I had an interesting comment the other day from a friend who said that he had worked with incumbents and start-ups. The big difference is that the incumbent views digital as a cost-cutting exercise, whilst the start-up sees it as a customer-enhancing opportunity.

It rang a bell with me. Having spent so long dealing with incumbent banks, I’ve hardly met any that see technology as a customer service tool. They see it as a cost reduction structure. If the customer self-serves, then we don’t need to serve.

Most traditionalists focus on digital as a cost and efficiency driver versus the start-up that views digital as a way to create valuable and powerful customer propositions with digital. The start-up is using digital to differentiate and to drive rapid customer and market share growth as the main objective. In so doing, they benefit from all of the savings and efficiencies of digital-only processes ... as a by-product.

This is a critical point. If you only look at technology as a cost reduction process, you never get the market opportunities. If you look at technology as a market opportunity, you get the cost savings naturally as a by-product.

When you think of it this way, you can see why so many fintech start-ups have achieved unicorn status. Why? Because they’re using technology to give customers a better experience and, as they do, they get the rewards of more customers and more revenues and more investment. There’s no discussion of cost reduction in the majority of start-ups. The discussion is about the customer and the customer experience.

In fact, this has been my biggest frustration throughout my life, which is that we would spend months writing a business case for a bank executive team that would show the clear cost-benefit analysis for why they should invest in a technology. They would then rip it apart and we would spend another six months doing it again. It was a waste of time.

When we outlined how the technology would enhance the customer relationship, grow more revenue and deliver greater profit, no-one listened. If we could show that they could make 1,000 people redundant, they listened. For example, one of my favourite stories is that JPMorgan could fire 1500 lawyers thanks to AI doing the work:

JPMorgan Software Does in Seconds What Took Lawyers 360,000 Hours

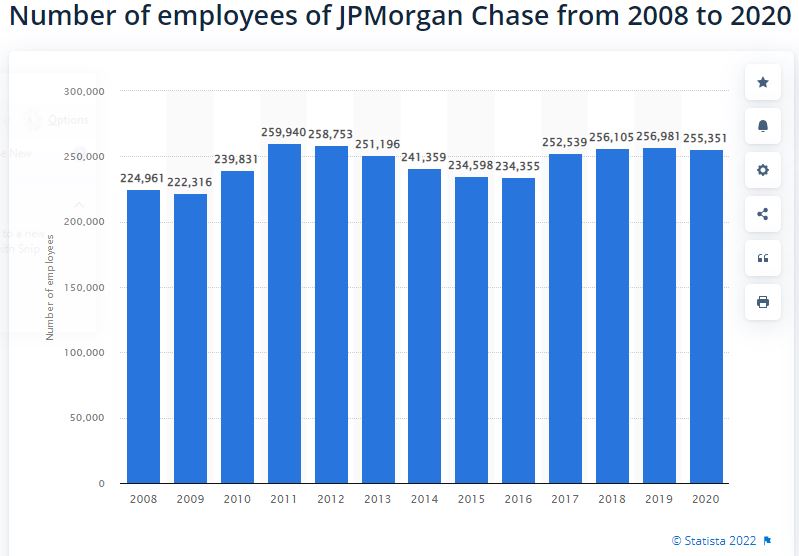

I’m not sure they did, as they still employ a lot of people (over 250,000 last time I looked).

Source: Statista

In fact, according to some like the former Chief Economist at the Bank of England Andy Haldane, banks are the worst at getting return on investment from their technology.

In fact, the financial markets of Rockefeller and J.P.Morgan a century ago were more efficient at a unit cost level than the markets of today.

No wonder fintech has emerged as a massive market of change. It’s focused on customers, not on costs, and it’s delivering the ROI that banks have missed for decades.

Banks should be worried …

Totally agree @JReadman - @StarlingBank & then @monzo all the way...

The High Street Banks just can't understand either #CustServ or #Tech & the role these #ChallengerBanks have used to embrace this #FinTech #technology

The #BigFour are no more thanks to #StarlingBank & #Monzo

— Ian M Calvert (@IanMCalvert) April 12, 2022

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...