Banks are loners. They do it all internally. They don't want outsiders stepping in. Too much risk. Leave us alone. Thing is, that doesn't work anymore. Today, banks are just a component on the network of finance. They are just part of an ecosystem on a platform. Do they understand this? I don't think so as, these days, they find it difficult to focus. Equally, is this top of their list?

There's new regulations, a pandemic, changing government policies, inflationary pressures, competition in all markets that is fierce, and a C-level suite full of people who understand risk, compliance and regulation, but tech? Not so sure.

Even if they understand tech, it’s difficult to focus these days. There are too many things happening in tech, too many changes, too many headlines:

- CBDCs, stablecoins, Diem, bitcoin, Ethereum, cryptocurrencies and more.

- Banks dealing with digital transformation, regulation, money laundering, competition and more.

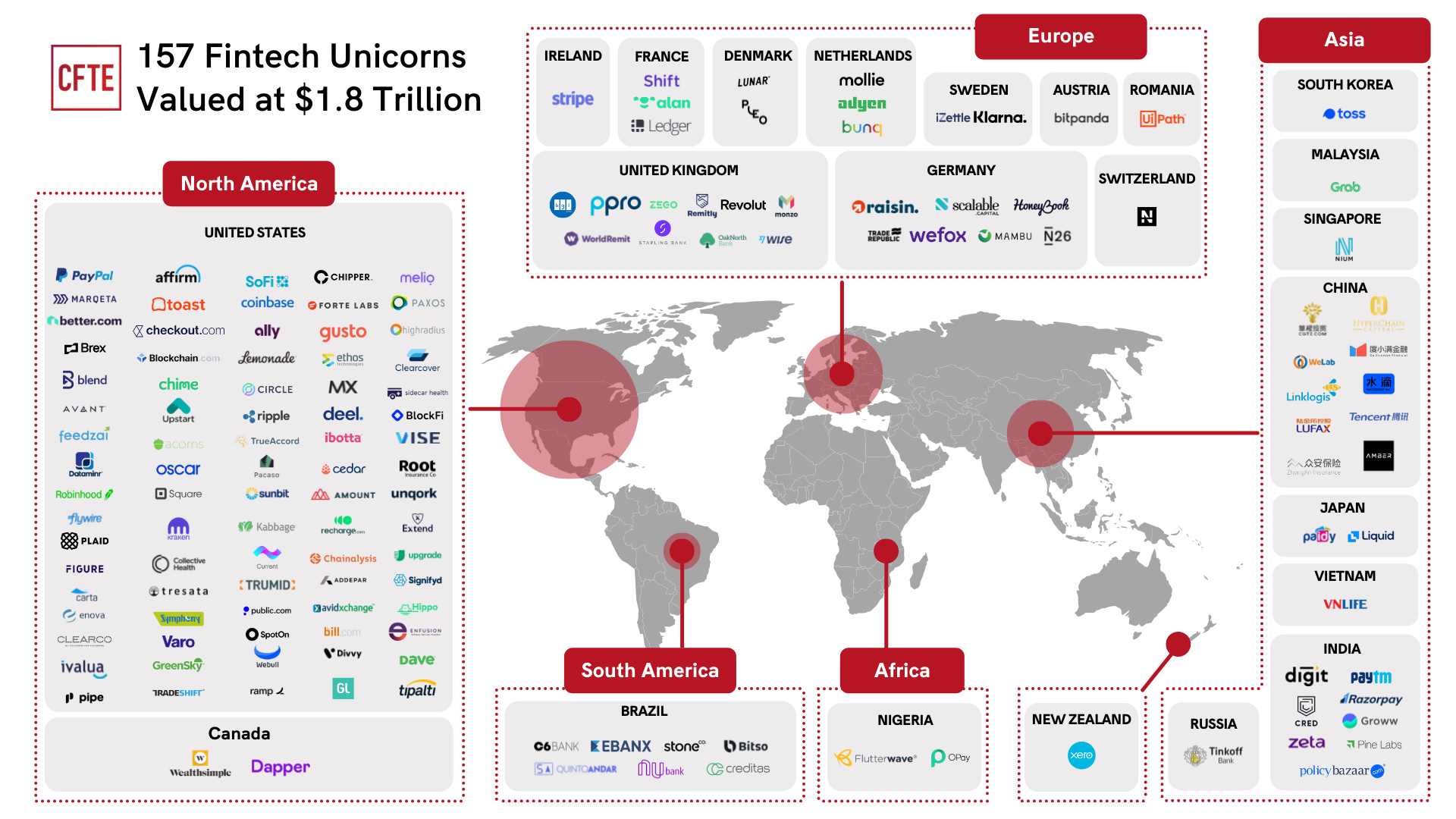

- FinTech start-ups getting unicorn valuations, creating new ideas, succeeding in niches and more.

- Big Tech companies creating disruptions by offering a phone as a payments terminal to squash Square and more.

The list goes on, and doesn’t even touch upon the economic things like America-Russia-China relations.

No wonder I find it easy to blog every day, as there’s always something to pick out of the pile of news. Today, it’s that the mash-up of all of these trends proves we are in a defining moment of change.

When I see a headline that Starling Bank is competing with Barclays Bank over assets, something has changed.

When I see that new banks have gained 8% share of old bank markets in just three years, something has changed.

When I see FinTechs worth more than many banks, something has changed.

Source: CFTE

When I see bitcoin moving in line with mainstream investment markets like Nasdaq, something has changed.

I guess these are all ramifications of Open Banking and DeFi. It is an irresistible movement away from traditional finance to new financial structures. It’s been bubbling away for twenty years or more, but is now in full flow. In fact, it’s almost like the movement from the high street to online; it’s a movement that is unstoppable.

Now, banks are all awake to digital transformational requirements but, as I blogged the other day, they are doing it the wrong way. Most C-level bankers still see digital transformation as a project with a budget delegated to a function. That is so wrong.

