Back in the day, a number of books were key to my management thinking. Books by Peter Drucker, James Champy and Michael Hammer, Ricardo Semler, Michael Treacy, Don Peppers and Martha Rogers, Tom Peters and Robert Waterman, and more. All of these books were about changing businesses to be customer focused, and one of the key books in this context was The Loyalty Effect by Frederick (Fred) Reichheld.

Reichheld has been a leading thinker for three decades in this space, and is the guy who came up with the idea of a Net Promoter Score. So, it was a great pleasure to meet him the other day, and to hear his thoughts in this space.

Fred has been a huge advocate of customer focus for decades. When we talk about customer focus, it’s easy to go oh yeah, we got this but, like most corporations, some get it and some don’t.

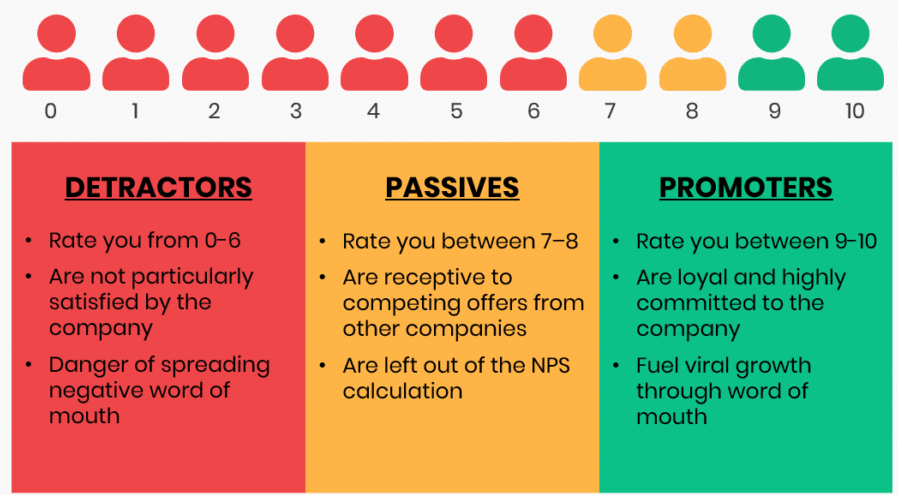

The mantra is easy; the execution is hard. By way of example, one of Fred’s slides hit home with me. He talked about NPS, the Net Promoter Score, as system he invented in the 1990s. I’m sure you all know NPS but, just in case:

Net promoter score (NPS) is a widely used market research metric that typically takes the form of a single survey question asking respondents to rate the likelihood that they would recommend a company, product, or a service to a friend or colleague. NPS assumes a subdivision of respondents into "promoters" who provide ratings of 9 or 10, "passives" who provide ratings of 7 or 8, and "detractors" who provide ratings of 6 or lower.

The whole idea is that the more customers love your company, the better your company performs.

Fred had many slides that prove this, but the slide hit me was when he talked about his own personal experiences.

He talked about how he had terrible service, and then received an email from the salesman at the autoshop – he had just bought a new Mercedes-Benz – demanding a rating of 10 out of 10 as that affects his commission.

This hit home as NPS is based upon customer feedback. Too many companies focus upon 10 out of 10 – the score – rather than the actually experience – the customer. I spend so many times these days myself, sitting on a phone and getting a message that most of our operators are busy right now, please call back later or be prepared to wait until your life is no longer worth living that I give up.

The majority of companies – banks, telcos, airlines, retailers and more – have moved into self-serve mode. As long as you serve yourself, it costs us nothing. When the self-serve mode fails, and you need to talk to someone, then things collapse in most firms, because their focus is on profit and not on the customer.

