Building up to Christmas, I got a lot of FinTech predictions sent by PR firms and friends. Here are my top picks:

One of the biggest US FinTech firms Lending Club sent me four big things they predict:

Prediction #1: The fintech and bank consolidation arms race continues

2021 brought on more fintech M&A than ever before, and this trend will continue. According to CB Insights, 42 fintech companies became unicorns by Q3 of 2021, a term that refers to a privately held startup being valued at over $1 billion.

We predict that more fintech companies, flush with cash, will look for new ways to expand and drive growth via M&A. We may also see more of a seismic shift as banks leverage fintechs to help them offer new services to their customers that they are unable to offer alone.

Prediction #2: Battle for the customer will accelerate

Financial services and products are not one-size-fits-all. What works for one person won’t work for the next, and the good news is that financial institutions are finally catching on.

As the internet continues to reduce the barrier between consumers and retail banking, as it has done in so many other industries, we will see more focus on digital banking solutions that are uniquely tailored to specific customer segments.

Prediction #3: Increased regulatory scrutiny in many aspects of fintech

With the increased importance of fintech in everyday Americans’ lives, there will be increased regulatory scrutiny. We believe this is a good thing for the industry. Within the next few months, there will be new representatives in many of the agencies that look at financial services companies. We expect that this will lead to more regulation on fintechs, specifically the emergent areas of BNPL and crypto.

Prediction #4: Every company will become a fintech

This next prediction has been in the works for years, and will only accelerate in 2022. We will see more financial services embedded into non-financial companies, like Uber letting us pay directly through the app or tipping for your pizza delivery on the same form you order pizza, but on a grander scale.

Financial institutions will look to whittle away the banking and payment barrier to offer a more seamless experience for consumers.

There is then my friend Ron Shevlin, whose column on Forbes is getting a lot of momentum these days, who has predicted five big trends.

I think the headlines speak for themselves but, if not, checkout his thoughts here.

Equally, if you want an old banks’ view, ABN AMRO have posted their predictions. In this case, six big trends:

- Big tech is moving into finance… but will we see big tech banks? [No]

- Banks are getting in bed with fintechs… and liking it [Open Banking]

- Digital banking is sporting new technology [mainly videobanking]

- New security threats and solutions are on the rise [ransomware is they key]

- There is a drive to generate income from sustainable initiatives [blah, blah, blah]

- Will crypto ever replace fiat currency? [who knows?]

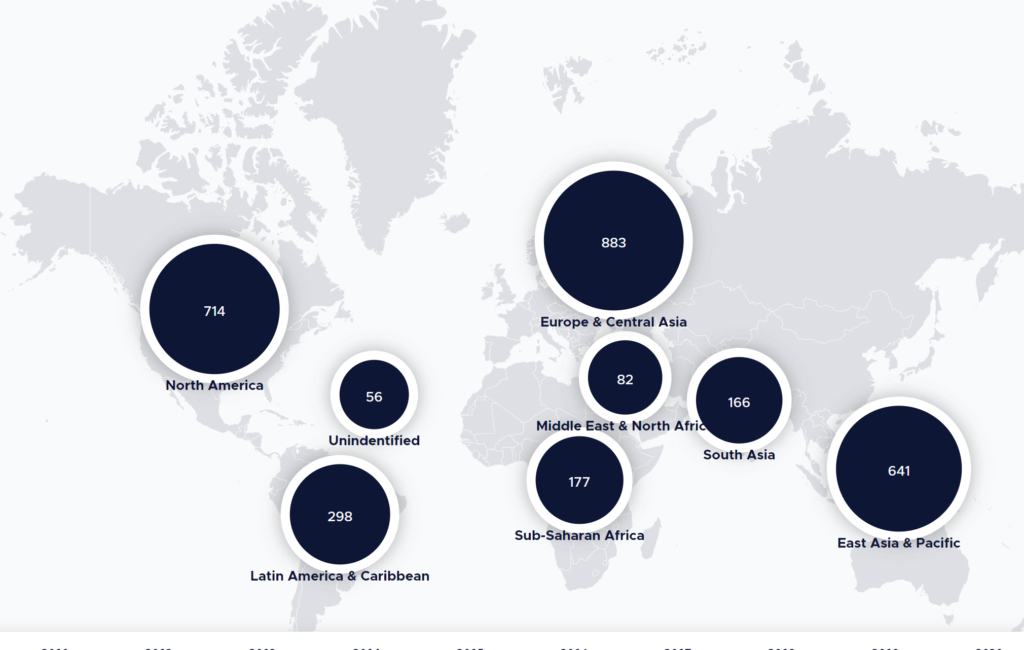

The best state of current FinTech I've seen is an interactive map developed by the University of Cambridge, where you can zoom interactively to each region and country by year, and see how active their FinTech activities are.

Recommended.

There’s a bunch of other predictions out there but my big one, which most people don’t like, is that FinTech will take a stumble this year.

The next few years will see a Big Regression. It started in China when the $300 billion IPO of Ant Group was dismantled. Now it is clearly happening in Europe and America. What is the Big Regression? It is the reversal of technology progress. It's not that people will reject technology. It's governments and regulations.

In fact, it is likely that FinTech will be affected by the Big Tech fall-out. As governments crack down on the FATBAGs, they will also have a magnifying glass on the FinTech unicorns and their brethren. They may like some of it but, specifically in FinTech, the Big Regression will be a thing as regulators dismantle some of the unregulated markets that they now want to regulate. We’ve seen it already with P2P lending stalling and, in some markets, failing. By way of example, Zopa has just given up P2P lending. Then we see it in crowdfunding, when Kickstarter is finding it hard to kick or start. And we can see the governments getting more and more of a squeeze on everything from BNPL to cryptocurrency exchanges and bitcoin mining.

Part of this is the action of governments and regulators, but part of it is the view of customers and users. Just look at the trust in Facebook. No wonder they've changed their name to Meta.

Therefore, my prediction for 2022 is that there will be a major shift away from things people don’t know and understand, and a return to things they do know and understand. It’s the Big Regression. Back to banks and away from tech.

Contrary to this view is one thing. Cryptocurrencies. I don’t see people bailing out of bitcoin and ETH. Why? Because they’re becoming more trusted than dollars and euro. So the crypto ball will keep rolling, whilst the FinTech momentum will plateau. That’s my view for 2022. I may be wrong, but the bottom-line: cryptocurrencies continue to rise but FinTech investments decline.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...