Do we just end up with another standard?

This cartoon strip amused me …

… shared by my friend Theo. In fact, I blogged a while ago [2016] about “Standards – which one do you want?”

The thing is that standards strike at the heart as to why blockchain has not really worked yet [I also blogged about that in 2015], and the core of standards is not standards. It’s all about co-operations and agreements. How do you get 5, 50, 500 or 5,000 or more people, companies, institutions and public authorities to agree something?

This is why there are so many standards.

In the tech world, I’m always reminded of this quote from Ken Olsen that first illustrated to me the issues of standards:

In other words, this is not a new discussion. It’s a very old one.

There is this natural aspiration to achieve a standard that everyone can use to link and connect. There is an equally natural resistance to use a standard that you didn’t invent yourself. That’s why non-Americans dislike Visa and Mastercard so much (the EU is always trying to create an alternative); it’s why China and Russia want their own versions of SWIFT; it’s why ISO and the EU continually have to regenerate their standards over and over again; it’s also why:

On the other hand, there are standards. Visa, Mastercard, SWIFT and more have standardised many aspects of financial transaction processing. USB ports and plugs have standardised connections, although there are multiple versions. The fact that my mobile phone works pretty much everywhere in the world – admittedly with higher costs in some territories – shows that we have a global standard for talking. Could we create a global standard for transacting?

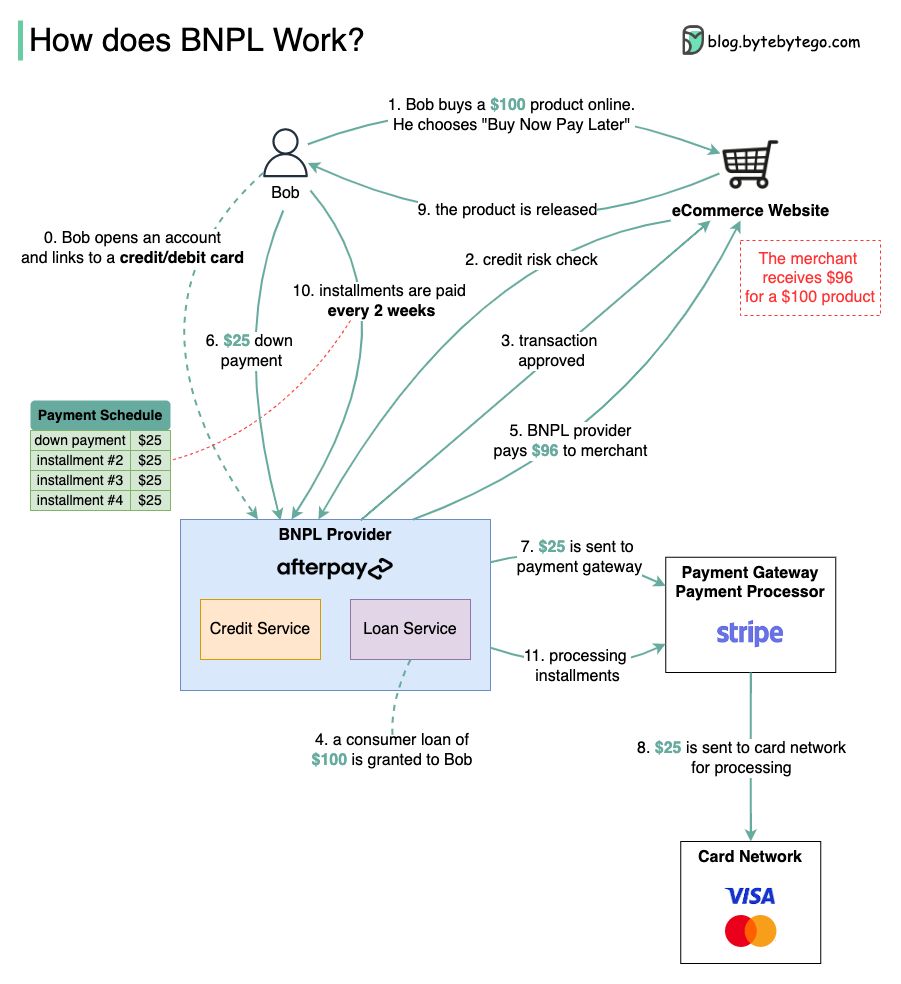

I think we can, but it will take time and effort. By way of example, a friend posted this picture about how BNPL (Buy Now, Pay Later Ed: do we still need to explain that acronym?) works:

Source: Blog.bytebytego.com

I looked at it and thought (a) this is confusing, (b) it seems too complex, (c) no wonder BNPL has taken off, (d) it’s even better if you are the merchant offering BNPL like Apple, and (e) we can make this simpler using crypto.

The whole idea of cryptocurrency is to make peer-to-peer transacting simpler, easier, cheaper, faster and digital. Isn’t this why so many people believe that cryptocurrencies are needed?

In some ways, I look at the picture about BNPL above and feel that it is obvisou we have system that is wrong. The system above is adding more and more to an old service, created for physical exchange in retail stores. We need to simplify.

In fact, simplification is the greatest opportunity FinTech firms have to offer. You may say but BNPL is simplifying credit at checkout? I would reply not really, BNPL is adding more fees and credit services to an already over complicated and expensive marketplace.

You can make your own mind up.

But then, going back to my opening words, what is the standard here? The over-complicated model has at least offered standards for transacting which Stripe, BNPL and others have added to, in order to try to simplify the existing model. The real question is whether we can replace the standards of the existing model with a new one, or do we just end up with another standard?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...