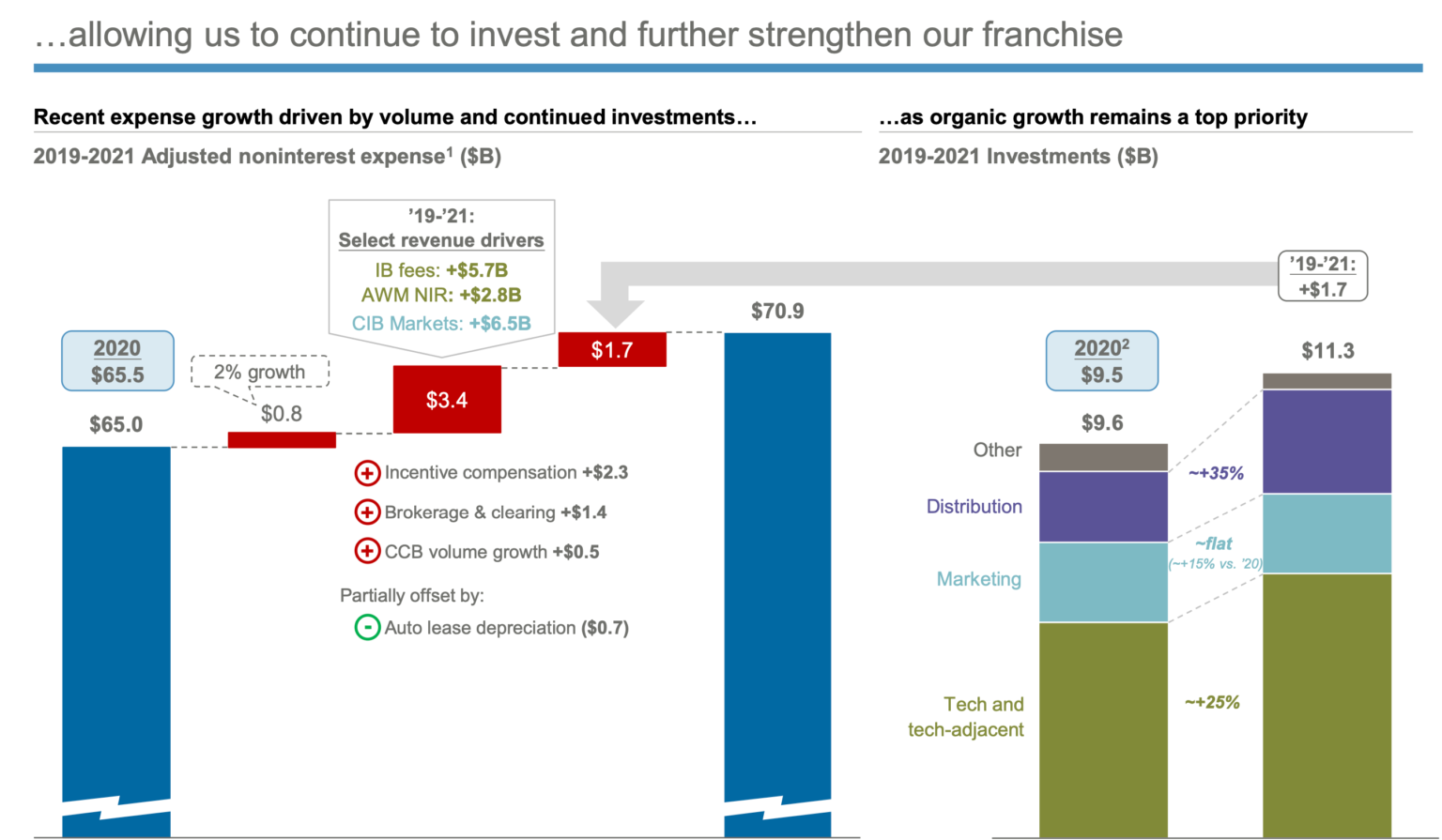

I was intrigued by the announcement by JPMorgan Chase that they’re spending $12 billion on technology this year.

Admittedly, I’ve been tracking this and it seems to go up by around a billion year-on-year. Although this is up 25% on 2020, the bank had said they were investing $11 billion in 2019. And they’re not alone. Citi, Wells Fargo, Bank of America and others are spending billions on tech, increasing year-on-year. In fact, it almost seems to be a mine’s bigger than yours game. JPMorgan leads the pack, but everyone else wants to announce that they’ve got a humongous budget for tech in a bank, because we’re not a bank: we’re a technology company with a banking license.

Rubbish.

You’re a bank, plain and simple, and now you’re trying to be a fintech bank. I loved this comment from James Shanahan, an analyst with Edward Jones:

And there’s the rub. Banks are spending more on technology than most FinTech’s are getting in investment. JPMorgan spent more on technology in two years (2018-2019) than the total investment in all European Fintech’s in 2019. But what are the results?

A new digital bank launch in Britain? A failed digital bank launch in America? Building an internal blockchain? A renovation of spaghetti legacy IT? Keeping the lights on?

According to the FT article, the investments are “earmarking new funds for data centres and cloud computing, as well as expansion into new markets like the UK and marketing costs”. Thing is: what does this actually deliver?

… and, more importantly, how do you measure it?

I have this belief that the structures of banks sees huge amounts of dissipation of investment as it waterfalls through the organisation. Think about the waterfall company. The CEO says: we’re investing billions in technology this year. Then think about a waterfall. As it cascades from top to bottom, you have the main waterflow which is strong and irresistible. But you also have lots of the water hitting the sides, lost as spray, jumping from the main flow, and doing its own thing.

