In the final part of my welcome to 2022 series, here are the big trends in technology in general (not just FinTech).

According to the World Economic Forum, there are ten key technologies to watch including 3D printing houses, tracking humans through the network and getting drugs through apps.

That’s only ten things, so Forbes goes five better and predicts 15 things:

- Increased Use Of AI By Hackers

- Integration Of Siloed Data

- Enhanced Search Optimization

- Digital Twin Technology

- Health Tech Focused On Human Connection

- Optimization For Hybrid Working

- Increased Workplace Automation

- Ongoing Tech Talent Shortages

- Marketing Through Connected TV

- Consumer-Focused Experience-Based Technologies

- Challenges From A Return To In-Person Work

- Focus On The Benefits Of Digital Transformation

- Blockchain Technology

- Omnichannel Customer Support

- Sustainable Technology Design

Of course, that's good but The Economist went better and predicts 22 technology trends for 2022. I guess there’s something in that. Theirs include hydrogen powered airplanes and vertical farming. Interesting stuff.

Thing is that whatever the World Economic Forum and Economist can do, Fast Company can do better, so they picked out 40 key tech trends. As explained by Mark Sullivan:

“Big things have small beginnings.” That line from Lawrence of Arabia may be a good way of characterizing the coming year in tech. Tech that will be very important to the future will begin graduating from R&D labs and enter the marketplace. More self-driving automobiles will traverse the roadways. Augmented reality glasses may even start showing up in public. The U.S. government is likely to begin regulating Big Tech in such areas as antitrust and privacy. The industry will continue talking about, and in some cases even building for, the metaverse. And some of the foundational technologies underpinning Web3 may begin to take hold.

He goes on to explain that he and his colleagues spun their Roledexes, looking for the smartest and best-placed people to offer their predictions. They asked startup founders, Big Tech execs, VCs, scholars, and other experts to speculate on the coming year within their field of interest (they missed me). Altogether, they collected more than 40 predictions about 2022, which you can read here.

