There’s a regular debate about whether BNPL (Buy Now, Pay Later) is a good or bad thing. There’s a big call for it to be regulated and comparisons with payday loans are made often. Nevertheless, it makes sense as many companies are now grabbing a slice of this space. The latest one is Apple.

It amused me when everyone started saying oh, Apple is now a bank.

Apple’s kind of a bank now [The Verge]

They’re not. They are offering a layover credit facility, a line of credit, a service they think their customers want. It’s not banking. It’s credit.

Having said that, the press and media coverage was huge. Here are a few highlights from The Financial Times:

Apple is making its biggest move into finance by offering loans directly to consumers for its new buy now, pay later product, taking on a role played in its other lending services by banking partners such as Goldman Sachs. Short-term loans made through the iPhone maker’s new Apple Pay Later service, announced on Monday, will be made through a wholly owned subsidiary, Apple Financing LLC.

They note that Goldman Sachs are sidelined in the announcement – Goldman Sachs provide the financial kudos to do the Apple Card – but then also note that "Goldman is facilitating Apple Pay Later by allowing Apple to access Mastercard’s network, since the iPhone maker lacks a licence to issue payment credentials directly. But Apple is handling the underwriting and lending using its new subsidiary."

Hmmm … maybe there’s an issue here. SFGate notes that:

In California alone, 91% of all consumer loans issued in 2020 — defined by the California Department of Financial Protection and Innovation as loans for “personal, family or household purposes” such as car, utility or medical loans — were buy now, pay later loans, also known as point-of-sale loans. Gen Z, in particular, has fallen in love with the short-term loans, spending 925% more now through point-of-sale services than in January 2020.

Any problem with that?

30% of [BNPL] users said they’ve struggled to make the payments and had to skip paying an essential bill to avoid defaulting on their payment plan.

Source: DebtHammer

There will be a reset on this space, and Apple’s move is interesting as it fuels a market already under review. Reuters writes that:

Buy Now Pay Later (BNPL) firms have created one of the fastest-growing segments in consumer finance, with transaction volumes hitting $120 billion in 2021 up from just $33 billion in 2019, according to GlobalData.

But notes that this market grew out of a zero-interest payments world. What happens when we have huge demand, limited supply and interest rates rising?

“Most Buy Now Pay Later providers don't have access to deposits, they generally aren't financial institutions," said Jordan McKee, principal research analyst at 451 Research. "They need to borrow these funds to lend out and as interest rates associated with borrowing those funds increase ... it's costing them more money to extend money out to consumers and that puts pressure on their margins.”

Add to this, it’s all going to be regulated heavily soon … just not today. Apple may find this move pretty stressful long-term to be honest so, far all those lauding this as Apple becomes a bank. It’s not. It’s just offering a line-of-credit to its users, in a space that is unregulated and under review, and they may find that this offer is a mistake.

If you want to know more about the reality of what is going on, read Ron Shevlin’s piece on Forbes ...

Despite the hype, Apple Pay Later is just a small part of Apple’s overall strategy to sell hardware (like iPhones).

And/or read Simon Taylor's detailed breakdown:

- BNPL and Pay Later are different things

- BNPL's value prop to the merchant is higher

- Pay Later is more of a pure consumer value prop

- That "no integration required" might change things

- And Apple coulddo BNPL

- But Apple isn't a data player

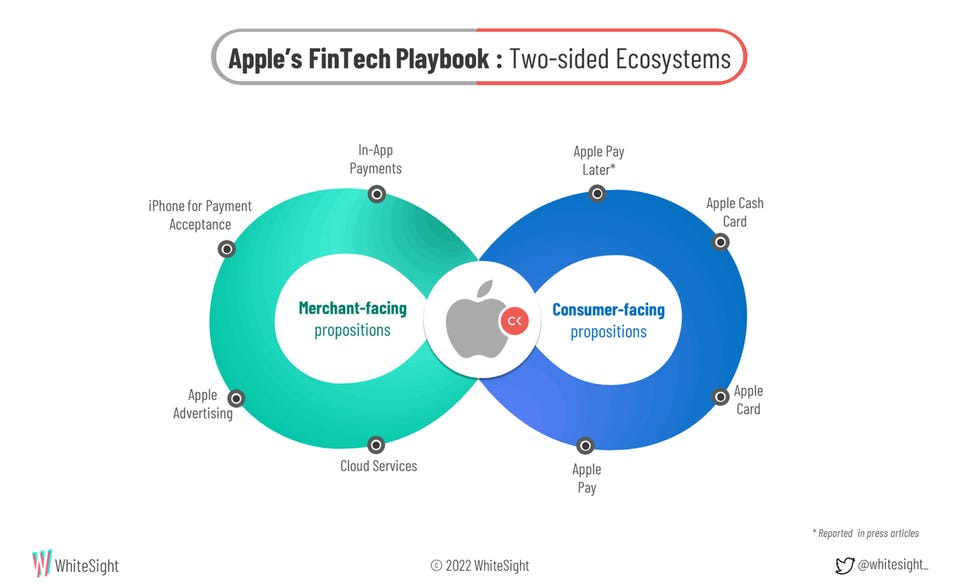

- They do have one heck of an ecosystem though

- And they're slowly claiming identity like a Boa constrictor

- What the heck is Apple Financing LLC?

- What other lending might Apple do?

- Will this kill BNPL or even other lenders?

Simon's first points are the most important for me. Apple Pay Later is purely about consumer convenience because, at the end of the day, Apple wants its customers to spend more easily, not necessarily spend more. BNPL is all about getting consumers to spend more, as their focus is on supporting merchant sales, not consumer purchasing.

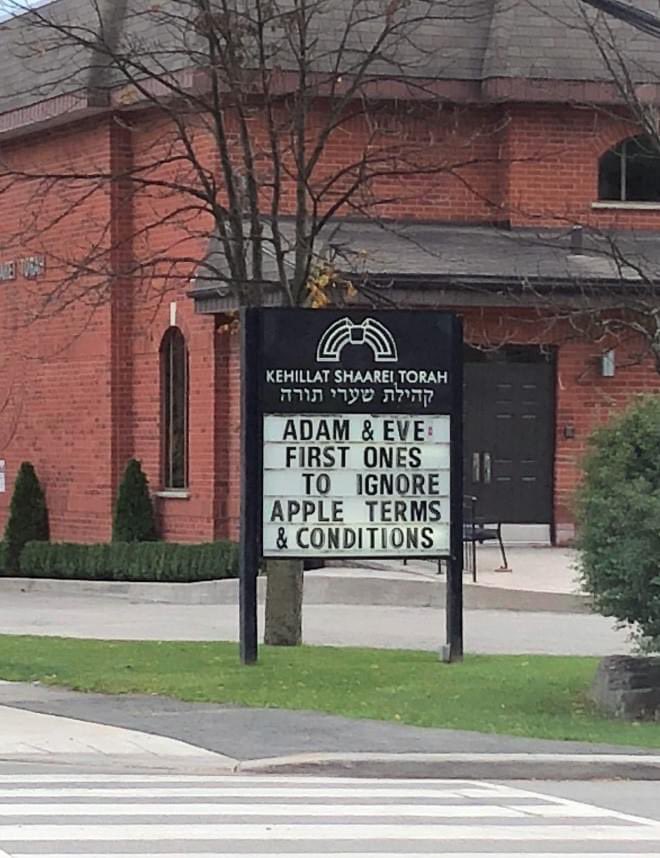

Final thought, Apple are building a payments system on their platform that includes credit. They're not a bank, and don't want to be one, which is why they use Goldman Sachs for banking services. But do remember this ...

#nuffsaid

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...