Ron Shevlin, now Chief Research Officer at Cornerstone Advisors, a US research and consulting firm, posted a fascinating article based on his research the other day. Supposedly, banks and credit unions in America think they're are doing digital transformation. Interestingly, less think they're doing it today than a few years ago. Here are Ron's thoughts:

The End Of Digital Transformation In Banking

Bank and credit union executives are holding a loaded gun pointed at their feet. The name on the gun is “digital transformation.” Banks are deluded into believing they’re digitally transforming their organizations when all they’re doing is deploying new tools for yesterday’s industry.

Digital Transformation is Pervasive in Banking

According to Cornerstone Advisors’ 2022 What’s Going On in Banking study, to date, three-quarters of banks and credit unions have launched a digital transformation initiative. Another 15% plan to develop a digital transformation strategy in 2022.

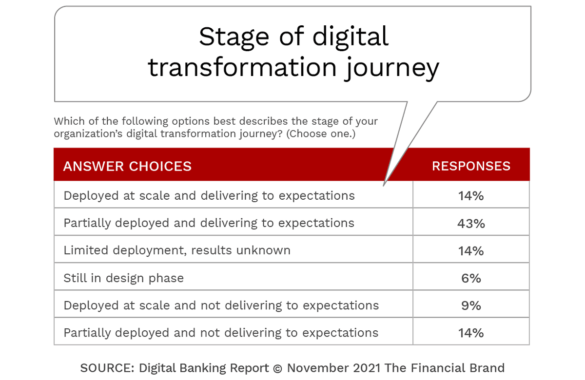

How far along in their digital transformation strategies are the banks?

Of those that launched their initiative in 2021, 28% said they’re already halfway or more done. And among those launched their strategy in 2020, almost half (46%) are at least halfway done with their strategy.

These have to be the fastest transformations in the history of mankind.

Digital Transformation Impact is Lacking

Banks’ perceptions of how far they’ve come in their digital transformation journeys don’t jive with the impact they think they’ve seen.

Not surprisingly, banks who think they’re only 10% (or less) through their digital transformation strategy have little to show for it so far.

But roughly four in 10 institutions who are a quarter of the way done with their efforts say that they’ve seen a “significant” (defined as greater than 10% improvement) impact on loan productivity. That’s a higher percentage than the banks who are half way through their strategy said they’ve had.

Among the banks and credit unions who believe they’re three-quarters or more done with their digital transformation only half have seen significant improvements in loan productivity, 28% report significant reductions in their operational expense structure, and less than one in five have generated significant increases in payments revenue and other non-interest income.

Maybe I don’t understand the meaning of the word “transformation.”

Digital Transformation Delusions

I’m not calling anyone a liar, but it’s hard to believe that banks are as far along in their digital transformations as they think they are. Among other requirements, digital transformation efforts should be addressing core system limitations and emerging artificial intelligence (AI) tools and technologies—but they’re not.

Read the rest of Ron's thoughts here ...

Meantime, if you want to hear more about this report sign up for Ron's preview release of the details on January 19.

Coincidentally, another of our brethren, Jim Marous, also wrote up some research on the same said subject on near enough the same said day.

6 Digital Banking Transformation Trends for 2022

Playing a game of catch up, banks and credit unions have accelerated their digital banking transformation efforts. They have invested increasing amounts of capital and human resources into data and advanced analytics, innovation, modern technologies, back-office automation, and a reimagined workforce with a mission to improve the customer experience while reducing the cost to serve.

Much of the impetus is because the fintech and big tech competitive landscape continues to expand, offering simple engagement and seamless experiences, causing customers to fragment existing relationships with their existing bank and credit union providers.

The good news is that there are a multitude of options available to work with third-party providers that can deploy solutions faster than can be done if developed internally. Incumbent institutions can also partner with fintech and big tech competitors while modernizing their existing systems and processes at the same time.

With every financial institution looking to become more digitally future-ready, it is more important than ever to understand the evolving financial industry landscape. This is why we are again providing our perspective on the digital transformation trends for the upcoming year.

Each organization will need to determine which trends and priorities work within the parameters of existing and desired business models. Whatever path is selected, there is definitely pressure on traditional financial institutions to act quickly and decisively. Here are the most important digital banking trends for 2022.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...