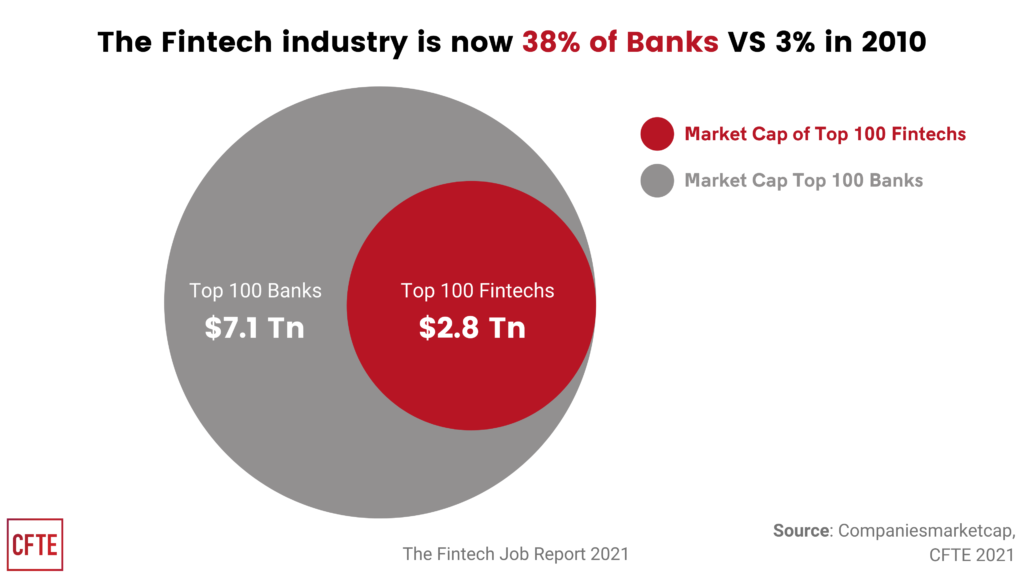

I met with some friends the other day, who showed some stats that demonstrate that all FinTech is worth a third of all of the banking market worldwide.

Source: CFTE's Fintech Job Report [sum of largest 100 banks (market cap) vs sum of largest 100 Fintech companies (market cap + public valuations)]

How times have changed.

FinTech. A flash in the pan? Irrelevant? Banks dominate? These guys are deluded? It doesn’t matter?

Any banker who believes that FinTech is not a threat to their core business is deluded. I said this the other day, and I will say it again: banking is being reinvented by technology. That’s why FinTech counts, especially when we consider Open Banking, but it’s more than this. It’s the core of what I said way back when in Digital Bank:

Banks were built for the industrial revolution for the distribution of value through paper using buildings and humans; banks need to reinvent themselves for the digital revolution to distribute value through data using software and servers.

It’s simple statement but hard to execute, especially if you are a big company with a big office and big history. It is another statement I often make, which is:

FinTechs have no trust, no history, no capital and no customers; banks are licensed for trust, have centuries of history, billions of capital and millions of customers.

So, why is FinTech needed? Because banks are failing to evolve in the right way.

Another statement I make often:

Banks know they need to change, they just don’t know how.

More than this. I use the Charles Darwin quote often:

“It is not the strongest of the species that survives, nor the most intelligent; it is the one most adaptable to change.”

Thing is that we know we need to change, but change into what? If you change in the right way, you survive; change in the wrong way, and you die. It’s like a game of Saw, you make the right move and you get to the next level; one wrong move, and the axe falls.

Anyway, back to the core point. FinTech is not destroying or even disrupting banking. I think it is changing and evolving banking into something else. It is creating a new banking market based upon choice and service. It is lowering the access to banking so finance can be offered to all, and it is extending finance into every niche and corridor it is needed. In other words, the valuations of FinTech firms are not displacing the old banks; it is adding new layers and levels to banking, and the valuations reflect the digital reach and vision, rather than the industrial past.

Banks that understand the digital reach and vision, and reinvent themselves to embrace it, will be the ones that not only survive, but thrive. Banks that don’t will be acquired.

No bank will be bankrupted by FinTech, but many banks will be assimilated by FinTech. These valuations reflect that, as does the move for more and more FinTechs to get banking licences by buying old banks. We will see more and more of that.

The net:net is that FinTech is not separated from banking. It is banking. It is banking of today. It is digital banking. Today’s digital banking is an amalgamation of apps, APIs and analytics from hundreds of companies, integrated by a fully licensed and trusted entity through Open Banking reach. It is a bank that has a business model based upon apps, APIs and analytics as their front, middle and back office, and provided through Banking-as-a-Service. It is a bank built for the 21st century from 20th century technological roots, but those roots have been ripped out and replaced. The bank has been replanted.

For the banks that get this, they might retain a valuation of half of the market in a few years. Today, it is two-thirds. Yesterday, it was nearly all.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...