This means that, of that $12 billion budget, I would estimate $2 billion will be wasted in internal conflict, politics, power bases and mistakes.

That’s how I see banks investments in technology.

In fact, if I broke down Jamie Dimon’s $12 billion, it involves around $6 billion servicing technical and process debt: just keeping the lights on or, more importantly, servicing the power bases of the CIO and COO; and $6 billion in digital transformation.

In other words, don’t read the top-line, look at the bottom-line. $6 billion to compete with the FinTech and Big Tech community is still as sizeable number, but it’s not $12 billion.

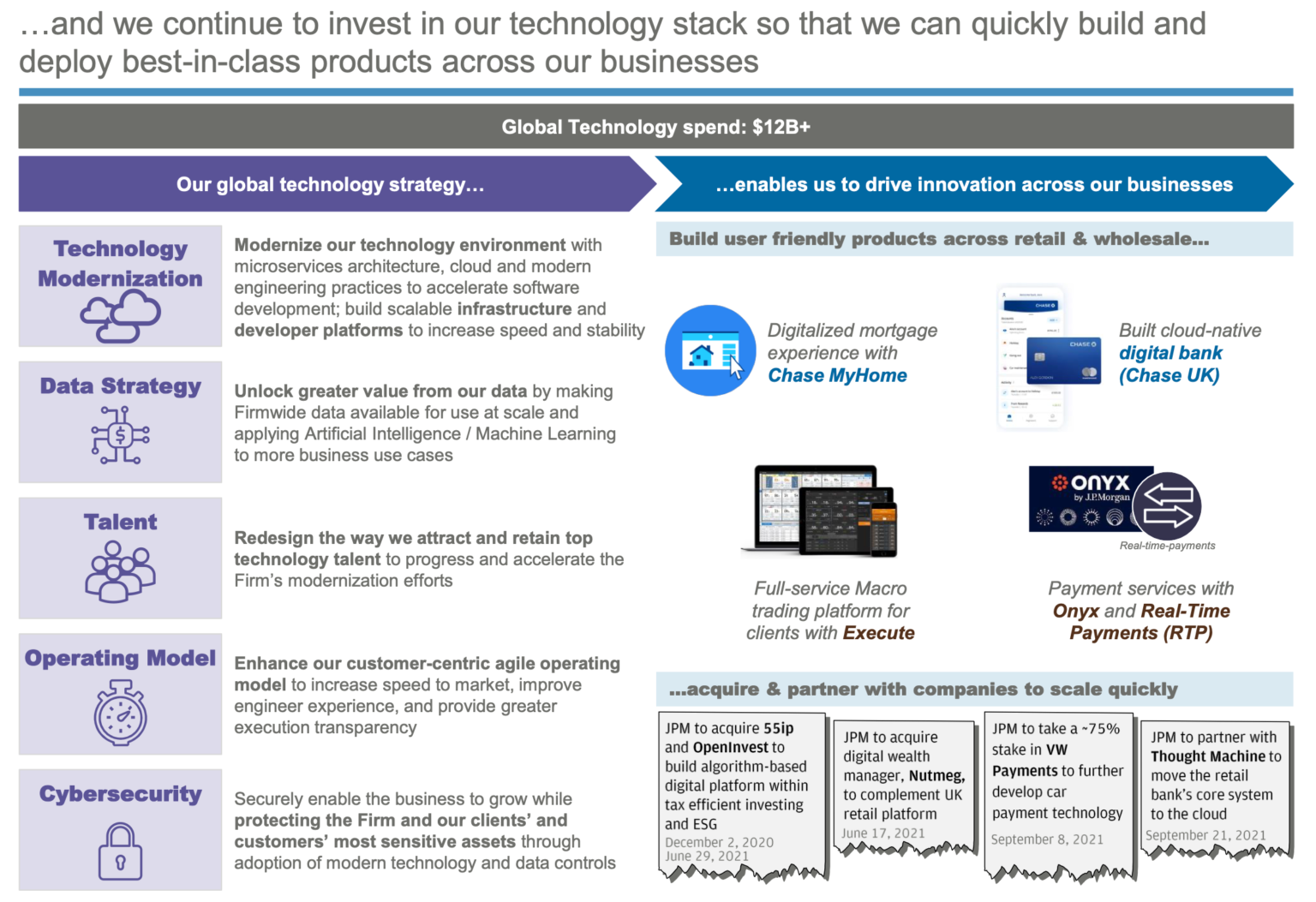

Most of the keeping the lights on budget is spend on regulatory-related investments, modernisation and the retirement of technical debt. According to The Tearsheet 2022’s technology spending includes:

- Modernization, which includes migrations to the cloud, as well as upgrading legacy infrastructure and architecture. Jamie Dimon said that this year, roughly 30% to 50% of the firm’s apps and data will be moving to the cloud.

- Data strategy that enables the bank to extract value in its proprietary data by cleaning it and staging it and deploying modern techniques against it

- Attracting and acquiring top talent with modern skills

- A “product operating model“

What is a product operating model? Building a new bank using new tech?

Source: Ron Shevlin

JPMorgan is moving its core systems to the cloud via Thought Machine. That sounds like a billion-dollar project.

Then you have the launch of a brand-new shiny bank in Britain. That’s going to cost them a minimum $100 million to get off the ground and, including marketing costs, probably double that.

Finally, with only 59 million digital Chase users, JPMorgan somehow continues to position itself as a scrappy underdog, competing against FinTech and Big Tech. It continues to invest big money to ensure it stays competitive with its products and services big time.

Bottom-line: if the highest valued bank in the world has a $6 billion budget to compete with FinTech and Big Tech, what budget do you have and what do you do with it?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...