JPMorgan had their investors briefing on Monday. It was interesting, with lots of content (you can download all of the presentations here).

I took a look at their briefing, and it is pretty mind-blowing tbh.

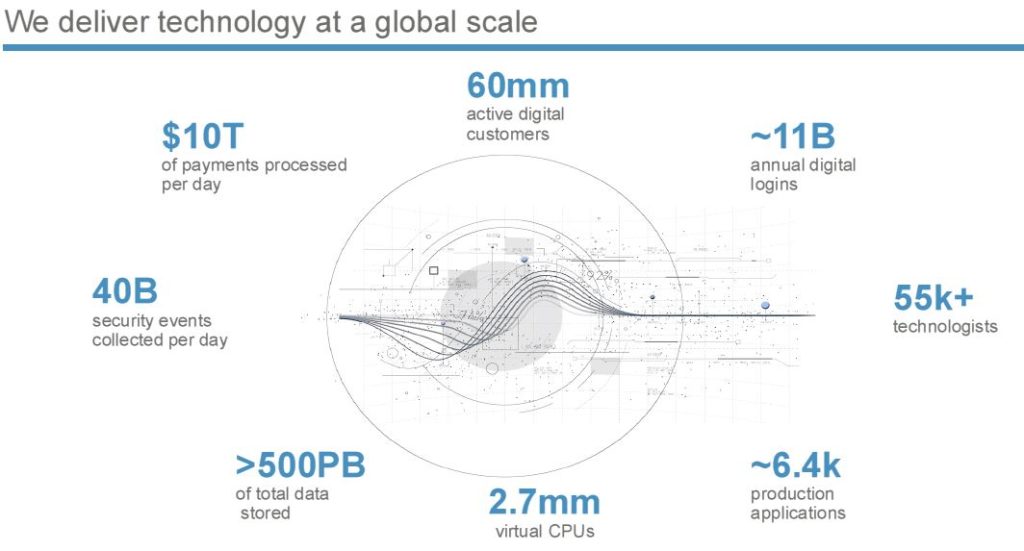

A bank with 60 million active digital customers, processing USD$10 trillion a day with 40 billion security events a day. A bank with half an exabyte of data stored – that’s 500 petabytes or 500,000,000 gigabytes if you prefer. A bank with over 55,000 technologists in a firm that employs 256,000 people.

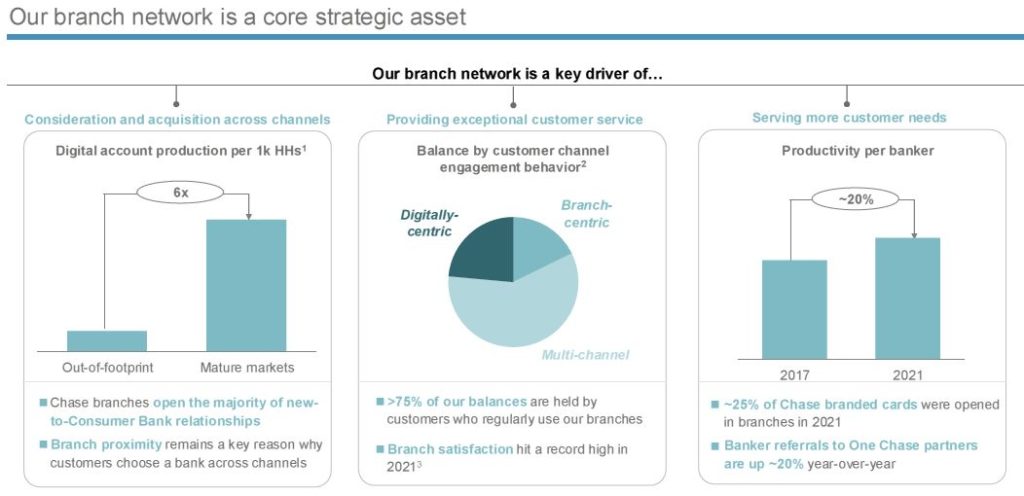

A bank that states that branches are still critical to their strategy in the USA …

… but not overseas.

As the Financial Times notes:

The all-digital overseas push contrasts with JPMorgan’s approach in the US, where it operates almost 5,000 branches under its Chase brand, making it one of the country’s biggest retail banks. The strategy is a bet by JPMorgan that it can build a profitable retail banking network that eschews bricks and mortar.

“There’s no chance that JPMorgan will put 100 branches in Mumbai or Hong Kong or London or anywhere and actually compete,” JPMorgan chief executive Jamie Dimon said at the investor day.

I’ve also noted that this is a bank that seems to add $1 billion every year to their IT budget but this year added $2 billion. JPMorgan will spend over $14 billion on tech this year, half of which is to run the bank (maintenance and management) and half on change the bank (innovation and invention).

