Back in January, I called 2022 the Big Regression for FinTech. Ten months later, sure enough, it is. Daily headlines about losses and layoffs are gathering non-stop, and storm clouds are gathering fast to demand market change through consolidation and merger.

- German online bank N26's losses widen in 2021 as customer growth slows

- With new cuts, Klarna joins the ranks of companies having to conduct more than one layoff

- Brex, valued at $12.3B earlier this year, lays off 11% of staff as part of restructuring

- Fintech market set for cooling and consolidation

- Dry powder: A FinTech M&A boom is kicking off

The Economist even calls this “a FinTech bloodbath”.

Where is this heading? It’s heading over a cliff for some and into the sun for a few. We had very heady times, so much so that some companies became unicorns with no substance.

Decentraland’s billion-dollar ‘metaverse’ reportedly had 38 active users in one day

But then I’ve been saying for years the valuations of FinTech firms are a little bit mad. By way of example, in 2019, N26’s co-founder Maximilian Tayenthal told the Financial Times that “in all honesty, profitability is not one of our core metrics”. Maybe that’s why they’ve had bigger losses year after year ever since?

It reminds me of another tech start-up founder Marc Lore who, as quoted in Business Week, didn’t even know what profit is (see last paragraph).

This year we are seeing a big adjustment, as it’s the first year that most FinTechs have experienced a recession. Most FinTechs began in the 2010s. It was a frothy period of good times and easy money. That’s not 2022. In 2022, crypto has crashed, markets are squeezed, inflation is rising and funding is not.

The ten largest FinTechs have lost $850bn in value in the past year, and FinTechs have sacked 7,300 staff between April and October 2022. The Financial Times notes that, in London alone, almost 1,000 start-up employees have been laid off since the start of the pandemic, according to Layoffs.fyi, a dashboard tracking redundancies in the sector. These include start-up FinTech firms like the investing app Freetrade, revenue-based financing provider Uncapped, and SumUp, which provides payment services for small merchants.

Equally some cash-strapped giants have seen their valuations slashed by more than 80% in “down” funding rounds, and even Stripe has been affected, losing more than 20% in its valuation this year versus last.

According to Finch Capital European FinTechs picked up $6 billion of funding in 2020. Last year, that figure rose to $19 billion. By contrast, this year has so far seen a 25% decline in funds raised by European FinTechs; hiring is down 50% on 2021; exits are down by as much as 70% in some areas of the market; and start-up numbers have fallen 80% over the past year.

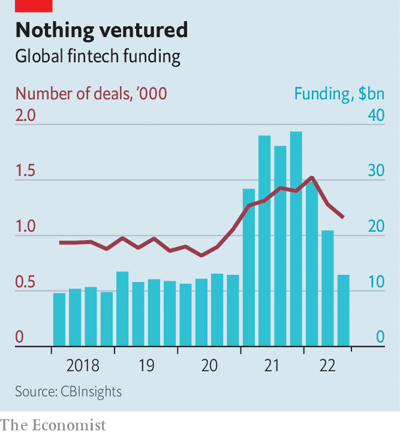

CBInsights chart shows an even gloomier picture:

The average deal has fallen from $32m in 2021 to $20m in 2022. Between July and September a mere six firms graduated to unicorn status, achieving a valuation of $1bn or more, compared with 48 in the same period last year. Exits have also stalled. There were 27 public listings in the last quarter of 2021, compared with two in the one just passed.

The Economist writes that all technology sectors have been impacted in 2022 by recession and contraction of spending, but that FinTech is particularly vulnerable “because many are directly exposed to the risk of recession. Lenders that used cheap funding to provide online mortgages and buy-now-pay-later loans face soaring costs and rising defaults. Neobanks that rely on transaction fees are being starved of revenues. Businesses that banked on the boom in retail investing, from crypto exchanges to online brokers, are suffering as trading volumes collapse. Those catering to small firms may well go under with their wobbly clients.”

The article continues to cite that only three types of FinTech firms have a positive outlook today.

“First are companies that reduce inefficiencies, from the management of company expenses to the reconciliation of business payments, and thus ought to help companies cut back in more difficult times. Next are firms that create new revenue lines for their clients, such as enabling a travel agent to sell their customers insurance. The final group includes financial plumbers, from firms providing data or ones dabbling in crypto to those that help banks comply with sanctions.”

So, for the likes of GoCardless and Clearbank, times look rosy but, for the rest – especially the credit and lending firms – it’s time to batten down the hatches.

The bottom-line is that many of these won’t disappear – they will be eaten.

Global FinTech M&A saw a sharp rise in the first half of 2022, according to a recent report from Hampleton Partners, which has recorded 591 deals so far this year, defying the broader M&A slowdown.

This represented a 46 per cent increase on the same period in 2021 when there were 406 FinTech deals as well as a 70 per cent increase (348 Fintech deals) on the same period in 2019 before the pandemic set in.

Data from Dealroom reported by Sifted also points to another healthy year for FinTech M&A in Europe, with 190 FinTech acquisitions in Europe, versus 241 in 2021.

In other words, the industry has cooled and will see massive consolidation through 2022 and 2023. Hopefully, by 2024, we will know the outcomes but, right now, it all looks a bit uncertain.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...