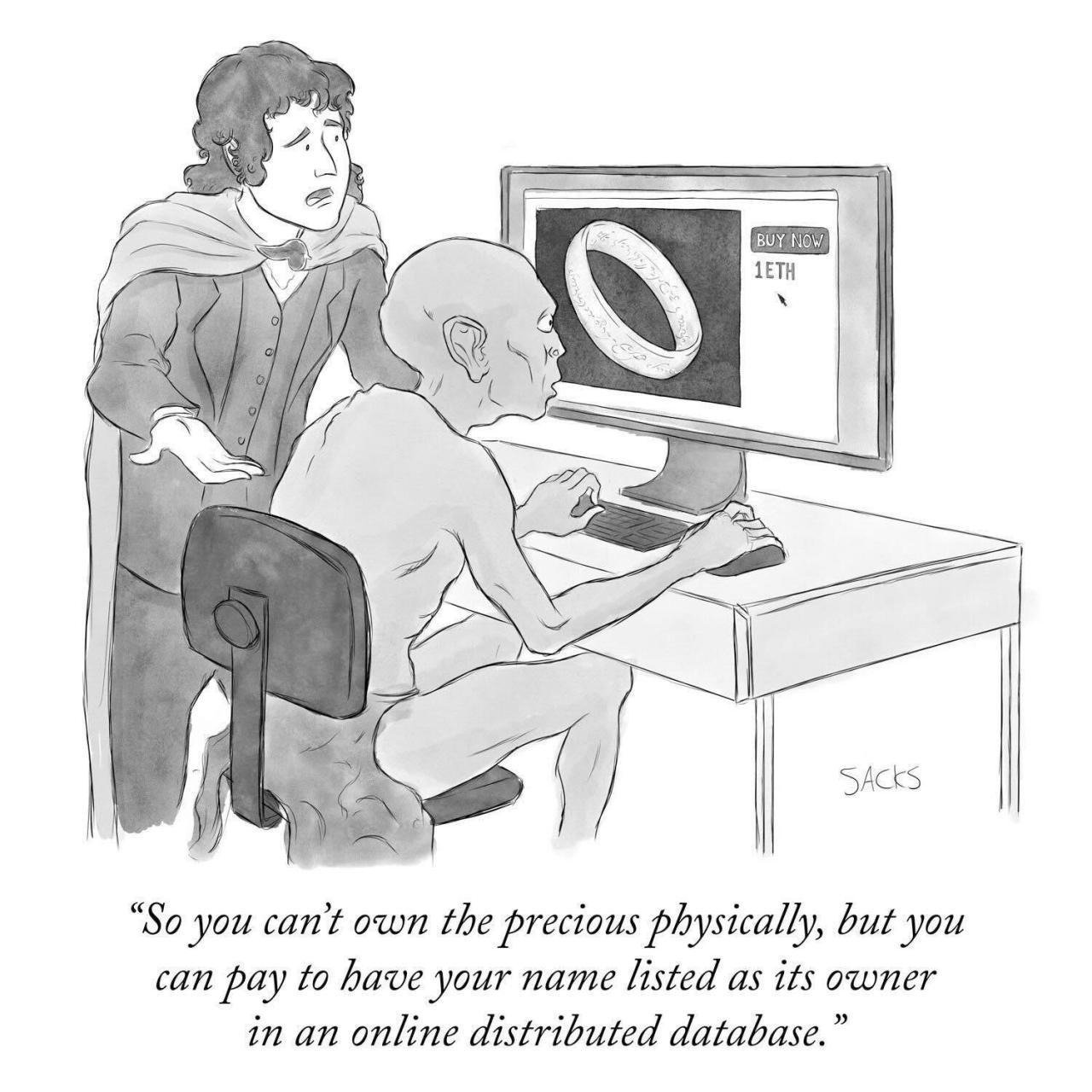

South Park recently did a great skit on NFTs, and one line really resonated with me:

The reason the line works so well is that money and finance, markets and companies, countries and laws, are all about beliefs. That’s the basic underlying fundamental. If you believe this contract with this currency authorised by this government will work, then it does. If you don’t believe it, then it does not.

Now, I’ve known this for a while and blog about it a lot, but I keep coming back to the theme as it is a critical underlay of everything in the financial system.

What is it we value? Why does it have value? How is it traded? Who can you trust to trade it?

These questions strike at the core of cryptocurrencies, but they also strike at the core of banking. Why do you need someone to store value? Who can you trust to store value? Where can you trade your store? How do you trade your store?

The questions always come back to the same fundamentals, but the fundamentals are changing. For decades or even centuries, we’ve built a system of trust based on government regulations of trusted intermediaries. This is changing. We are now building a new system of trust based on networked regulations of trusted platforms.

This is ground-breaking and revolutionary and, for all of those who think it's just SSDD, it’s not. I am seeing a rapid change from physical assets to digital assets; from government currencies to networked currencies; from traditional banks to open finance; from industrial structures to digital innovations.

Our world is changing rapidly before our eyes and it’s all about what we trust; who do we believe in; what do we believe in; and why.

It’s not a religious thing, but I’ve been shocked by the impact Elon Musk has made on Dogecoin, Shiba Inu and others. We suddenly create ecosystems out of nothing, because a few believe that this ecosystem is worth believing in … and that’s what NFTs and crypto is all about. The new generations believe it has value.

Of course, like most central bankers and been-around-the-block elders, I worry that they will all lose their money in a Ponzi style networked scam but hey, if you believe in it and I believe in it then they will believe in it.

It’s all about beliefs.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...