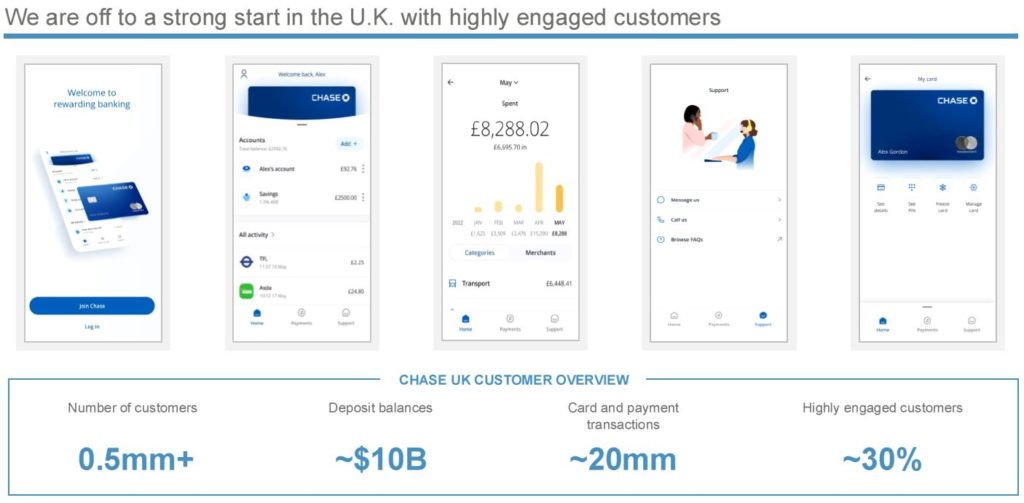

Within this, and being parochial, I was interested in what was happening with their UK digital bank business. Launched in summer 2021 as a test-bed for creating a pan-European digital bank, Chase has been spending big time on growing their UK business. And it’s working. The bank reports that they now have over half a million customers, making more than USD$10 billion worth of deposits, and over 20 million payment transactions.

Nice. Mind you, it does help when you offer the best interest rates on deposits of any bank in Britain. I also wonder how much they’re spending on marketing within that budget as their advertising is pretty heavy and consistent on mainstream media. I wonder how much they’re spending on digital media, as I can’t find their TV ads online.

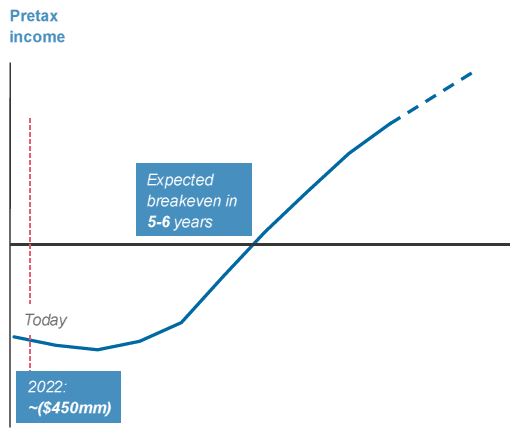

Meantime, there are not many companies that can bet billions on a new bank venture. JPMorgan expects to lose USD$450 million on the venture this year and for several years to come, with the international consumer business projected to breakeven by 2027 or 2028.

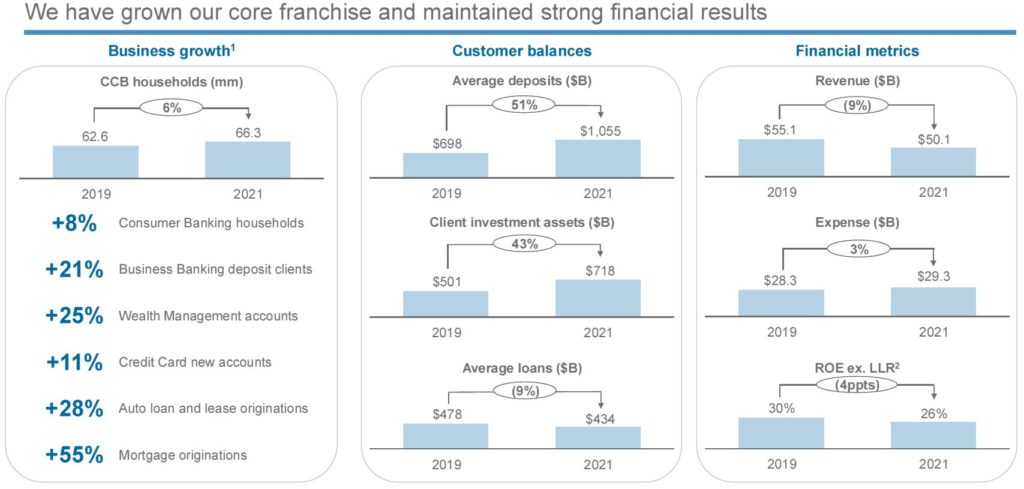

I guess like Goldman Sachs with Marcus, who are spending millions on advertising and offering interest rates that are unsustainable, it's all about buying market share for the big boys. For the small guys, can they compete? Having said that, it's diddly-squat for a bank that has over a trillion in customer deposits.

With over a trillion dollars in the bank, spending $14 billion on tech and taking a billion dollar gamble on a digital bank in the UK is just a sidebar in the funfair.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...