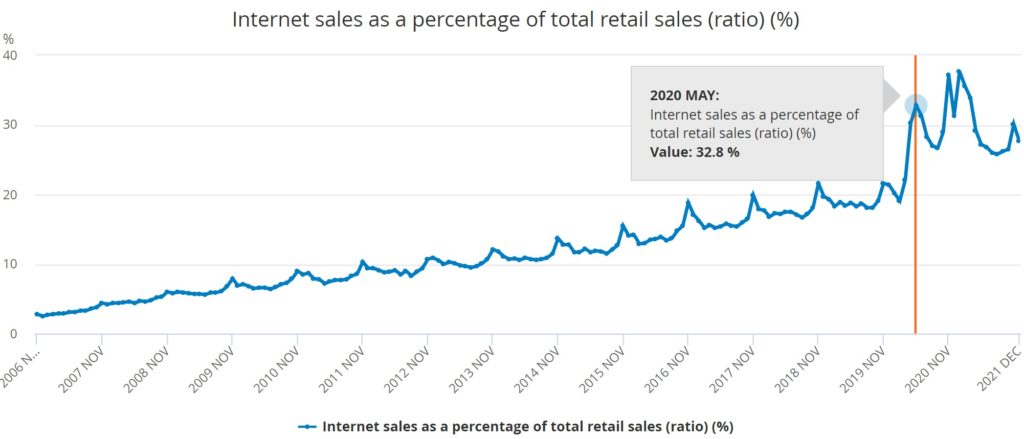

I’ve talked a little bit about a K-shaped economy. The upside of the K is digital; the downside is physical. This really struck home with me when I saw the latest retail sales developments in the UK. According to the Office of National Statistics (ONS), Brits now order a third of their shopping on apps and the internet.

Source: ONS

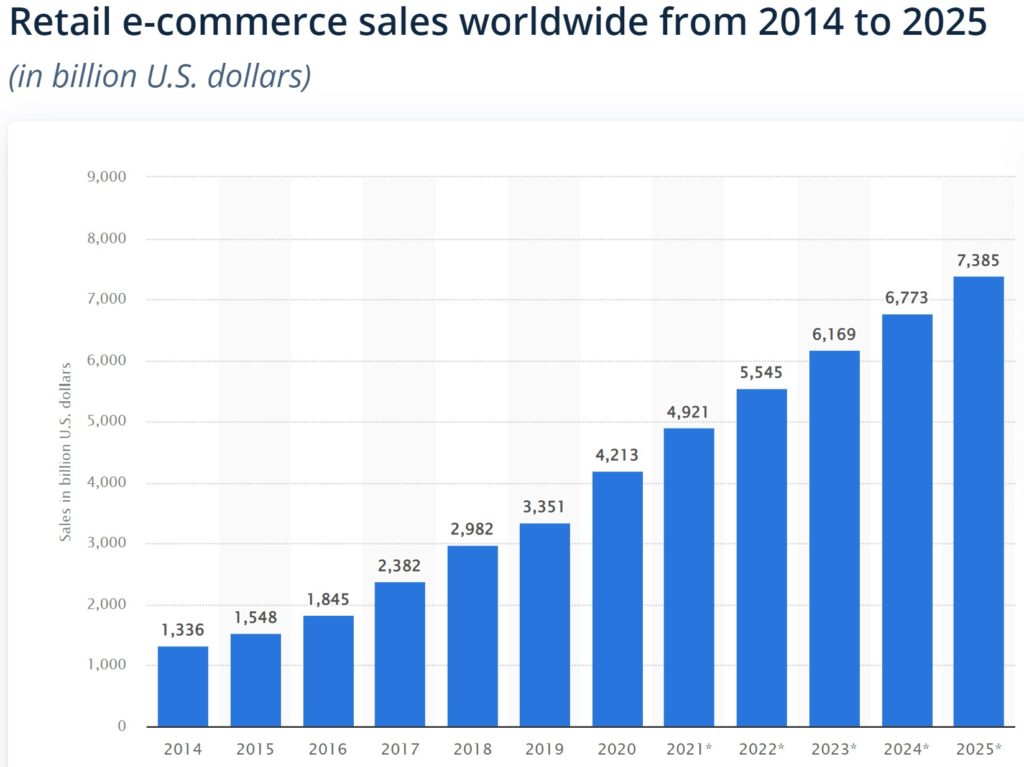

In fact, as you can see, by the end of 2020 internet sales were almost 40 percent of all retail sales. Worldwide, in 2021, internet sales almost reached USD$5 trillion and, by 2025, are forecast to grow a further 50 percent to USD$7.385 trillion.

Source: Statista

These are interesting stats as, just a few years ago, respected analytic firms were forecasting e-commerce to reach USD$6.7 trillion by 2020 [Frost & Sullivan Future of B2B Online Retailing report released in 2014]. They weren’t far out when you think that, for context, J.P. Morgan released a report in 2011, saying that e-commerce revenue will grow to $680 billion worldwide up 18.9 percent from 2010 revenue.

In a decade, we’ve grown from $680 billion to $5 trillion.

That’s pretty incredible, enabled by FinTech payment firms like PayPal, checkout.com, Klarna, Adyen and Stripe. But has it come to an end?

PayPal’s share price sunk after its latest earnings were released.

PayPal shares tumbled more than a quarter in early trading (on 2nd February), after the company warned … supply chain problems that were eating into cross-border transaction volumes, reductions in travel and events because of rising coronavirus cases, the elimination of government stimulus and inflation. The fall-off was being felt particularly among “lower-income cohorts” … [and] PayPal was abandoning its medium-term target of reaching 750m users after finding that many of the 120m new customers added over the two years of the pandemic had failed to actively use the service ...

What’s interesting here is that, if we had not had a coronavirus, would the numbers be very different? I think they would. Pre-pandemic I was flying around here, there and everywhere, spending most of card payments on flights, hotels and souvenirs. For two years, that’s pretty much gone out of the window and I know I am not unique. The loss of global tourism and travel has been a specifically hard hit for online sales.

The United Nations World Tourism Organisation (UNWTO) estimates that 2021 levels of tourism were down 72% compared to 2019. That’s the K-shaped economy right there. If it’s physical – travel, tourism, hospitality, restaurants – it’s dying; if it’s digital, it’s flourishing. It is why Elon Musk became the richest man in the world in 2021, with Jeff Bezos a close second.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...