I had quite a lot of response to Gail Bradbrook's post on February 1. It would be too much to share all, but this particular email from a friend (former CxO at a Big Bank) was the most detailed and illuminating, so I'm sharing it here. I'm sure Gail will respond to such critique in her column next month.

Dear Chris

I saw the entry you posted from Gail Bradbrook of Extinction Rebellion (XR) and am shocked, surprised and disappointed that you shared her views here on your blog. We in the banking community have recognised the pressure such activist groups are laying upon us, but you cannot have activist groups who are breaching civil rules taken seriously. XR have broken my bank’s windows in both branches and head office and encouraged protests that disrupt the economy, such as access to Heathrow airport. For me, this makes them an extremist organisation that you should not be encouraging to take part in our community.

From a banker’s perspective, I must also make clear that we are promoting renewable investments and green finance. But this change cannot happen overnight. It takes time. So many countries and companies rely on oil, gas and coal today. You cannot turn that off overnight. XR say we have till 2030 to make that happen. I think that is not realistic. It will take us until 2050. Nevertheless, we are working on it and, for all the accusations of greenwashing you throw at us, we cannot switch off fossil fuels like turning off a light. It has to be managed, over time, and affects countries and economies so it has to be co-ordinated.

We are working closely with all government influencers and NGOs to make this happen, and that is the purpose of meetings like COP26 and Davos. We will make it happen. We just need time.

Now, regarding her specific points shared, let me give you answers.

First, Gail talks about the film Don’t Look Up. It’s an entertaining movie, but the reality is that humans would never act this way. It’s a work by the far left to make us feel guilty and doesn’t understand that, if humanity was threatened in this way, we would act.