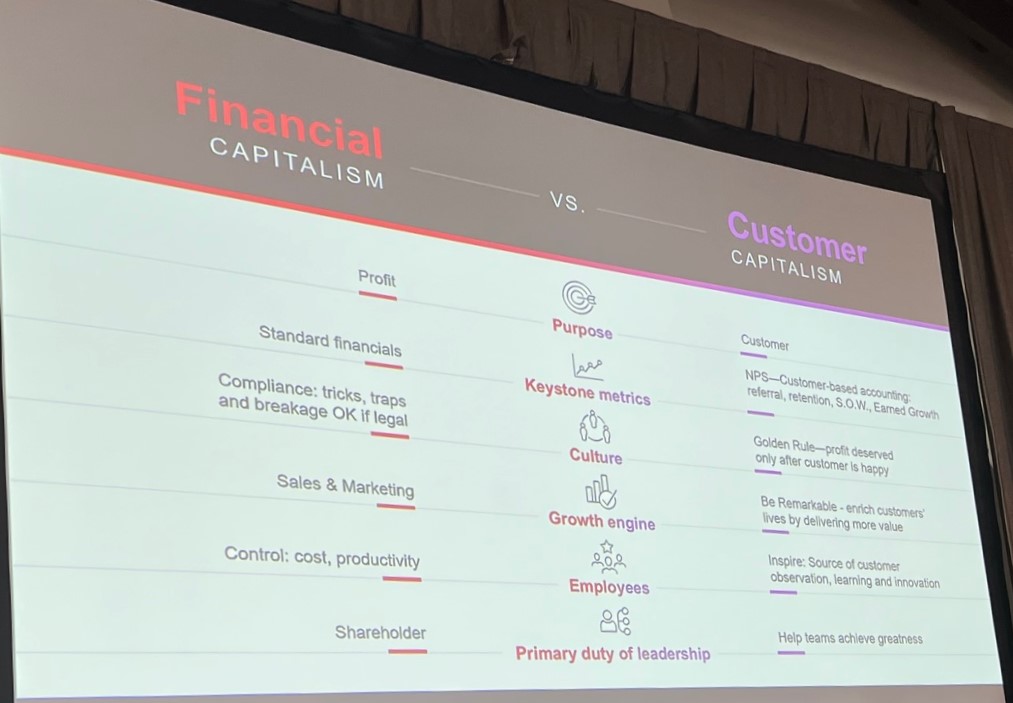

This was another key point Fred made. Your company wants high NPS scores – you even beg for them – but your focus is on profit, not customers. This is the difference between financial capitalism and customer capitalism or, as I would place it, shareholder capitalism and stakeholder capitalism.

The profit-focused organisation has metrics based upon shareholder returns; the customer-focused organisation focuses upon stakeholder returns, led by customer experiences.

The result of that simple statement is that the whole organisation is then led to operate as either a pure business or an enriched business. Pure businesses purely want to comply and manage; enriched businesses want to win. This is the theme of Fred’s latest book Winning on Purpose, which has the subtext the unbeatable strategy of loving customers. It made me smile that his latest book is called Winning on Purpose as I was tempted to call my latest book Purpose-Driven Banking.

The key message he was making is that the profit-focused organisation build NPS into their business under a financial and compliance structure – give me ten out of ten or I don’t get my bonus – whereas the customer-focused organisation does this as part of their culture – I don’t care about my score, I care about you.

He gave many examples of this, and there are many more in his excellent book. I am selective, as I’m a financial technology guy, so one of my favourites was his experience at USAA, the highly digital customer-led American bancassurance firm for people who had been with the armed forces. Fred shares the story that the company is highly customer-led but a key to this is having people working in the business who are happy.

As he left the tour of their offices, he noticed that there were many boxed meals laid out at the exit. Fred spoke to the guy who was boxing the meals, and discovered he was the chef. The meals are nutritious and aimed at ensuring that USAA employees don’t have to go home and cook. The company gives them the meals to create more staff happiness and make sure they can go home and enjoy quality family time, rather than slaving in the kitchen. A great example of a customer-led business who know the key:

Happy staff make happy customer make happy business

I’ve said this for years and first heard it way back before encountering Mr. Reichheld’s books, and it is so true. If your company is happy, it shows.

