I was reflecting on the fact that I’ve been talking about digital banking for a decade and a half. That’s a long time. I’d claim to have fathered the phrase Banking-as-a-Service back in the 2000’s, and yet only a third of banks understand the concept of BaaS today.

Wow.

There’s a fundamental issue at stake here as we meet the juncture between the start of the century and head towards the mid-century. Those who don’t understand BaaS, digital and digital transformation are now too late. It’s over. You should have done that by 2020. As we approach 2030, there’s another agenda in play and you probably don’t even know it.

Last decade, banks should have moved digital to the core. They should have replaced their old back office systems with a tech stack built of apps, APIs and analytics. If you didn’t do that, you’re too late.

This decade, you need to move digital to purpose. What is the purpose of your bank? What is the purpose of finance? What is the purpose of commerce?

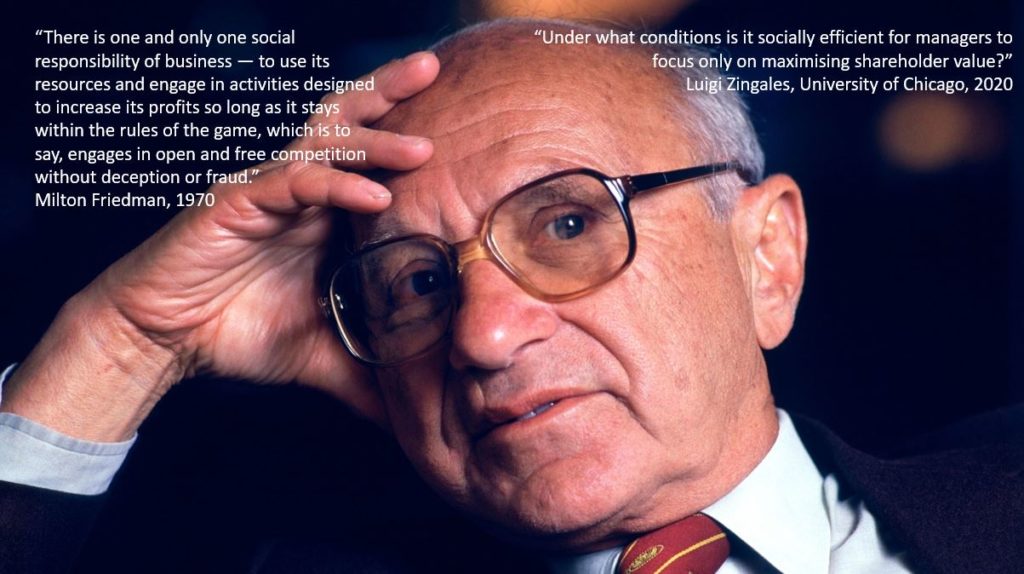

I often point to Milton Friedman at this point and shareholder capitalism. People tell me I’ve simplified it too much, which I have, but Friedman’s economics was to focus on making profit at any cost, as long as it’s legal. Interestingly, even Friedman’s university disagrees with that view.

The view today is that we need to move from shareholder capitalism to stakeholder capitalism. That’s what Jamie Dimon advocated when he delivered the Business Roundtable’s manifesto in August 2019, and this is the agenda for the 2020’s.

But it goes further than this. It goes to the heart of what I’m passionately talking and writing about these days. It’s about how do we bring technology and finance together to make the world a better place?

Putting this in context means that the last decade was about doing digital. This decade is about using digital.

We should have moved from analogue to digital years ago. By that, I mean that you’ve moved to an open structure of apps, APIs and analytics that is network-based. You’ve moved from physical structures with buildings and humans to digital structures with software and servers. You’ve moved from a traditional structure, where products are centra,l to networked structures where customer experience is the key.

That’s done and dusted. If you haven’t done that, you’re dust (bear in mind 1 in 3 banks still don’t understand BaaS).

The next decade will be predominated by the cultural values of the bank and how they align with customers and investors. What is the purpose of this bank? Is it aligned with stakeholders or purely profit-driven? How is this bank changing its values to support ESG, renewables and society? Does this bank have a moral compass? Is this bank ethical? Is this bank socially useful?

There are so many things that feed into this, and most banks will probably respond with a view that, as they are a utility: does it matter? How many customers actually tick that carbon offset box on their flight booking? Do customers really care if their electricity is delivered by coal? Do customers care if their gas comes from Russia?

Maybe or maybe not.

But things are changing for sure, and so the key here is that the financial institutions who are truly digital and can clearly demonstrate purpose, based on stakeholder values, will be the ones that not just succeed in the 2020’s, but exceed. I’d like to be with one of those …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...