Sometimes you think there’s not much more to say about a subject. Then a friend sends you some links and suddenly you’re falling down another rabbit hole, this one all about banks and climate change. A friend of mine just shared a bunch of documents about banks’ funding of fossil fuel firms. It makes for interesting reading. Here’s a few items that jumped out at me:

As revealed in the Rainforest Action Network’s report, Banking on Climate Change:

- 35 banks have funnelled $2.7 trillion into fossil fuels since the Paris Agreement in 2016 and 2020;

- JPMorgan Chase, Wells Fargo, Citi, and Bank of America are the top four bankers of climate chaos, accounting for nearly a third of fossil fuel finance from 35 banks;

- since 2016, these banks have financed 2,100 companies across the fossil fuel industry; and

- just in 2020 alone, Chase sunk $51.3 billion into fossil fuels, and Citi followed close behind, plunging $48.4 billion into coal, gas and oil.

Thing is, we know about the issue, but what can we do about it? That’s the tough call, as politicians, business leaders and finance are in this unholy alliance together to seek profit over purpose.

“We believe that Barclays can make a real contribution to tackling climate change and help accelerate the transition to a low-carbon economy.” Barclays ambition to be a net zero bank by 2050; and yet from the start of 2020 to the eve of the COP26 climate talks, Barclays financed $5.6 billion to the fossil fuel industry, making them the UK’s number one fossil fuel-funding bank this year.

Some take a lobbying approach, getting online petitions signed and encouraging more and more actions to get politicians to act. Others take more direct actions through peaceful protests, sit-ins and, in the more extreme cases, breaking windows of banks offices and branches.

But I would look at it a different way, and I made this point the other day in a Board meeting. Customers don’t care. If customers cared, they would close their accounts and switch to ethical banks and yet the UK’s leading ethical bank, the Co-operative, has held that position for years and never did great business.

In an interesting article, Diane Osgood explains that are too many factors involved to compel a consumer to switch their accounts from one bank to another based upon green behaviours.

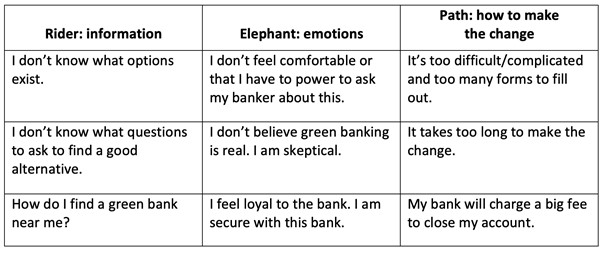

The responses fell into three categories that correspond to the image of a rider on an elephant trying to steer the elephant down a path. The elephant, symbolizing our emotional body, must want to go. The rider, symbolizing our mind, must want to go as well. Our minds are lazy, so the change needs to be easy. Finally, the path must be clear with no obstructions or unacceptable costs. If any of these three conditions aren’t met, change will be difficult. The customer will not change banks.

Using this simple framework, we see focus group results hit all three types of categories.

Does this mean that the only way banks would change behaviours is if they were told to by the regulators? Probably, but the regulators haven’t stepped up to that chellenge (yet) as they are controlled by politicians who are controlled by economic interests of business and finance. This is why Norwegians maybe the greenest citizens on Earth, but they make most of their money from oil and gas (Scotland also has this issue).

Nevertheless, as I blogged about the other day, for start-up companies green finance can be a USP.

In fact, what is likely to happen over the next decade is that young visionary FinTechs and start-ups will carve niches around banks, offering better services that are cheaper and greener. Add those capabilities together and maybe people will start switching.

Deloitte research found that more than 60 per cent of some 1,250 British adults would leave their bank if they found out it was linked to environmental or social harm, even if it had the best financial offer available.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...