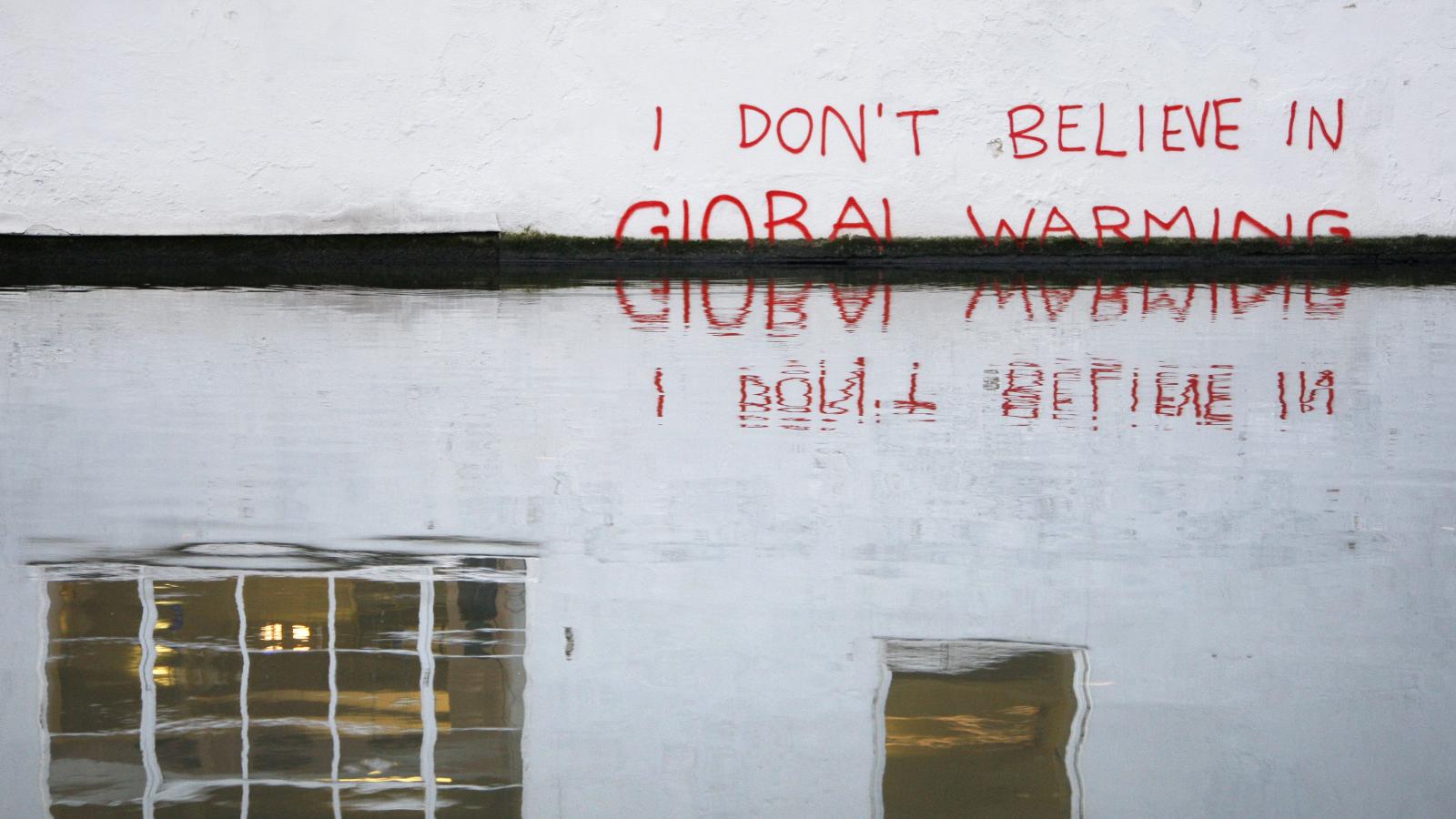

Second, she discusses tipping points and climate extremes affecting Earth. I am conscious that we need to address this – climate risks are one of the greatest risks to the world’s financial balance sheet – but is it climate change and a climate emergency or just a natural movement of Earth’s tectonic plates and a predictable reality? I’m not a climate denier, but I get fed up with all these films of Polar Bears dying because they cannot reach an ice island any more to get around when the reality is that there are more Polar Bears today than ever. They’ve just all moved to Canada.

The food issues are also notable and being addressed. We have technologies today that can create food. We have vegetable based alternatives to beef and we can even print drinks.

Technology will, in fact, solve many of the issues that Gail raises, which is why we are investing heavily in the tech industry and offering development hubs and mentors for companies that deal in environmental and food solutions with technology.

Regarding the Ostrich syndrome of wilful blindness, I disagree. Humans are hard-wired to fight or flight. I get the impression that Ms. Bradbrook prefers flight whilst I prefer to fight. We should be investing in bridging technologies to fight the issues she raises, not sitting passively on roads or breaking windows to do this. In fact, if you looked at our investment portfolio, we may have 1 in 5 dollars of profit coming from fossil fuel loans, but we are also investing 1 in 5 dollars in renewables. Admittedly, 3 in 5 dollars are going into fossil fuel firms today, but the balance is shifting and, as we see more and more of this so-called climate emergency, we will invest more in the fight. But we are not going to focus on flight. We will fight.

Gail’s comments about tax-dodging and corruption does not apply to my bank or most banks. These are things that may have been around in the last century but, with transparency – as you can read in our annual report – it is changing. We believe in full access to all data and complete transparency of our actions. These are the 2020s – can’t she see that banks have changed?

She mentions encouraging whistle blowers, but why would you want to employ someone who is a whistle blower? What goes on inside a business should stay inside the business, as long as there is full transparency externally after the case.

Finally, Ms. Bradbrook goes for the heart strings of how can we look after a legacy for our children and grandchildren. This is laudable and is why I have ensured that our property, art and other investments in assets will leave them with plenty of funding to do whatever they have to do to have a better life. What more do you need?

I appreciate you are trying to stir up a debate here Chris, but allowing an extremist activist to write a column on your blog left me feeling angry, upset and possibly believing you are being disingenuous. Please let me know if I am wrong.

Yours sincerely

Anonymous C-Banker

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...