If you didn’t read my blog last week asking whether the pandemic had transformed banking to be digital forever (answer: no), what is obvious is that the pandemic has changed consumer behaviours forever.

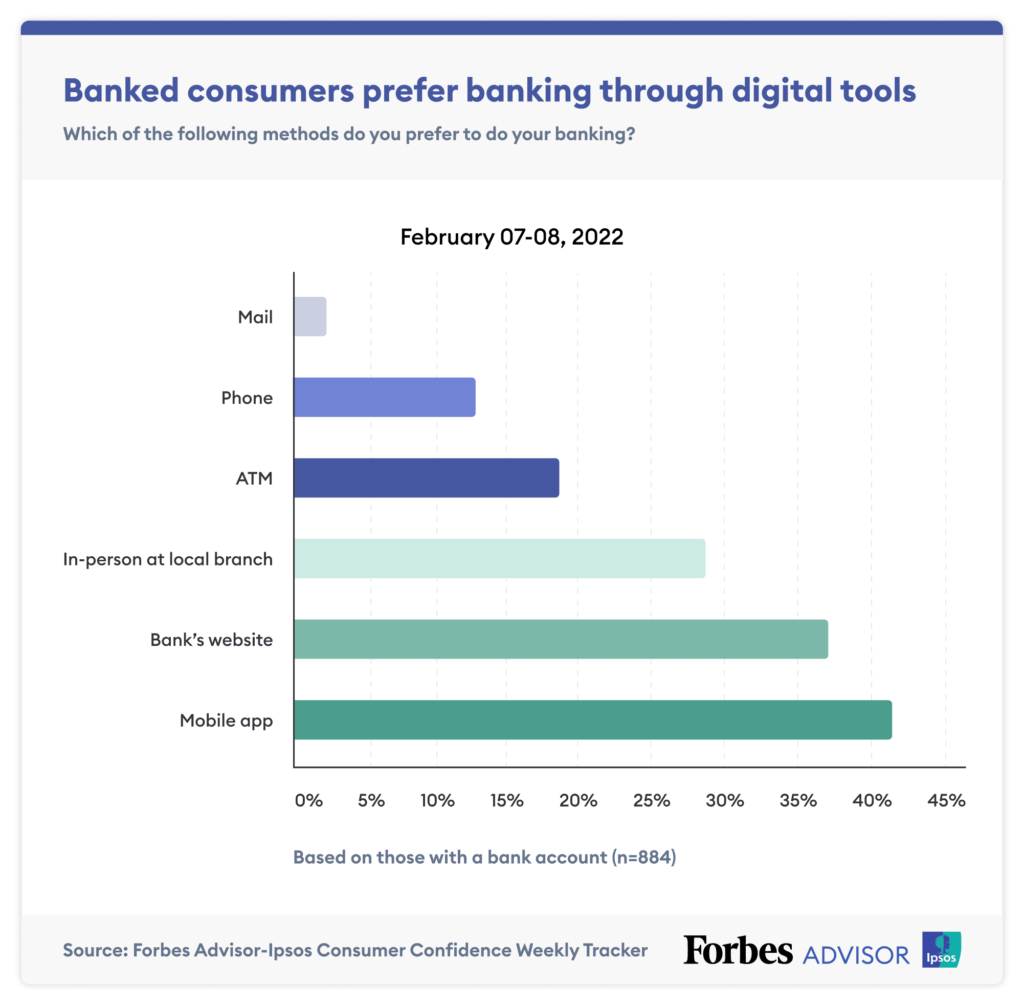

This was brought home to me when reading the Forbes-Ipsos survey of American consumers views of digital banking.

The survey took place in February 2022 and found that four out of five consumers (78%) prefer to deal with their bank via their apps and websites. That’s quite a change when only a third of consumers were regularly using bank apps four years ago (PwC survey).

