A long time ago, I predicted that telecoms and retailers would acquire and buy banks and vice versa. Hasn’t happened. Will it happen? I don’t think so. After so many years, I’ve realised something. Banking is difficult and does not have the same features as other industries.

This is something that the naivety of youth does not realise. They think banking is dumb and stupid. It’s not. It’s old and difficult. Sure, we can take shots at the bits of banking that don’t work well and sure, we can take bits out of the lending and payments business, but the overall landscape of banking is far more than just a loan or transaction. It’s all about trust and regulations.

I realised this again as now, many years later, everyone is predicting that big tech and FinTech will destroy and disrupt banking. I’m not denying that it is challenging and changing banking, but destroy and disrupt? I don’t think so.

This goes back to the comments I made about Bill Gates getting it wrong when he said: “we need banking but we don’t need banks” back in the 1990s.

He was wrong. We don’t need banks to do payments and lending, but we do need banks to do banking. After all, what is banking? What are banks for? Do you ever ask yourself that question?

Banks are not for the things we think they’re for. What they’re really for is to keep money safe.

Keep money safe.

Sounds so simple, but when you consider 99% of the world is trying to steal money, it’s a tough job. Think of all the movies and shows you watch: how much of it is about trying to rip someone off, get into a bank vault, make a hustle or fake and deceive? Think of your own life and the phishing emails you receive, the fake texts you get, the friend who didn’t payback or the family member who constantly leans on you for help. Money revolves around the centre of our lives so any company that claims to keep money safe is offering a tough ask.

This is also the reason why banks are so heavily regulated. I was struck by this when I saw the latest scam: Authorised Push Payment (APP) fraud.

What’s that?

An authorised push payment (APP) “occurs when you - knowingly or unwittingly - transfer money from your own bank account to one belonging to a scammer. For example, a scammer pretends to be from your bank’s fraud team and warns that you need to move your money to a safe account but it’s actually an account the fraudster controls.”

APP is a scam that is totally convincing. You believe the bank has called you. You say you will call them back. You ring the banks’ telephone number, but the scammer has held your line and they answer pretending to be the bank. It totally sucks you in. You then authorise money to be moved, as the bank is telling you your account has been hacked or compromised, and that money is then lost forever.

Over the past five years, this scam has been rising rapidly and is now common.

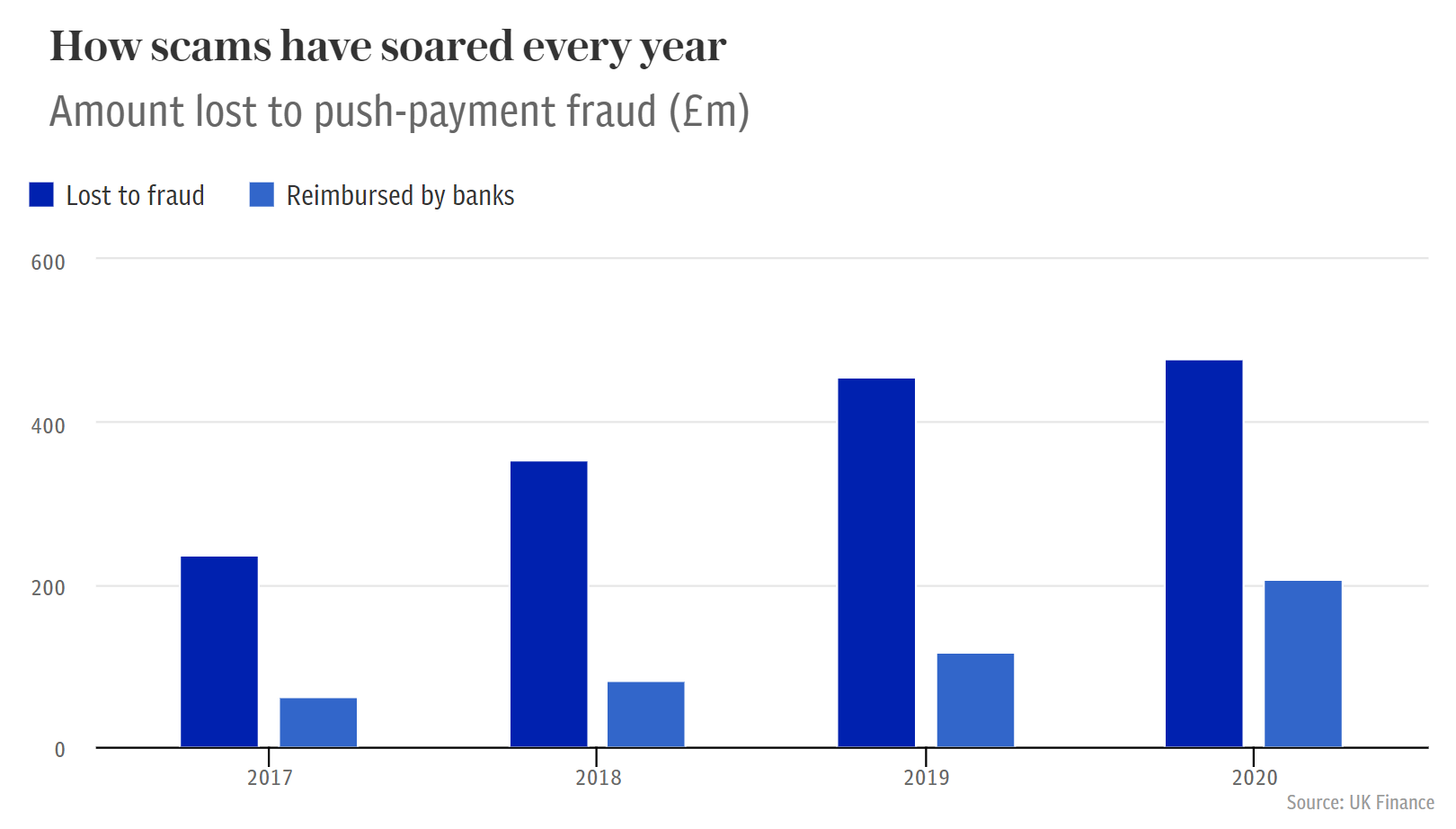

Such scams now cost Britons around half a billion pounds per year, with reported incidents having risen every year since records began, as the chart above shows. Cases soared during the pandemic, rising 71pc in the first half of 2021 compared with the same time the prior year, according to the banking trade body UK Finance. [The Telegraph]

But banks are meant to keep money safe, so how come scammers can appear to be the bank? Because the bank has failed the customer, according to the regulators, so the banks are now liable for any losses made by such a scam.

Like I said the other day, beware of anyone who emails, texts or even calls you saying they’re from the bank but, if you are called by the bank and they tell you to call them back on the bank’s real-life telephone number well … no wonder the regulator is saying the bank is accountable.

And for FinTechs and Big Techs and neobanks and other industries who think they want to get into banking … is it really worth it? Maybe, but it ain’t easy.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...