A preview of Michael Lewis’s FTX series: “A Fried Bankman”

During the holiday season, I binge-watched Billions once more. It’s a great series, and up there with West Wing and House of Cards. But it is fiction based on fact.

The fiction is the dramatisation of a hedge fund skating on thin ice against the SEC, Federal Reserve and Attorney General. The fact is that there is thin ice in markets and, if you skate on them, you can sometimes fall into the water.

It’s all about shenanigans (World Cup word of the year 2022) to do with truth, justice, markets and manipulation. The aim is always to outmanoeuvre the person or company that cannot be outmanoeuvred.

I like this metaphor, as the aim of any strategy should be to outmanoeuvre the market. But then you can apply this to any area of our world. My strategy is to outmanoeuvre my opponent, whoever that opponent may be. By doing this, I gain power and power is what it’s all about.

What is your power? Who is your opponent? How will you outmanoeuvre them? And what is your aim, objective and end-result?

These questions crop up all the time in strategy discussions, or they should if they aren’t already. In fact, for me, the most interesting plays of all time is where a company or individual has plays two, three and four in hand when they play Play One. Play One is the start. You respond to Play One, and plays two, three and four are ready to rock and roll.

Like a scene from Billions, West Wing and House of Cards, the situation is one of being ahead of your fiercest opponent. In fact, Aaron Sorkin, the playwright, is the best at depicting this situation and has been writing many of my favourite series where this plays out.

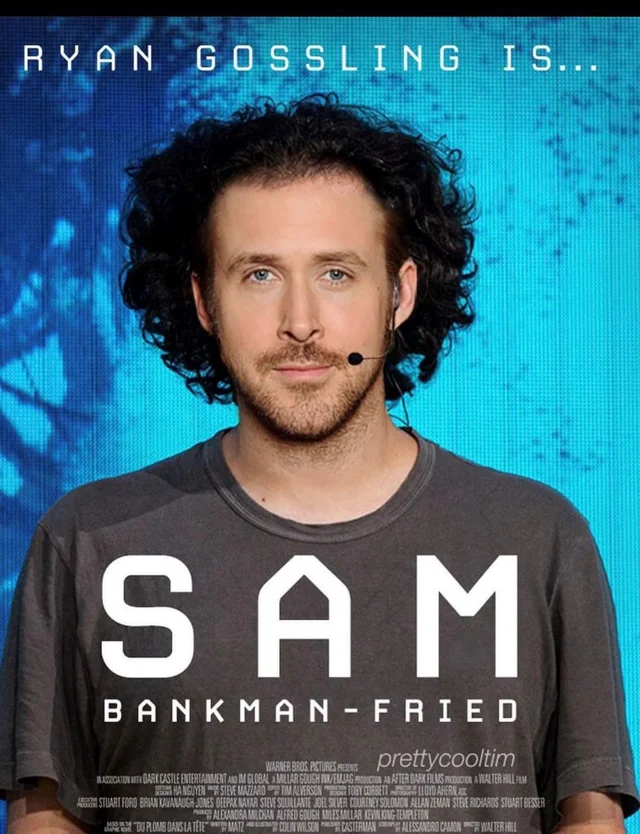

So, I wondered how he would write a TV series about crypto and here’s what I came up with ... except this one is written by Michael Lewis, an inside man with the inside track.

CRYPTO – THE NEXT MOVE

Sam Bankman-Fried or, as those who know him call him SBF, sat in his room, looking out of the window at the beautiful Caribbean Sea. He knew his time was up. He had asked himself many times: should I stay or should I go? But he always ended up in the same place. In his office, looking out at the Caribbean Sea. He felt the need for flight but, more importantly, he felt the need to do right. So, he stayed.

When the authorities picked him up, they flew him to New York, and he was jailed. It was a done deal. SBF had lost billions and he deserved a trial that would see him given a life sentence.

But little did they know that behind the scenes, it is alleged that Caroline Ellison had created an offshore financial firm that held key assets of FTX. Moving a few million dollars here and there, it is alleged that a security blanket was created for her and SBF to fall into, should their bridges be burned.

And now their bridges are burnt, but maybe not all of them.

Oh, and sure enough, just like Billions, West Wing and House of Cards, this will soon be on your screens. Thanks to Michael Lewis, author of Liar’s Poker, Moneyball, The Big Short and more:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...