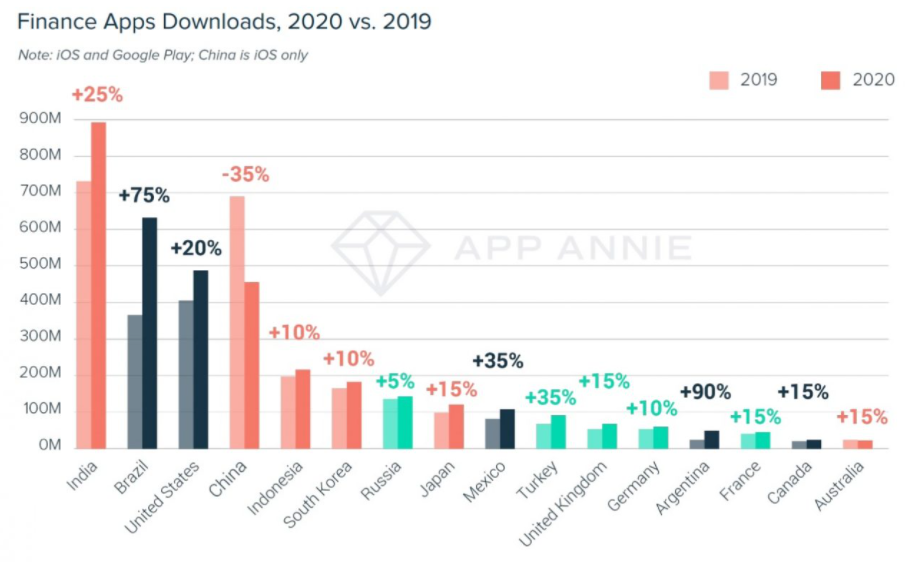

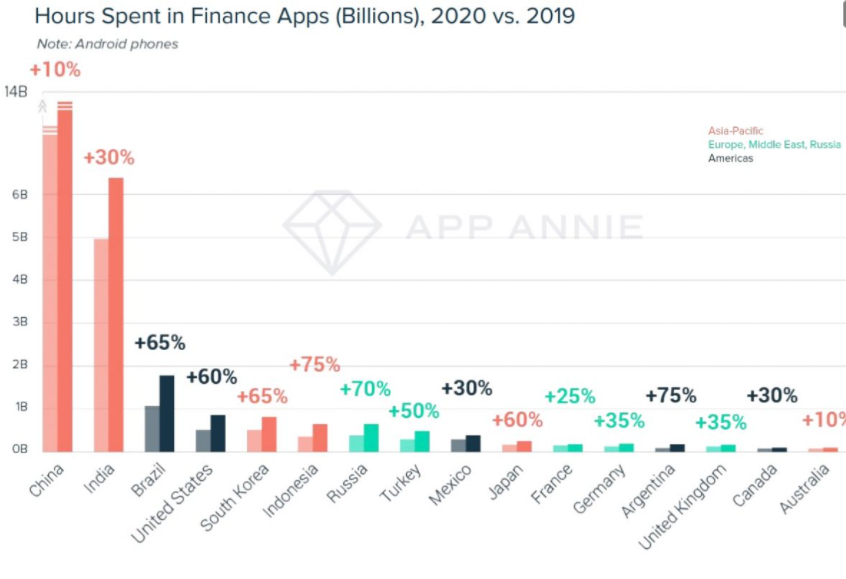

It is obvious the pandemic has made people more digitally savvy. Liftoff’s annual Mobile Finance Apps Report in 2021 shows that Finance app installs increased by 15% in 2020 compared to 2019. Users installed 4.6 billion finance apps globally and spent 16.3 billion hours in-app, up 45% from the previous year.

[12% of the UK population downloaded their bank's app in the first month of lockdown]

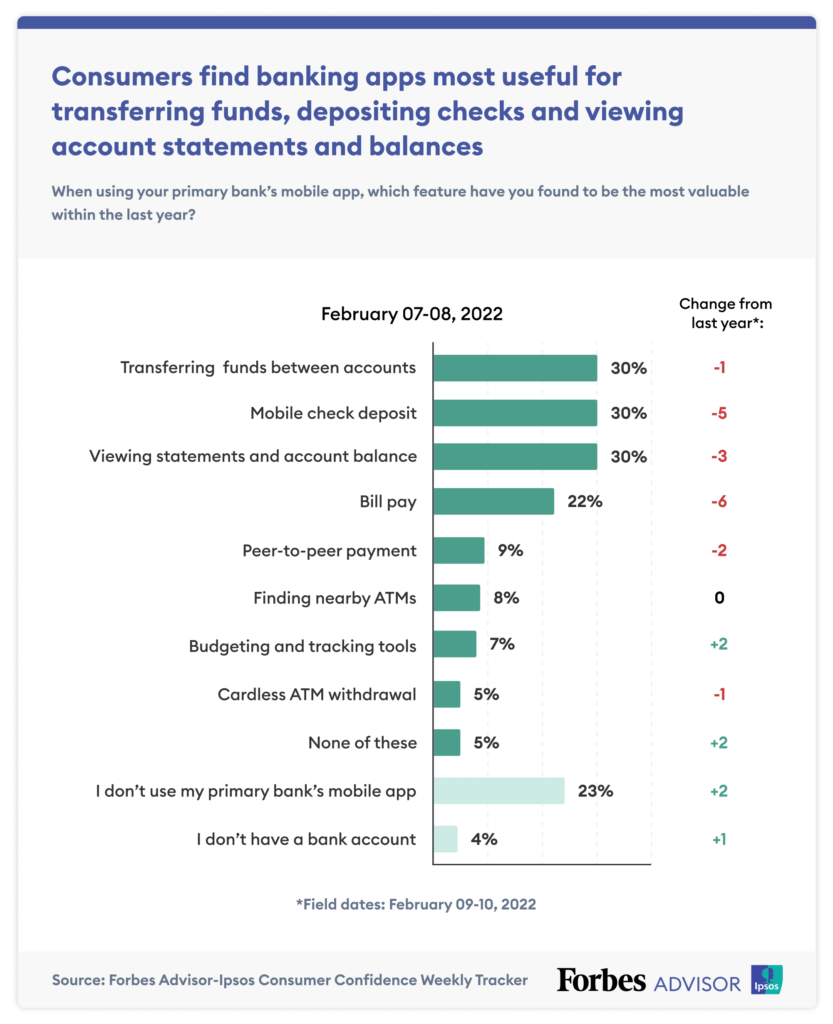

Forbes survey is interesting as it asks the question: what are people using digital banking for?

According to their survey it’s mainly for checking balances, depositing checks (remember this is America) and transferring funds. Other features of convenience were seen to be nice-to-have but not used as often, such as peer-to-peer payments, finding nearby ATMs and budgeting and tracking tools.

All in all, it shows that the customer is now pretty comfortable with technology. The question is whether their bank is? For example, mobile downloads and usage may have spiked in the pandemic, but Liftoff’s survey noted that FinTech apps were far more successful than banking apps, with FinTech outperforming even the best banking apps by a factor of up to 10.8x.

Hmmm … now I wonder why that might be?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...