Talking of Open Banking, I hosted a dinner focused upon Open Banking and Banking-as-a-Service (BaaS) in London the other night. The conversation was with neobanks and challengers and was an interesting mix of old and young views.

For example, someone opened by saying that BaaS and Open Banking has hardly delivered anything. It’s disappointing and clearly underwhelming and probably widely misunderstood. Someone responded misunderstood or not trusted? Either way, there was a feeling that this movement has yet to deliver a change. I’m not sure if I agree or disagree, but it is still early days.

“Over 3 million UK consumers and businesses were using open banking-enabled products at the start of 2021.” OBIE Annual Report 2021

Another added that they felt that BaaS is just banking-in-a-box with a new label. Banking-in-a-box, or Bib as I call it, is an olden term for a packaged form of banking systems that you could just open and run a bank upon. That’s not BaaS. Bib is a package; BaaS is a patchwork quilt. Bib comes with all of its own bells and whistles; BaaS means you have to go out and find the bells and whistles. They are different.

In fact, the best way to imagine the difference between Bib and BaaS is a bag of sweets. Bib comes with all the sweets pre-selected; BaaS comes as a pick and mix, where you choose what goes in the bag.

This led to a discussion around the Lego Bank (have I mentioned that before? July 2017)

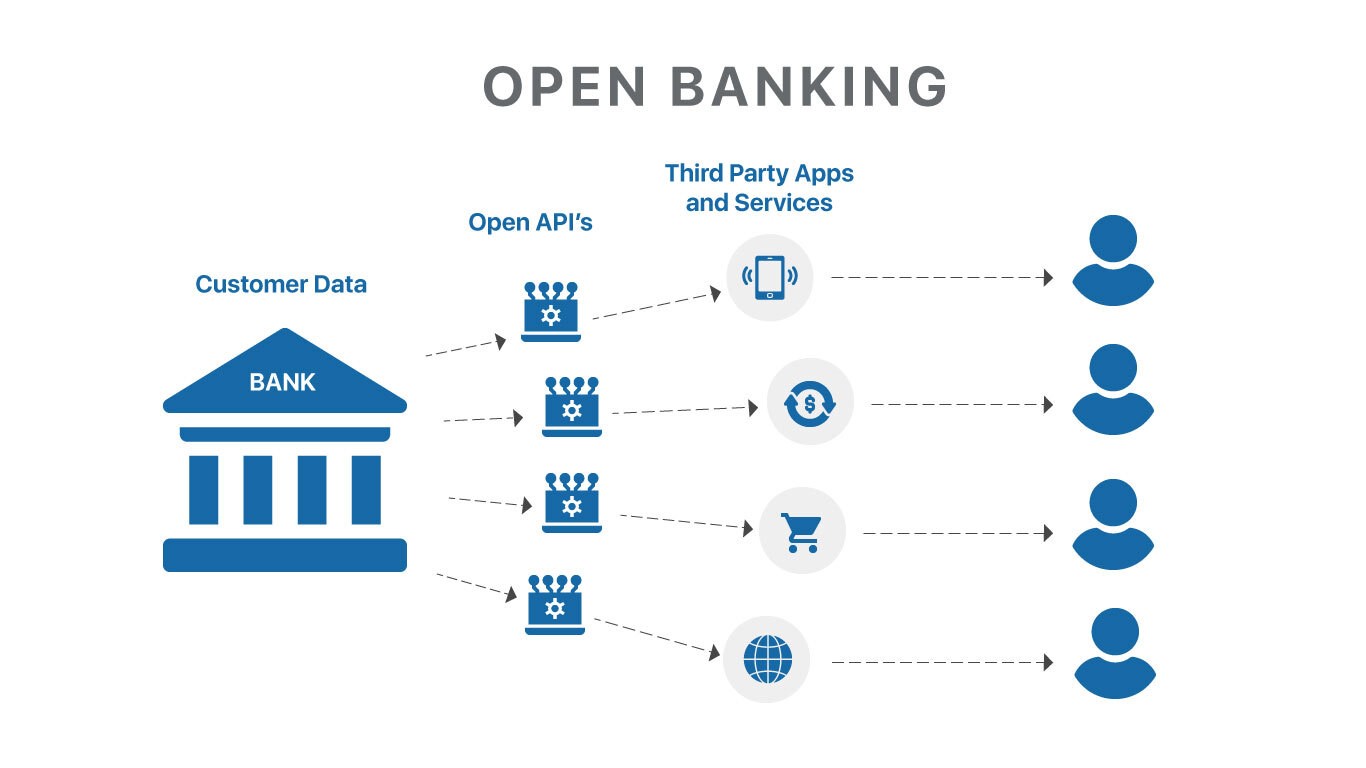

The Lego Bank offers a pick ‘n’ mix of apps, APIs and analytics to create completely new bank products, services and structures. The question for all is: what bit of the pick ‘n’ mix do you make? Where’s your niche? Have you thought about that? Have you worked that out?

This led to the next point: where are the innovations? What has Open Banking and BaaS delivered? So far, it feels more like more banking. It’s banking, but it’s banking as we know it. We need new banking, new finance, new services. What are the new services that could be offered through BaaS? I have some ideas, with the core being access to finance without the overhead of onboarding and vetting that exists today … now, there’s a thought. How? By using geolocation, biometrics and artificial intelligence.

That raised the thorny head of GDPR and PSD2. Can we share customer data safely? The answer to that one is yes, of course, but it’s down to whether the customer wants their data shared. Why do customers want to share data? To get better rates, deals, offers and services of course. So, that’s put that one to bed … or has it? The corollary of sharing customer data is that the customer might want to share data to get better deals, but does the bank incumbent want to share that customer’s data to get better deals? Are traditional banks ready to be open?

It seemed that the majority, several of whom had worked for big banks in the past, believed that no, banks are not ready to be open. Banks feel third parties are hard to trust, sharing data via APIs undermines their position with the customer and that they would rather make the customer feel sharing data is a bad thing, rather than a good thing.

This is why traditional banks place so many barriers in the way of customers to share their data. They have to tick boxes, fill in forms, print them off and post them to the bank. By the time it’s processed with approval from the bank to share their data, the customer has forgotten what they were asking for in the first place and so it goes.

We then moved on to looking towards the endgame: who will survive the BaaS process? Obviously, those who find their niche, but the ones who might not survive are those who remain closed, resistant or try to control the whole process. No one entity controls banking anymore, and no one bank owns a customer relationship anymore. Grow up and learn that you have to adapt and partner and those who partner first will win first. After all, if you’ve got the strategic partnership with Google or Amazon for the UK, who else can follow that? Few, especially if you create exclusivity.

This is clearly different between retail, wholesale and investment banking, but the principles apply to all: they who dare wins.

A comment I particularly liked clarified the terminology. Open Banking is the ecosystem; BaaS is the integration of that ecosystem; and the BaaS provider needs to be a bank, but could easily be a neobank or challenger bank, as long as it provides what the customer wants.

And I guess that’s how the evening ended. Provide what the customer wants. But what does the customer want? Many don’t know. Do you?

June 2018:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...