I stumbled across an interesting report by Clarivate who, using a statistical analysis, have identified the 100 most innovative companies in the world.

Technology advancement is a complex composition of talent, of competition and of need. New ideas emanate from everywhere scientists, engineers and developers reside.

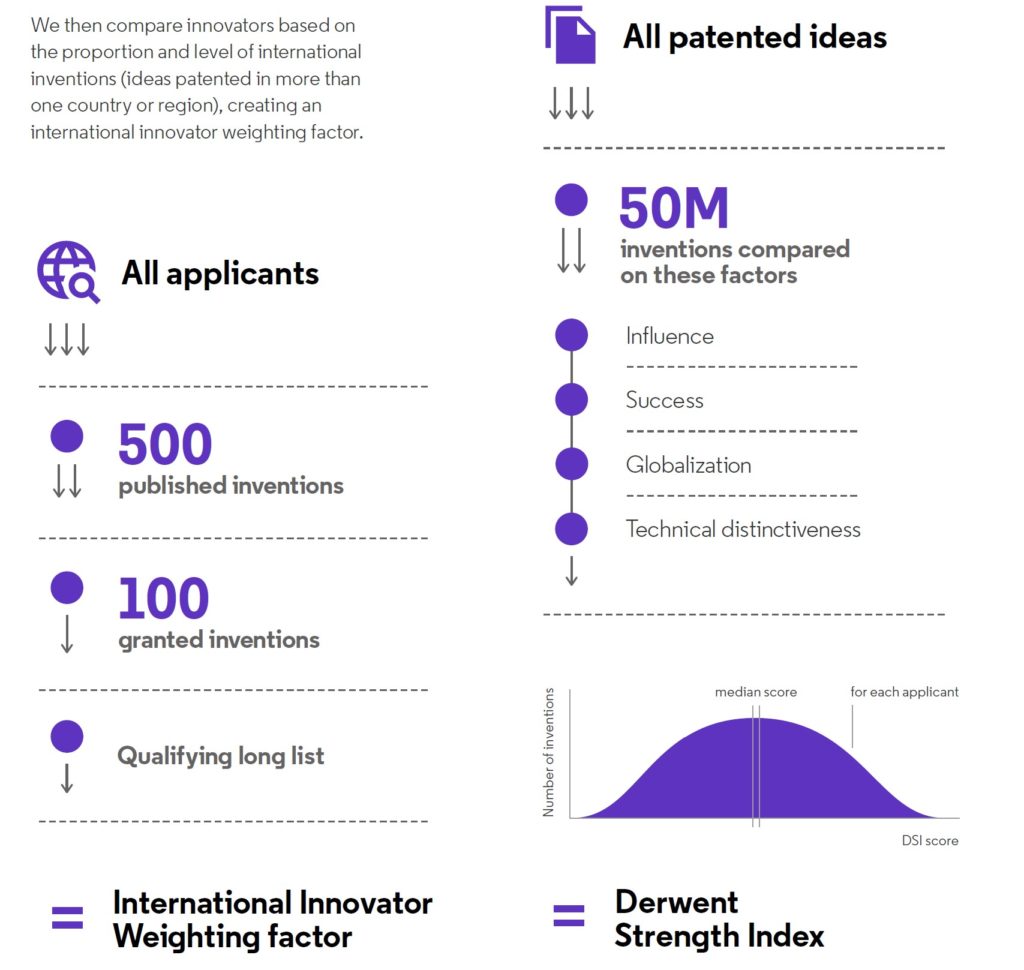

What is the methodology? They basically take the inventiveness of a company multiplied by its patents to arrive at a score of innovation.

Some may criticise the method, but I decided to check the list and see how many are financial firms.

Answer: none.

Not one.

You might give me pushback, as Ant Group from China are on the list, but they are listed as software, media and fintech. There’s not a single bank on the list. There’s not a single financial institution on the list. And there’s no company on the list that I’ve dealt with in finance apart from Ant.

Hmmm.

For an industry that has banged on and on and on about how innovative it is, and how important innovation is, that’s a surprise. For an industry that claims it’s a technology industry with a banking license, that’s surprising. For an industry that points to leadership in ideas, that’s not something you expect.

Or is it?

TBH, banks and financial firms are the least innovative companies in the world. FinTechs and start-ups, big tech and industries like pharma and auto are far more innovative. For all the claims to need to innovate, banks spend most of their time just keeping the lights on (my old mantra of core systems legacy issues).

Picking out a few names from the top 100 list, do banks really believe they are more innovative than ABB, Boeing, Bosch, Canon, Fujitsu, GE, GM, Honda, HP, Olympus, Panasonic, Samsung, Sony, Toshiba and Volkswagen? Oh, or Alibaba and Ant Group?

I must admit, the list surprised me a little as it misses Apple, IBM and Tesla, for example. Nevertheless, what is being innovative all about? Coming out with ideas (patents) and then implementing them (inventions).

Is a bank about patents and inventions? Not really. Banks are all about boring. Banks are about being dull. Banks are about being nice, but dim.

Nice but dim = good-natured, while also being rather unintelligent.

We don’t want banks to be out there on the edge of innovation. We want them to be stable, secure, reliable and resilient. We don’t want them being too smart and experimental. We want them to look after our money safely and make sure there are no cracks in their systems. We don’t want them to be hip and cool. We want them to be nice, but dim.

OK, OK, OK, I’m being a bit extreme, but don’t you get it? Technologists and technology-based organisations are expected to innovate and yet, for all the discussion of banks being technology companies with banking licences, they are not technologists or technology-based companies. They are regulated institutions that are, by nature, meant to be boring.

No wonder there’s not one bank on the Top 100 innovators list. After all, what are they going to patent? A new collateralised debt obligation? What are they going to invent? A new form of bank account?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...