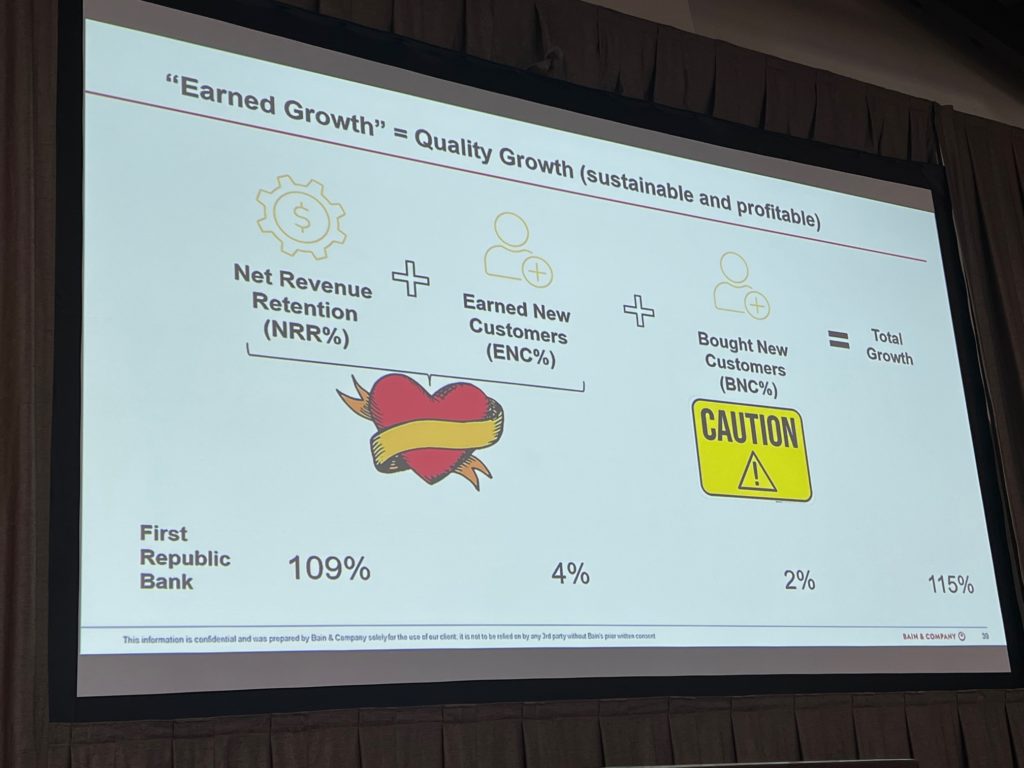

Another case study reinforced this, which was First Republic Bank (FRB).

FRB are a purpose-driven bank and Fred highlighted the values they uphold.

How did they come up with these values? Fred’s book gives the detail which I would summarise as something like this:

First Republic’s COO explained to me that he was tasked to meet over 100 employees around the company and ask them: what is it that makes us really us? The resulting list is a distillation of what they heard that makes their culture special.

Does this purpose-driven, customer-focused approach make a difference in reality? You bet it does. Fred presented the aha moment, which was seeing FRB’s results.

When you have a happy business with happy staff, your happy customers become promoters. Forget advertising, and the real promoter focus is not the NPS score but the customer. Customers who love businesses create sustainable businesses who outperform always.

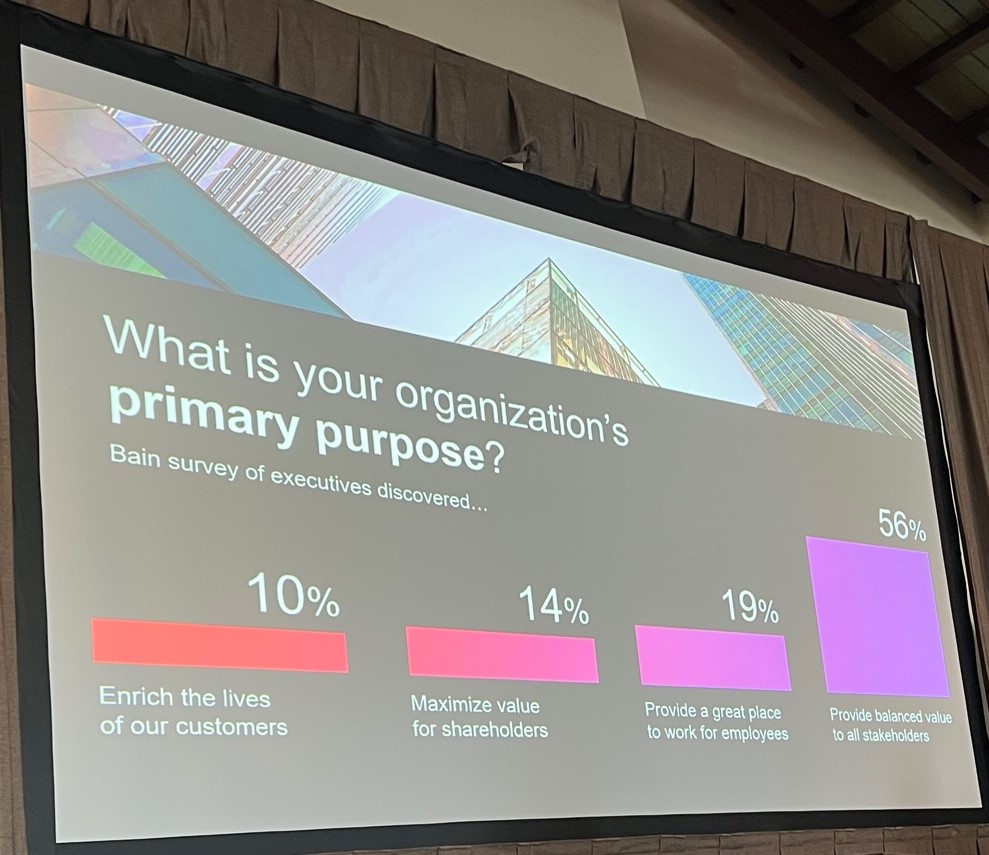

Fred’s conclusion was to ask what a business’s primary purpose should be? Is it to create customers who love you or deliver stakeholder return? I would claim it’s both, but he would claim it is the former and then all else is delivered as a result.

Personally, I would have voted for a balance across shareholders in that, as highlighted, employees, community and customer returns are all key to a happy business.

Nevertheless, it was great to meet one of my own management heroes and chat with him for a while and, unusually for me, I’m actually reading his book!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...