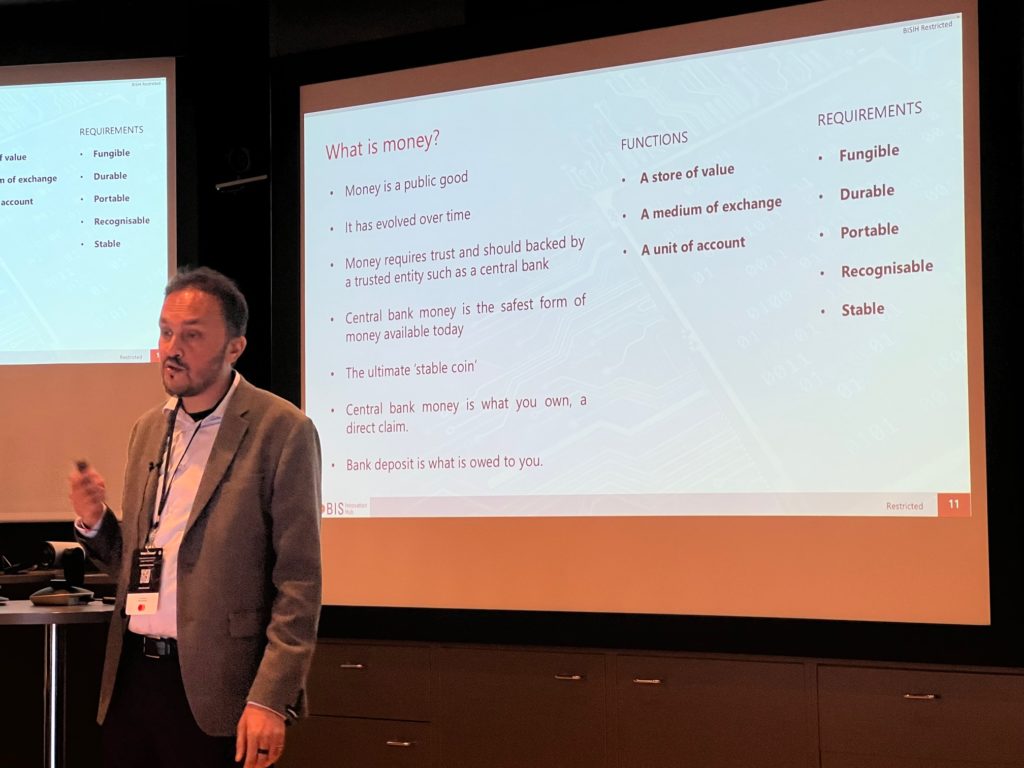

Benju Shah, Head of the Nordic BIS Innovation Hub for the Bank of International Settlements, followed up Sveinn’s session with a discussion defining money.

When defining money, Benju started by saying it is for the public good. Hmmm … not so sure about this although Digital for Good is all about making that a reality. Money should be about delivering stakeholder values, particularly around community and society, not just something driven by shareholder needs, return-on-equity and profit.

#justathought

Benju explained how it has evolved over time, with key features:

- a store of value

- a medium of exchange

- a unit of account

Those things are all good and, if that is the basis of the belief system, does bitcoin live up to this promise? Not yet is the answer. Above this, money needs to be:

- fungible

- durable

- portable

- recognisable

- stable

So, going back to most cryptocurrencies, they are not a store of value or stable. That is the critique that most banks make of such currencies. Add to this the loss of belief, does that mean crypto is dead? Not at all.

I am 100% convinced that a global network needs a global currency. I’m just not convinced it needs 10,000 or more of them. Show me the money! Show me one cryptocurrency that could globally work with all of the above features. Eventually, one or two will win.

Obviously, as it’s the BIS, Benju argued that money backed by a central bank is the best. It’s the most trusted, because the belief is there. Really? What happens if you live in Zimbabwe or Venezuela and the belief disappears?

This kind of led to the final point I’m going to share here, which is that no one really agrees what money is. You have statists saying it is fiat currency; you have libertarians, saying it’s whatever we want to trade in; and you have a raft of folks in between who are just not so sure.

This is why I liked this slide from Benju’s presentation:

If you cannot read it, it’s a simple thing about an economist, logician and mathematician who meet on a train. They see a purple cow out of the window and the economist says: “look at that! All the cows here are purple!”; the logician says: “No. There are cows here and yes, one is purple.”; the mathematician then says: “No! There is one cow here and, on this side, the cow is purple”.

No wonder we talk about a confusion of economists, and a friction in our belief systems.

I accept that today this piece of paper is worth £20 or €20 or $20 or whatever. I accept that today, bitcoin is worth $20,000 whilst yesterday it was worth $70,000 and a few years ago was worth $20,000. These things are worth whatever you believe in and trust? Trust is the belief in a system. That system is anything from bitcoin to ether to dollars or yuan. It’s whatever you believe in. What do you believe in?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...