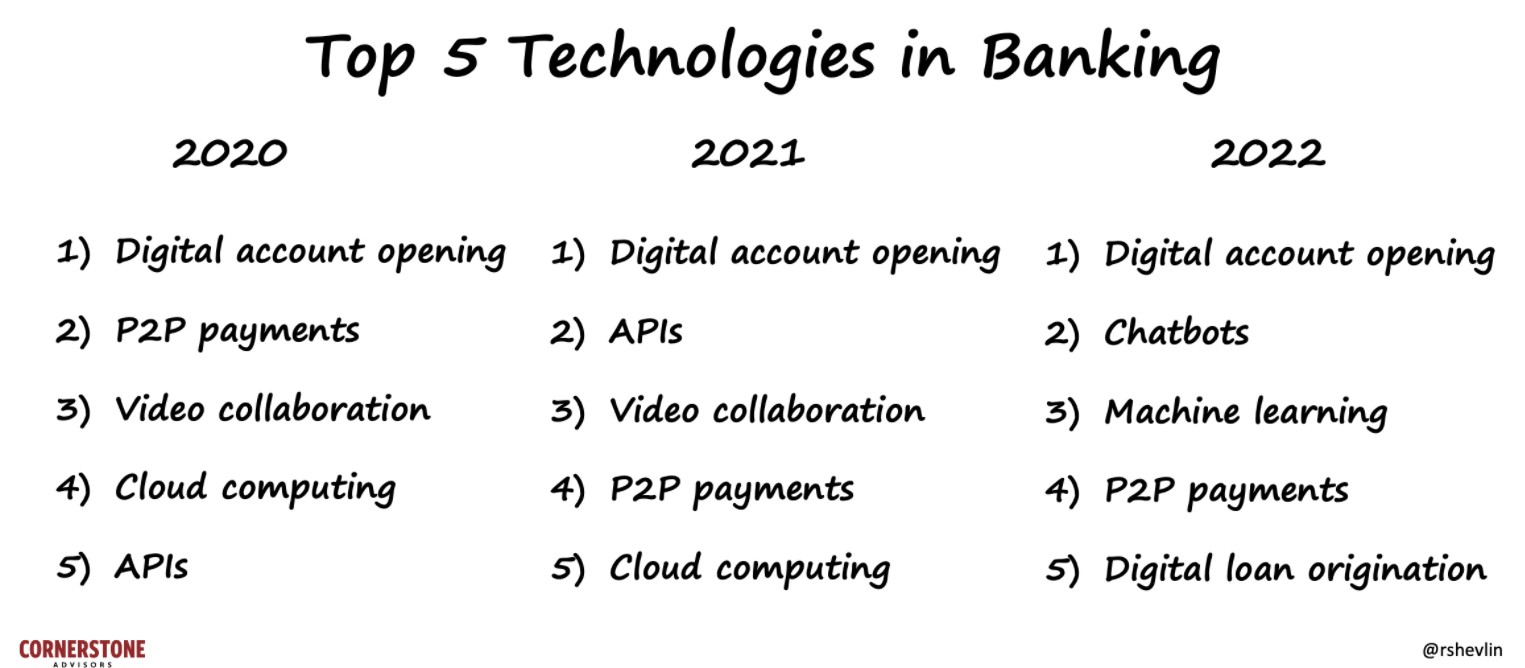

Meanwhile, Ron Shevlin puts these technologies in the context of banking and advises there are just five that banks need to focus upon as priority.

For me, the biggest tech theme coming through in 2022 is AI (Artificial Intelligence), and I don't mean chatbots when I say this. I mean fully integrated AI into all digital processes or embedded AI if you prefer. An interesting blog by Nvidia articulated this well. They surveyed a wide range of people across different industries. Surprise, surprise, I’ve picked out the one from financial services:

KEVIN LEVITT

Director of Industry and Business Development for Financial Services [Nvidia]

Your Voice Is Your ID: Financial institutions will invest heavily in AI to fight fraud and adhere to compliance regulations such as KYC (Know Your Customer) and AML (Anti-Money Laundering). Some are using a customer’s unique voice to authenticate online transactions, while others are turning to eye biometrics for authentication.

Graph neural networks are at the forefront of the new techniques AI researchers and practitioners at financial institutions are using to understand relationships across entities and data points. They’ll become critical to enhancing fraud prevention and to mapping relationships to fight fraud more effectively.

AI for ESG: Consumers and government entities increasingly will hold enterprises accountable for environmental impacts, social and corporate governance (ESG). Companies will invest in significant computational power to run AI models, including deep learning and natural language processing models, that analyze all the data necessary to track company performance relative to ESG. It also will be needed to analyze the available data externally to measure which companies are excelling or failing relative to ESG benchmarks.

I like this last point as, yes, you’ve guessed it, that’s the topic of my new book.

Building on this, there are more specific areas to focus upon. In an interview with Meniga’s co-founder, Georg Ludviksson, AI-powered virtual assistants will completely change the way people bank. Funnily enough, I said that almost twenty years ago.

In other words, as always, the real focus should be on the customer. What does the customer want today? Luckily, Money20/20 found out and they produced this really useful report about the future consumer and identified four key consumer sentiments that will shape how future consumers feel. Useful.

Finally, Zac Maufe, Head of Retail Banking, Google Cloud, sent me three big predictions:

Embedded Finance 2.0: The integration of payments and fraud detection into rideshare apps is just one example of how financial services are becoming more embedded in our day-to-day lives. Activities like small business loans and mortgages will become more dynamic and ingrained in the transaction process.

New Operating Models: As banks increasingly move to the cloud, financial data can be better combined with third-party sources, like weather information, for better insurance and commodity trading models. These uses of historical, analytic, operational, and third-party data will play a major role in 2022.

Acceleration of Cloud Adoption: Both financial institutions and regulators have gained confidence that well-built clouds can be every bit as safe, secure and reliable as the mainframe computers. Expect to see cloud play a central role in areas like security, fraud detection, and anti money-laundering.

I guess the cloud bet is not surprising coming from Google Cloud.

Key take-away? The future consumer is the same as the past consumer. They don’t know what they want until you show them.

“If I had asked people what they wanted, they would have said faster horses.” Henry Ford

Oh, and just to conclude these curations, guess what Nostradamus predicted for 2022.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...