I’ve recently wondered about the movements to recognise gender-status in banking. For example, a headline appeared saying that the Halifax Bank, part of Lloyds Banking Group, was stupid for allowing someone to be recognised as she/her/hers.

It didn’t go down well with some people …

But it is a thing. Pronouns count, and banks are recognising it … even HSBC:

HSBC Offers Gender-Neutral Banking in Inclusivity Bid

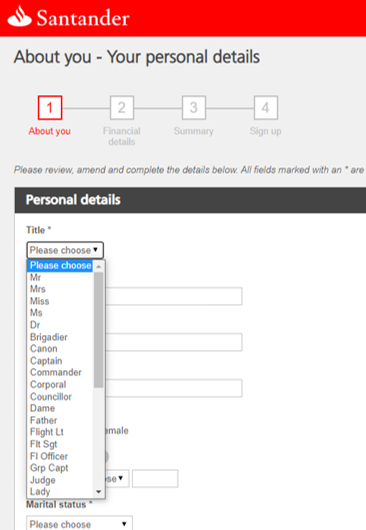

Nevertheless, there is a stark contrast between old banks and neobanks. For example, applying for an account or a loan with a bank like Santander, one of the first things you get is a drop-down menu to give your title …

Are you a Judge or a Lady?

Applying for accounts with any newer company, there is often no requirement to assign your title or gender. You just give your name and download the app.

Is this important?

Yes, it is, as it goes way beyond gender. It goes to the heart of how we view the world and how the world views us. I noted many years ago that banks are predominated by a male view of the world predicated on the fact that, if you are a woman, it is harder to get a bank account, a loan or a mortgage. A woman starting a business? Forget it.

In many countries, if you are a woman, you have to get a man to back you to say you are good for the money. You may say that view is dated, but it is not.

Women represent more than 50% of the population but own only 1% of the total wealth. Many women around the world, in an attempt to combat poverty, turn to self-employment. This frequently involves the creation of a business for which bank loans are usually needed. However, on a global level, women only have access to 3% of bank loans

Furthermore, statistics from poverty charity CARE International show that 35% of women globally do not have a bank account, compared to 28% of men. This is a 7% difference. Why such a gap? Solange Hai, Head of Women and Markets at CARE International UK, discusses how women in poorer economies face obstacles that men often do not.

“Women face a number of barriers in terms of accessing banking services. Social norms around gender roles can result in women having less control over financial resources,” she says. “The formal requirements associated with opening up a formal bank account (such as an ID card) are also a barrier, particularly for women living in rural areas, or those working in the informal sector.”

Add to this that women in low- and middle-income countries are 20% less likely than men to use mobile internet, which means that women are unable to access digital banking services.

It is more than this though.

There is a halo effect around women in finance. Whether working for a bank, trying to get a bank account or starting up a business as a woman, there is an immediate layer of barriers that men do not face.

Gender-neutral finance sounds great but, as a starting point, maybe we should start with equality banking. Stop asking me for my title and status. Just ask me: am I good for the money?

Postscript: the leading UK bank for gender equality has to be LBG (Lloyds Banking Group) whose advanced training in quality management is labelled LBGTQ+

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...