On reflecting the past decade of innovation in FinTech, it’s been interesting watching the struggles of regulators to keep up. The challenge is that the regulators haven’t been able to keep up. They allowed a lot of things to happen which, now, they’re trying to address.

Let’s take a few examples.

First, Peer-to-Peer Lending (P2PL).

P2PL rose rapidly after the first entrant, Zopa, in 2005. I’ve always called Zopa the first FinTech, as their idea was an eBay for loans. It worked! But, when they tried to expand into other markets like Italy and America, it didn’t. The regulators didn’t like the idea. However, the major market that did like the idea was China, and the regulators sat back and watched.

They watched and watched and watched … but took no action.

By 2018, there were thousands of P2PL firms – my estimate was over 3,000 – but then the regulator did act. They began to impose increasingly strict regulations, which included the appointment of a custodian bank, full disclosure on the use of investments, and caps on the maximum lending amounts that could be extended to individuals (1 million RMB) and companies (5 million RMB), in 2016.

That was the grenade that caused the implosion.

The thing is that the sudden collapse of 1,000’s of unregulated firms led to 1,000’s of people losing their life savings.

In an interview with CNN, a construction project manager in Beijing revealed he lost over 275,000 yuan (more than $40,000) after Tourongjia, the site he invested his money on, suddenly shut down last month. The figure, he said, included his parents’ savings, money borrowed from friends, and funds he was saving for an apartment he was planning to purchase for him and his pregnant wife.

For a full analysis of what happened in China, checkout this McKinsey article and it’s not just China, but P2PL firms around the world have seen crackdowns on their business … after the horse has bolted.

We’ve seen the same with BNPL, Buy Now Pay Later. Klarna emerged in the 2000s from Sweden with this innovative idea. The idea is just to layover payments for a goods online into a few monthly instalments. It’s a great idea imho, and yet it has been screaming to be regulated. I honestly don’t know why Klarna and their brethren didn’t got to the regulators first and ask to be regulated. Instead, there’s been lots of uncertainty. Two years ago, I blogged about it: #KlarNAAA? Is #BNPL a good or bad thing? Then I noted that everyone from PayPal to Square to Monzo were copying Klarna’s idea. Then governments worldwide woke up and started to look at this market and introduce regulations.

The result?

The valuations of BNPL firms like Klarna have tanked:

In a sign of the times, Swedish buy now, pay later giant Klarna is reportedly close to inking a new round of funding that would slash its valuation to $6.5 billion — about 1/7 of what the company was valued in June of 2021.

Klarna has sunk from a valuation of $45 billion a year ago to $6.5 billion today. Wow! Good news for citizens, bad news for investors. I guess this is the big thing: citizen and investor protection.

Regulators sit on the side-lines, watch and wait. Then their actions can decimate markets they’ve allowed to mature, with those invested in those markets – whether they be citizens (P2PL) or investors (BNPL) – to lose massively.

Then there’s the elephant in the room: cryptocurrencies.

Bitcoin has been in the wild for almost fifteen years. It’s been joined by over 10,000 brothers and sisters and offspring. No one needs 10,000 or more cryptocurrencies, and yet the regulators have sat and watched and tried to understand. They’ve constantly decried bitcoin, but cannot do anything about it. They’ve whinged and moaned about how these currencies undermine banking, finance and government … and no one cared. They’ve started trying to create their own alternatives – CBDCs – and most of the crypto community have laughed in their faces.

Yet, there is good reason for crypto regulations.

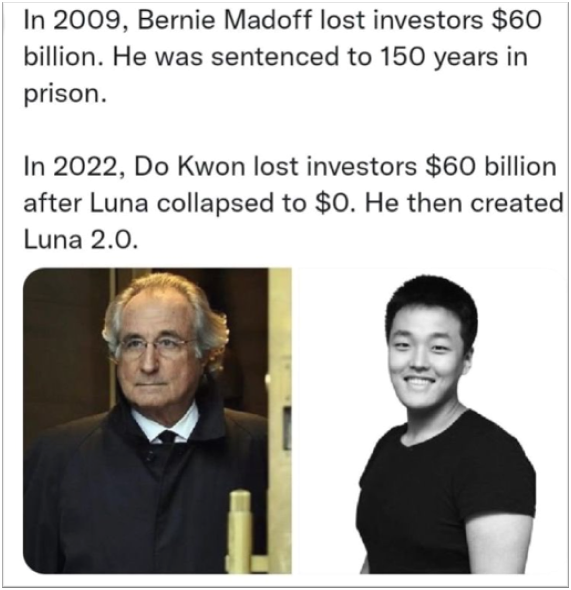

You had the 2014 collapse of Mt.Gox which for some (me) was painful. Then you had the death of Quadriga’s CEO in 2018, who just happened to be the only person with the password to the crypto exchange’s currencies. In the current crypto meltdown, you’ve got exchanges introducing arbitrary policies to stop people cashing out and, even worse, many accusing these services and currencies of being Ponzi schemes and madness.

TBH, many of the creators of these schemes – and I’ve met many – are so nutty and weird that they should be locked up in Arkham Asylum. But then, there is something in them regardless – there will be a global digital currency one day – and yet, as I’ve always maintained, you cannot have money without governance. The challenge is to ask: what is the right governance? Is it the Federal Reserve, ECB and PBoC saying you can trust this, or is it the network?

As the EU creates new rules based upon the Markets in Crypto Assets regulatory proposal, will it work? Can it work? And why have they waited so long?

Answer: regulators wait until they understand something before they regulate it and, sometimes, it takes them an awful long time to work it out. Usually, they do work it out. We shall see.

Anyways, there are four forces for the future: political (government and regulators), economics (finance and banking), social and technological. On the first two, covered yesterday and today, the challenge is that the political movement is always behind the others. They are always in catch-up mode and rarely have any vision of what’s next.

That’s fine when it comes to Facebook abusing our data, but when people lose their life savings, get sucked into debt or suckered into Ponzi schemes, it’s not so good.

We need regulators who understand network change, technology and digitalisation and clamp down early on malpractices, scams and schemes that open citizens and investors to abuse. The fact that most of them have waited years or even decades to draft a response seems shocking.

Let’s see what comes next …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...