When you look at the list above and the reality, bankers have to realise that the tsunami of digital change pressures are upon us, and they must act fast and with radical reform. Incremental change is no longer enough. Revolution is required.

Jamie Dimon has proven this and led the call for this. Spending $1 billion a month on tech, JPMorgan Chase is leading the charge for radical reform. But then Jamie Dimon got beaten up for this, as he could not explain what they were going to spend it on. The Financial Times:

There are few more artful communicators on Wall Street than Jamie Dimon. Unlike many of his counterparts, the native New Yorker is willing to speak his mind and can express himself clearly, dipping so easily into the vernacular that he sometimes sounds more like the host of a sports-radio talk show than the boss of the biggest US bank by assets. But some subjects are a little too complicated for even the JPMorgan Chase chief executive to turn to his advantage. Like other pillars of the banking establishment these days, he is making fateful decisions about how to respond to a new generation of fintech competitors — and explaining his technology spending to outsiders is proving tricky.

So, you’re spending billions. What are you going to do with it?

Who knows? We just need to spend billions to keep up with all of the above!

But what if you don’t have billions? What if you have just a million?

Well, the answer is stop trying to be all things to all people doing everything you’ve always done and everything everyone else is now doing. Just do one thing brilliantly well or, in a banks’ case, a few things.

I’ve talked about this a lot in the past, and now feel it is critical for banks to wake up and smell the coffee.

Banks have historically tried to manage all things for all people and never retire any service or function. They still do checks, take cash and offer face-to-face services. Today, in the platofmr ecosystem of Open Banking, they need to focus much more on how to integrate FinTech APIs and other services to their offerings to enrich them digitally.

It does not mean they stop doing everything they ever did, but it does mean recognising that they cannot do everything digitally better than everyone else does it.

Humility, partnering, being open and creating relationships with the ecosystem is what is demanded of banks today, rather than trying to do everything on their own … for a billion dollars a month.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...