I shared Gail Bradbrook's and Andrew Cass's ideas around ESG on Friday, the role of finance in this space, and how it isn't working as it should. This elicited an interesting response from Jeff Scott, Chairman and Co-Founder of Rewired Earth, a group that promotes the United Nations Sustainability Development Goals to deliver actionable insight and rewards for corporations. I don't always share responses, but his was interesting and so, in the spirit of balances ...

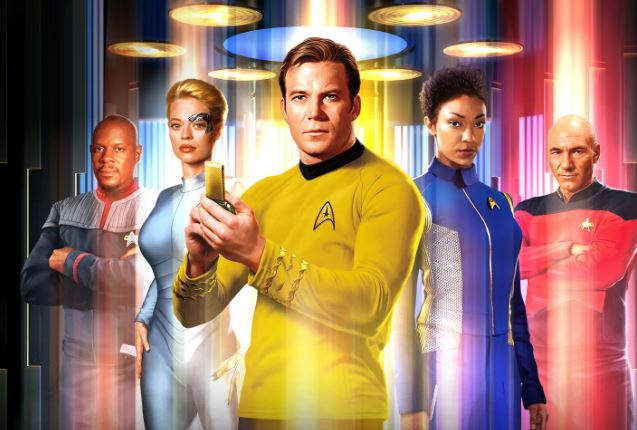

Don't beam me out Scotty!

Whilst Captain Kirk (former head of responsible investing at HSBC) may be happy to live in a world with half its land mass either underwater or uninhabitable, most of us do care and want to develop a more sustainable way of living which protects our planet and communities. This is also true for the vast majority of people that I have worked with in financial services. However, we have a systemic problem. Financial markets are geared up to reward the best return for the lowest risk, but mostly ignore sustainability. We have lots of consistent, comparable & audited data to measure risk and return, but data on sustainability is inconsistent, incomparable and poorly audited….

Andrew Cass was right, ESG isn’t working, because so many different definitions exist, and a whole new industry has been spawned, adding lots of costs but not much insight. Regulators are also struggling to join the dots with no practical way to measure things like scope 3.

No one person or company can solve this. It requires a global collaboration to deliver 4 key elements.

- A common global definition of sustainability metrics, … Fortunately the UN has already done this, 193 countries agreed the 17 Sustainability Development Goals (SDGs) in 2015. These are country level targets, we now need collaboration, not competition, to turn these into company metrics

- Understanding what people care about, using the SDGs if we could ask everyone what they cared about most, we could prioritise actions without the filter of governments or industry lobby groups.

- Tracking how each company performs against the SDGs (including the impact of their supply chain) using consistent, comparable and audited data which is easy to collect and not a burden for small businesses

- Enabling investors (& customers) to channel funding to (or buy from) those companies that are delivering against what people care about, rewarding transparency and action. This would make financial markets the most powerful force for good on the planet, directing the £35trn (source Bloomberg) in ESG funds to the right place.

We need to harness the knowledge and capability that already exists globally to rewire earth….

Imagine a world where:

- Moral sentiments don't need to replace market sentiments because there is no difference between what the world values and what the market rewards.

- The connection between what people value and the actions required is clear and doesn't need filtering by politicians or corporate entities

- We can directly assess the behaviours and actions of countries and companies against our stated values.

- We don't need to rely on a £100bn global fund to solve all the worlds problems (it wouldn't even cover the cost of HS2).

- ESG ceases to be seen as a business constraint for companies using an alphabet soup of non-comparable metrics.

- People can easily assess the products they buy against what they care about... and can track their own impact in the world in a simple, consistent way.

- Measurement is fact based and auditable, with no competitive advantage (or wasted energy/ resources) on defining the measures.

- Countries and companies are rewarded for saving the planet not destroying it.

By not competing on what should be measured, but focusing on what should be done we can change a catastrophic existential risk into one of the greatest opportunities of a lifetime... a true democratisation of sustainability.

We have created a not for profit, open source platform to deliver this, there are lots of challenges, but as Scotty would say:

I cannae change the laws of physics, Captain! A've got to have thirty minutes.

So if you can spare 30 minutes the team at www.rewired.earth can explain in more detail how we can work together to create a business case for sustainability.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...