What is the four-pillar model?

It’s a system created years ago to allow plastic card systems to work.

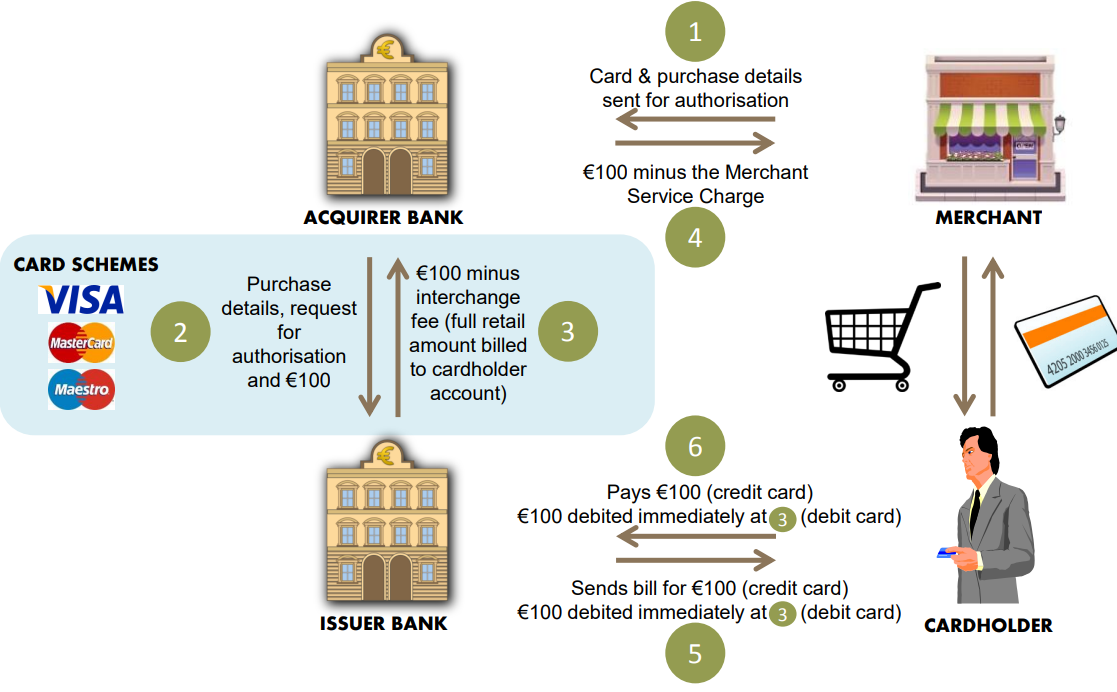

The system connects merchant to consumers via an acquiring bank and an issuing bank. Well, maybe it’s not that simple. Let’s let MasterCard explain it:

Interchange is a small fee typically paid by acquirers (retailer’s bank) to issuers (cardholder's bank), to recognise the value delivered to retailers, governments and consumers by accepting electronic payments.

Interchange? It’s that system of moving a transaction from the merchant to your bank account via different systems globally through the card network.

Oh, OK. So, what happens there?

Well, everyone takes a cut. The card processing companies take a fee, the issuing bank takes a fee, the acquiring bank takes a fee, and it’s all called interchange fees. Interchange is the change of data between intermediaries, basically, and each intermediary needs a fee.

But, as one reported recently, that costs.

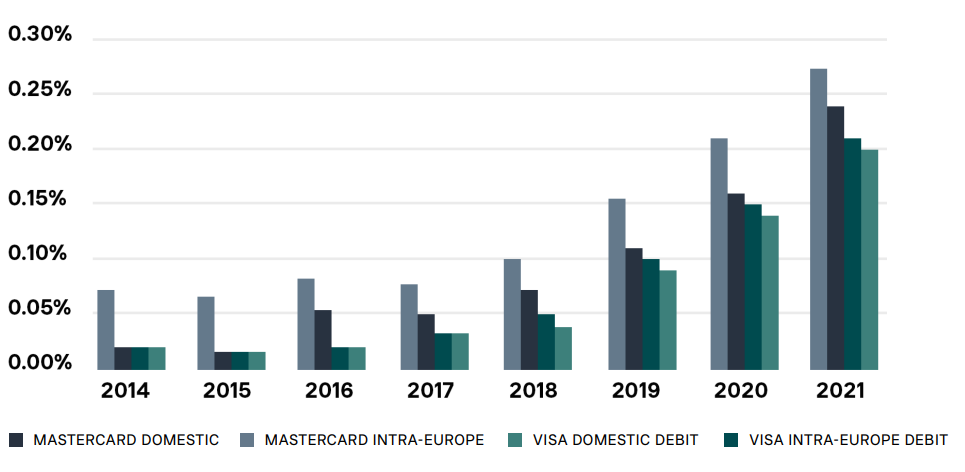

Source: Trustly

The report says:

“In the UK the situation is even more complex. For starters, the schemes have introduced a large interchange fee hike as a result of Brexit. UK card holders used to benefit from a 0.3% cap on credit card interchange fees and debit card interchange was set at 0.2%. These fees will increase to 1.5% and 1.15% respectively, since payments between the UK and the European Economic Area are now classed as ‘inter-regional’. Ultimately this cost could be placed on the UK consumer in the form of hidden surcharges like increased shipping costs. There are indications that similar interchange fees could also be imposed on EU issued cards - making them up to 5x more expensive for UK merchants.”

Not another Brexit thing?

Well, yes it is. The EU regularly debate interchange fees and limit them. The UK left the EU and the limits are no longer there.

The thing this creates is a call for removing the intermeidaires. If everyone is taking a cut, can we cut the cutters? Issuers, acquirers, card processors, networks?

I guess that’s what the crypto community is trying to do. Having said that, is it needed?

The card networks work. The four-pillar model is challenging, but it works. The cost of a transaction is no longer a big issue, or we wouldn’t have contactless transactiosn that cost nothing.

The cost of operating a contactless payment machine within your business can be divided into several different aspects, one of which is the minimum monthly service charge (MMSC). This is something you need to look out for when deciding which merchant services provider to work with, as the figure charged each month can vary from £10 to £30.

Source: GoCardless

Oh. Maybe not.

Of course, there’s a fee for everything but do we really need to replace the whole of banking and payments to reduce costs by one percent?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...