I often contact companies due to issues with their services. When I contact them, it inevitably means that something in their digital services has broken. It is then an opportunity to delight and provide a customer experience that exceeds exceptions. However, it normally means anger and annoyance as you wait on the phone for an hour to talk to a human who cannot resolve the issue or, more often than not, does not have the authority.

It truly pisses me off.

However, I had two companies recently deal with my issues in a way that exceeded expectation. Firstly, Survey Monkey and the second was a local builder. Survey Monkey charged me for an autorenewal ($500) that I didn’t want. I emailed once and immediately got a refund and apology. No question, no issue, no fuss. The local builder I contacted and he could not go far enough to service my request, even when I changed time and dates three times. Fantastic service.

The thing is that these experiences have become the exception rather than the norm. What has gone wrong?

What’s gone wrong is that we are far too willing to accept sub-service service today. It’s endemic amongst big banks, big telco’s, big airlines, big business, and it’s just wrong. Amongst most big business, condescension and arrogance has become the rule; amongst small business, authenticity and customer care is the rule.

The issue there is that how come businesses become big if they are arrogant and condescending? I guess it’s because, as with government, society has come to accept below average. We accept below average politicians who don’t care about their voters, as long as they get the vote. We accept below average banking, as long as we have a bank. We accept below average mobile phone services, as long as we have a mobile phone.

To be honest, I’m fed up with it and the fact that an authentic service response is so rare and unique, and stands out so much, speaks volumes. What if you could create a business that could give every customer a unique and authentic response? What if you could create a business that, with zero overhead, could make every customer feel unique and personalised?

Isn’t that what we’ve discussed with technology for the past quarter century? Isn’t that what 1:1 marketing was all about? Isn’t that what AI is meant to deliver?

It is, and yet what I get these days are platitudes and automated responses that are so clearly machine generated that they weren’t worth sending. This becomes clear when I tweet a complaint about my bank and every single time they tweet back:

Thanks for dropping by and visiting the ABC bank’s Social Media team. Your experience really matters and it would mean the world if you have a moment to rate us below based on your time with us here on the social team.

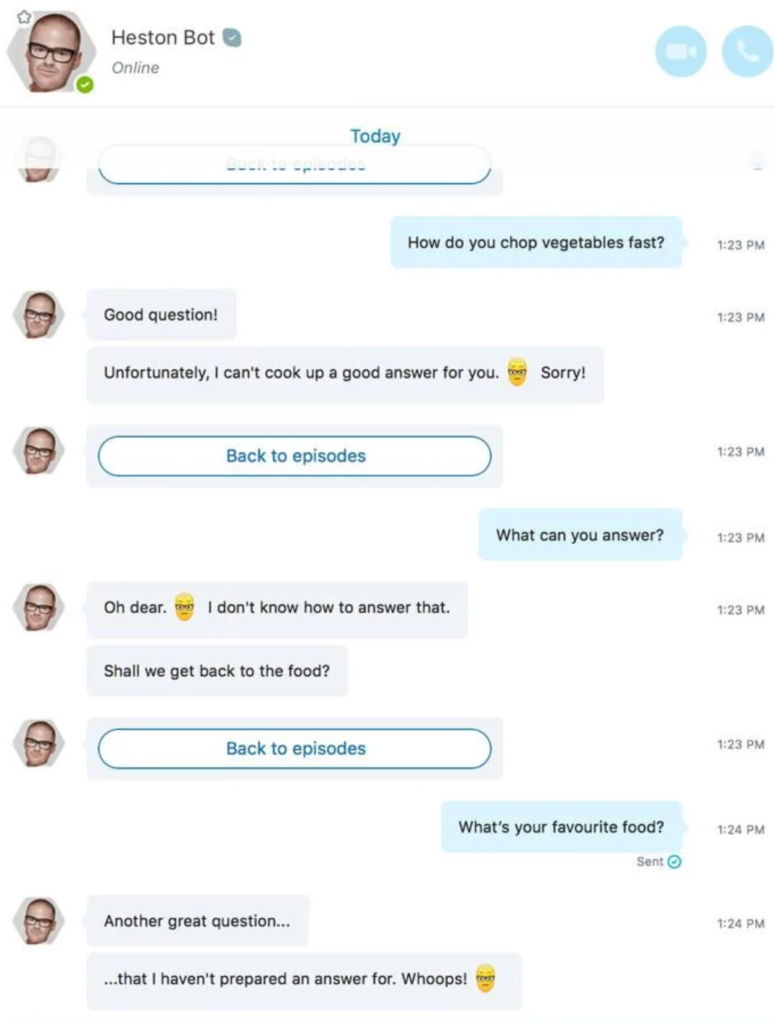

The first few times, I tweeted back but got no reply. Eventually, I gave up. I realised it was a chatbot. The same on SMS texts and other chatbots. Where’s the empathy?

Source: Toptal.com

The core of this is authenticity. When I could believe that the company cared about me is the day I could care about the company. Do you care? Does your company care? Are you authentic? Or are you just a robotic process automated condescending beast?

Most are the latter, but the former will win, and it doesn’t take a lot of effort to create an authentic approach. You just need to take a human-led automated approach.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...