For most of my time working with banks, regulators were about clipping banks’ wings to suit the market. Today they are all about opening markets and enabling innovation.

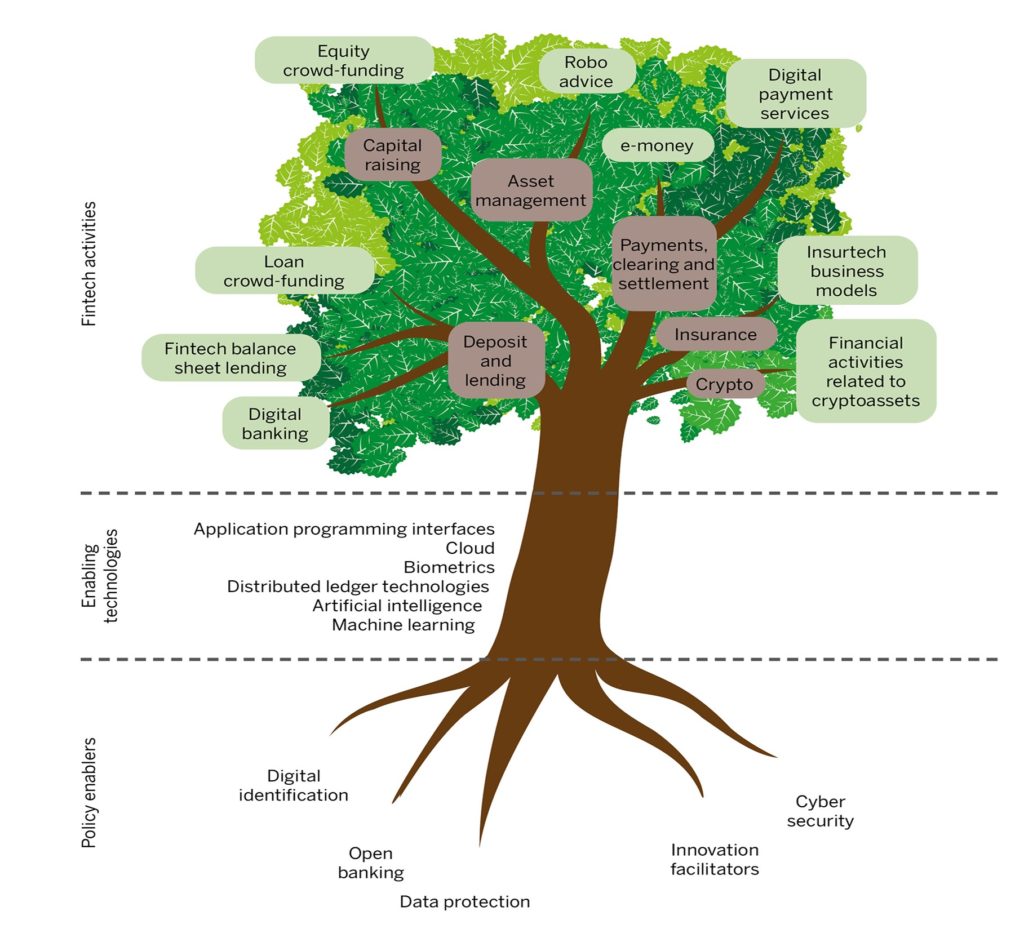

Jason Butcher, an entrepreneur and a friend, recently posted a picture of a tree on LinkedIn and likened it to today’s financial technology world. The diagram depicted the roots of the tree as innovation through enabling regulatory policies.

The core of innovation is in the tree trunk’s technologies, whereas the product of innovation — the leaves on the tree — is derived from enabling policies and technologies. However, it doesn’t work that way.

The way this really works is sporadic and unpredictable; it is neither planned nor managed. Start-ups see emerging technologies that are enabling and start building upon them. The result is that the regulatory policies emerge far later than the technologies or innovations. Regulators are always in catch-up mode and rarely in enablement mode.

Luckily, this has changed over the past decade. Having been around the block enough times, I’ve seen how regulations and regulators have developed. From the 1990s onwards, most regulatory activity was all about trying to control the miscreants of finance.

For example, I worked closely with the EU policy-makers in the 2000s and produced two books about the Single Euro Payments Area and Markets in Financial Instruments Directive. Back then, I was a boring old banking observer and knee-deep in regulatory wrangles. I always remember one eurocrat telling me that the Payment Services Directive was not trying to create a single eurozone, at that stage; it was trying to get all the sheep in the pen.

I asked him to clarify and he continued the analogy: “We are the sheepdogs and the banks are the sheep. Our job is first of all to get all the sheep in the pen. Once we have achieved that, we then have the job to get all the sheep to face the same direction.

“Once we have achieved that, we then have to get all the sheep through the pen to the sheep shearer. Once we have achieved that, we have to shear the sheep and get them fit to leave the pen. That is what we do as regulators. We get the banks into the pen; we then get them to harmonise; we then clip their wings to suit the market; and we then release them back into the markets.”

This view rang true to me: regulators in the 2000s were all about trying to force banks to behave better.

Empowering technologies

Then, at the end of the 2000s, enabling technologies appeared — in particular smartphones and the cloud — and allowed a burgeoning group of fintech start-up innovators to launch. The regulators were not prepared for this, but they liked the look of this innovation wave, as it would create more competition in finance. So, they supported it.

Light licensing, particularly for payments processing, allowed the likes of Klarna and Adyen to flourish. The UK, particularly London, encouraged these innovations, which led to the creation of a world-leading fintech community. Regulators launched internal innovation projects, as well as sandboxes to engage externally.

Yet the experience hasn’t been entirely positive. If you open markets and enable innovation, some of the innovators throw mud in your face. Some, like Wonga, created bad market practices; others, like Powa, gamed the system; and a few, like Klarna, emerged with questions about their business models. But there is also a small number of stand-outs, like Starling Bank, who seem to have their act together and fit the new world of finance and tech, or fintech as we prefer to call it.

From a regulator’s viewpoint, the challenge is keeping up, protecting consumers, making sure things work right and avoiding failures. This does not mean that regulators have to be completely risk-averse; but it does mean that regulators have to try to be more future-focused.

Meanwhile, if I redrew the tree, the roots are in technology; the trunk is in new business models and ideas; and the leaves are the enabling policies that enable the tree to truly blossom.

This article was previously published as Chris Skinner’s monthly The Banker column

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...