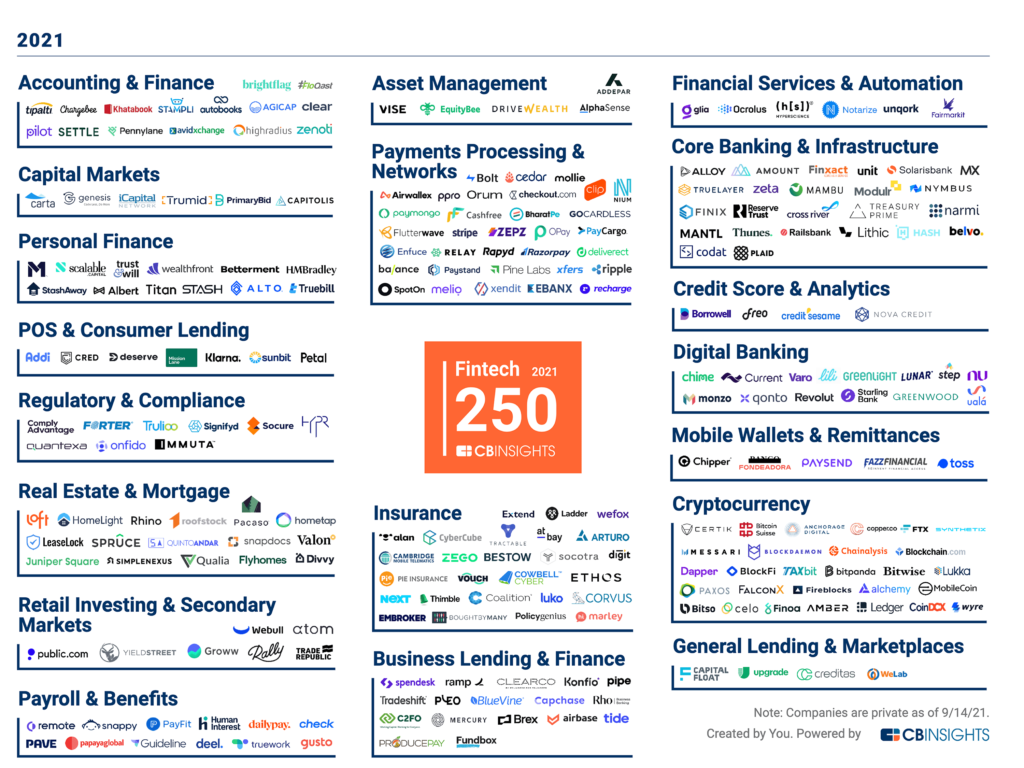

CB Insights just released their FinTech 250 for 2021:

These are the top FinTech firms in the world, in their view. The companies were selected by CB Insights’ Intelligence Unit from a pool of over 17,000 companies and, at last look, I’m tracking over 25,000 FinTech start-ups worldwide who garnered just under $100 billion of investment in the first six months of 2021.

Nevertheless, CB Insights chart is interesting as it demonstrates something I keep calling: a FinTech is laser-focused on solving one thing and does that much better than a bank that is soft-focused on solving everything. They take a single process in a single part of the financial jigsaw puzzle, whether it be retail or commercial or investment banking or insurance or wealth management or … and they solve it with beautiful code.

“If 1000s of new, shiny FinTech firms are doing one thing well, how can a bank compete when they’re full of legacy and heritage that means they do 1000 things average?” The Finanser, October 2017

Then we get into the thorny issue of how you partner with these firms. If a bank does step back and determine they want to pick up code and software with FinTech start-ups, what is the right way to do this? Philippe Gelis, co-founder and CEO of FX firm Kantox, summarised this well:

“[Working with banks] is a fine balance between your willingness to adapt to partnership requirements and your willingness to walk away from the deal if the demands are clearly excessive, or if they put your overall business strategy or focus at risk.” The Finanser, July 2019

In his case, they thought they had a bank deal but then, after months of talks, the bank turned away and copied their ideas. This is the challenge for a FinTech firm who desperately wants the opportunity to grow. Give away too much and you lose everything.

But then look at it from the other side. The bank wants the ideas, but doesn’t want to lose control. It does not really understand partnerships, as its never had them before, and is learning on the way too.

The thing is, as I’ve said often, a partnership between a FinTech and a bank is often unequal. The bank thinks it is bigger, better and stronger, and hence treats the FinTech start-up as lesser. Now translate that to your own relationsihps, and could you imagine having a partner who you think is lesser than thou? Partnerhsips don’t work that way.

So, we have 1000’s of niche and specialist start-ups doing amazing things to fix the things that banks do badly online, and 1000’s of large and traditional banks who are struggling to keep up with all of these innovations, and either copying or acquiring code to try to maintain their positions.

What’s the outcome of all this? Where’s the end-game?

The end-game is what I said the other day:

“Open Banking is the ecosystem; BaaS is the integration of that ecosystem; and the BaaS provider is a fully-licensed bank.” The Finanser, October 2021

In other words, the bank does not necessarily need to partner with FinTechs. What is needs to do is orchestrate and integrate. Most FinTech offer their code on a pay-as-you-use cloud API in the Open Banking ecosystem. Just look at Stripe, Adyen and more.

“The CIO becomes the Chief Conductor. The leader of the Bank-as-a-Platform must be a co-ordinator of many distributed parts. That is the conductor’s role. The conductor must be able to see all from the back office (percussion) through middle office (wind instruments) to front office (strings) and get them to operate with perfect timing and in tune to the song they’re playing.” The Finanser, September 2016

The Chief Conductor is the head of the pick 'n' mix of all those start-ups out there who are doing one thing brilliantly well. They then need to select the pieces to build and rebuild their bank, from a monolith to a Lego bank. The Lego pieces of apps, APIs and analytics are their choices, and they have to pick 'n' mix them to the best effect for the bank and for the customer.

In 2016, few banks understood the role of the conductor or the parts in the ecosystem that enable them to deliver BaaS. I’m afraid to say that, five years later, I still don’t see many banks that understand this structure. There are some doing well, but it’s far too few considering how quickly the markets change. Oh, and just for context, FinTechs numbered a few thousand and were funded to the tune of $12.8 billion in 2016. In 2021, FinTechs number 25,000 or more and will likely see funding burst through $150 billion or more. Times are changing. Banks need to keep up.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...