The new Intergovernmental Panel on Climate Change (IPCC) Working Group III report has just come out. The report looks into the progress made in limiting global emissions and the available mitigation options across systems and sectors in the short, medium, and long-term, and follows fast on the heels of reports I and II. Working Group I showed that climate change is widespread, rapid and intensifying; Working Group II stressed that cumulative scientific evidence is unequivocal: climate change is a threat to human wellbeing and the health of the planet.

As Oxfam notes it is clear that “the world is heading for 2.7°C of warming under current plans. That is a death sentence for climate-vulnerable countries like Vanuatu and Bangladesh.”

Yawn.

Heard all that before, so what? So, what? SO WHAT? I’ll turn off the lights and go back to bed?

Well the so what? Is delivered in another report released on March 30th:

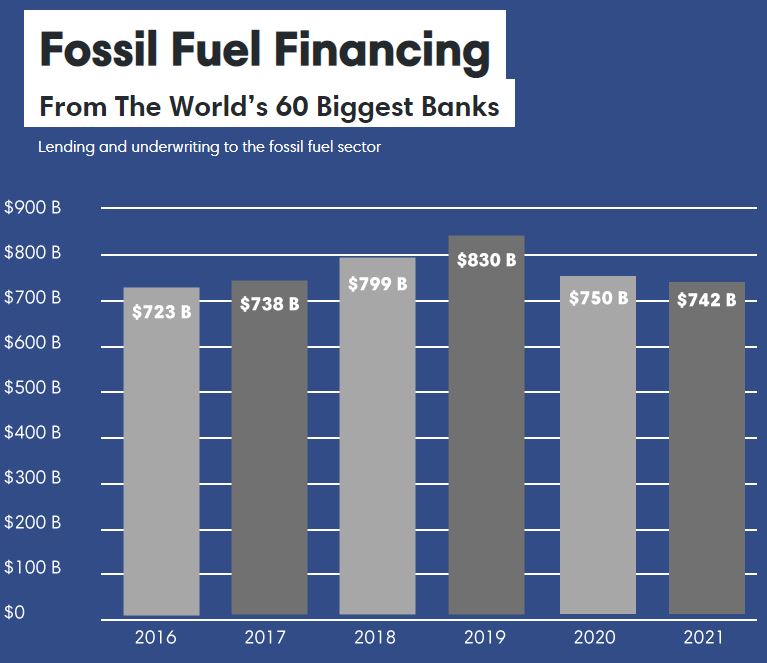

The 13th annual Banking on Climate Chaos report, the most comprehensive global analysis on fossil fuel banking to date, underscores the stark disparity between public climate commitments being made by the world’s largest banks, versus the reality of their largely business-as-usual financing to the fossil fuel industry. The report documents that in the six years since the Paris Agreement was adopted, the world’s 60 largest private banks financed fossil fuels with USD $4.6 trillion, with $742 billion in 2021 alone. 2021 fossil fuel financing numbers remained above 2016 levels, when the Paris Agreement was signed. Of particular significance is the revelation that the 60 banks profiled in the report funnelled $185.5 billion just last year into the 100 companies doing the most to expand the fossil fuel sector.

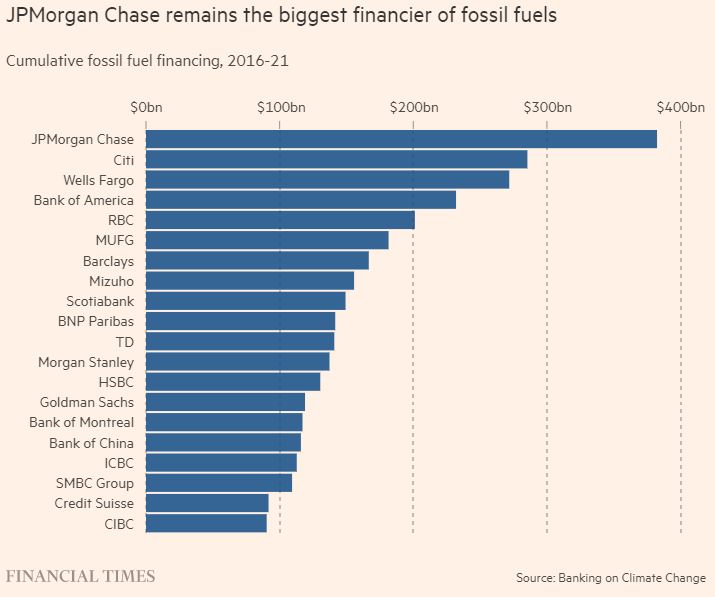

It’s interesting that The Financial Times spotted that the most funding comes from just four big banks (all American):

Fossil fuel financing remained dominated by the same four US banks, led by JPMorgan Chase, and followed by Wells Fargo, Citi and Bank of America, according to the annual report produced by a coalition of campaign groups organised by the Rainforest Action Network. All four banks are members of the so-called Net-Zero Banking Alliance that is part of Carney’s Glasgow Financial Alliance for Net Zero umbrella group. The group made the claim at the UN climate summit in Glasgow in November that $130tn of private sector assets was committed to achieving net zero greenhouse gas emissions.

Even more noteworthy is that, of the 44 banks that had committed to net zero emissions, 27 had no “meaningful policy”. As a result, these banks can continue funding fossil fuel projects without breaching policies. Oh my ...

You can download the report and get access to all the data here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...