Jim Marous at The Financial Brand just published a survey of what his readers think the future of banking holds. Before you read the results, here are mine:

- Retail banking focuses upon integrating everything digital

- Commercial banking focuses upon digital currencies for global trade

- Investment banking focuses upon the tokenization of equities and trading

Simples!

What I mean by the above is that retail banks will spend more and more time trying to deliver Banking-as-a-Service by working with partners to integrate offerings.

Commercial banks will be forced by their corporate customers to spend more and more time trying to understand how to use Central Bank Digital Currencies (CBDCs), stablecoins and crypto for trading around the world.

Investment banks will spend more and more time trying to work out how non-fungible tokens (NFTs) and tokenization could be used for trading and investing in equities and bonds.

None of this is simple. It’s an incredibly complex movement and transformation from physical to digital, but it’s now in full force. I’ve been talking about it for a while (did anyone notice?), but it’s now here and happening.

Anyways, rather than me rabbiting on and on, here’s the survey results from Jim:

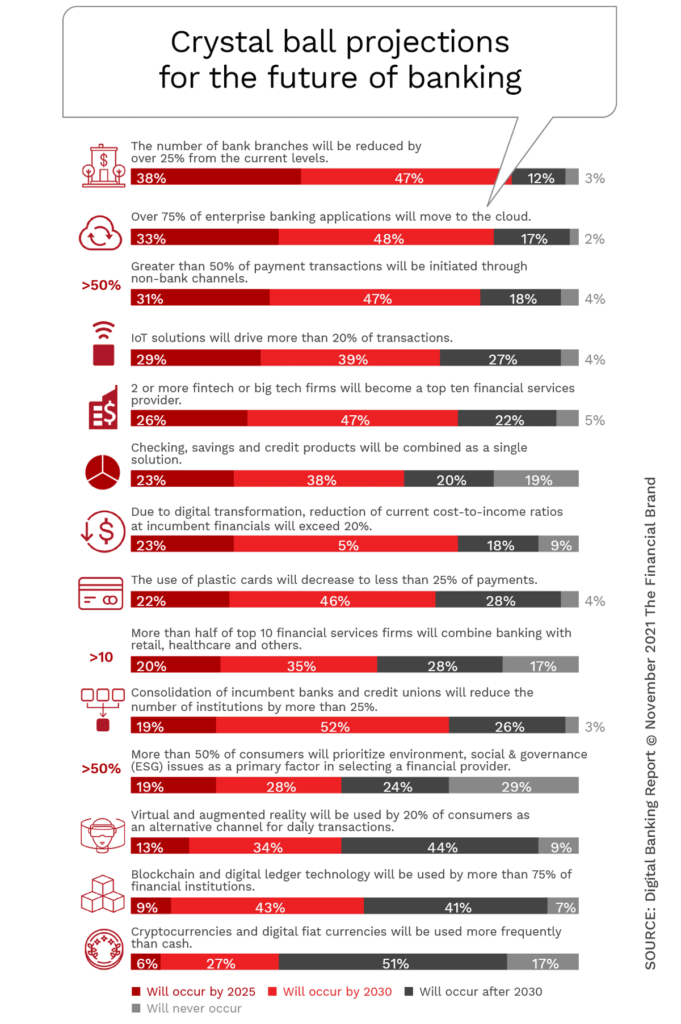

The greatest consensus among retail bankers was that:

- there would be a 25% branch consolidation by 2025;

- 4 in 10 expect of branches to be gone by 2025;

- the fewest respondents saw cryptocurrencies being used more than cash;

- only 1 in 10 surveyed thought that blockchain technologies would be used by most banks;

- 47% saw that consumers would select their financial institution based on ESG issues, but the ‘not at all’ perspective was the highest of all projections; and

- over three-quarters of executives surveyed thought that at least two fintech or big tech firms will be a top ten financial provider by 2030.

My takeaway from this is that people don’t know the future. It’s where we’re going, and we don’t know where that will be. I try and, in my trials, I know that:

- branches will not be gone;

- cryptocurrencies will join CBDCs and stablecoins as a means of payment for different purposes, and all will be mainstream;

- blockchain will eventually be used by most banks for global systems exchange, managed by a future Visa and SWIFT (or equivalent);

- consumers will see ESG as key, and this will become more and more of a priority over the next decade; and

- yes, fintech firms – not big tech firms – will be huge in finance and already are.

Want some more projections and predictions?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...