One of my favourite series, Black Mirror, is about to return to Netflix for Series 6. So, it made me think about the future world and thought I would give an outline of an episode. I'm no screenwriter but ... you never know.

Black Mirror, Season 7, Episode 3: The Office

I’m living in a world of embedded finance. Everything I do, everything I feel and everything I want is enabled by invisible payments. I don’t even think about it anymore.

Watching streaming video, jumping in a taxi, walking through a store. Nothing involves me thinking anymore. It just gets done.

Then, one day, a screen pops up and says: you’ve got no money. What?

I go to the bank to discuss. The bank obvs is in an app. I ask my roboadvisor what’s going on? Answer: we didn’t get your funding this month. Hmmmm …

I go to the office. The office obvs is in an app. I ask to meet my manager. My manager says what do you want? I ask where my salary payment went? My manager says did you not get the severance notice? We no longer employ you.

WHAT?

I ask for a meeting. My manager says that’s fine, but why? I say I want to talk about this.

I get a meeting. These things are best done face-to-face.

The next day, I order a robocar to take me to ACME’s headquarters. I enter and the roboguard gives me access. When I get to the third floor, I see my manager.

It tells me that I have not been performing. I ask why. It tells me that my productivity is -21.6758% of fellow workers and that the company has enforced a policy that all workers performing at -20% of recommended levels must be let go.

I’m not happy. I ask: surely I get some severance? My manager says: you don’t qualify for our severance package as, when you joined us and signed the contract, you did not read the terms and conditions.

WHAT?

I ask: what did I miss?

My manager tells me that there are terms in the employment contract that make clear that if I perform at under 20% of my colleague’s performance for more than one quarter, then I can immediately be terminated.

Goddam.

In tears, I leave the office and realise that I’ll have to go to the bank as my savings are low. Due to the nature of this termination, I want a face-to-face meeting. I arrange to meet with my relationship manager.

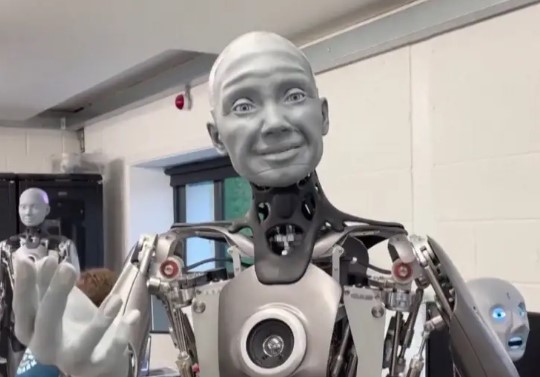

Walking into the branch – do we still call these branches? – I find my relationship manager is very welcoming although, I have to admit, maybe a little bit scary.

I explain the situation and it tells me that they can extend support for a maximum period of 182 days. What happens after 182 days, I ask. You will be terminated, it says.

OMG, WHAT?

In desperation, I leave the bank and wonder what to do. Obviously the answer is to get another job. But, what job?

I go to the job centre app to see what’s available. There’s not much. Robofixer, robo-maintenance, robo-support? These are not really my aims. I want something only humans can do, like love and relationships and thinking. I hadn’t realised that all of these jobs were now taken by robots.

Then there’s a job that pops up that really stands out. Creator.

Creator. I can be that. I can create. I don’t know what I will create, but I’m sure I can.

I apply.

Within a minute, a message responds saying that I can meet with them the next day. So, the next day I go to their office. The roboguard asks for my name and why I’m there, and I tell him I am here as a possible creator.

Excellent it says. Please take a seat.

After a short time, a robosec arrives and takes me into the lift to the office for an interview. Arriving for the interview, I realise that this is not the job for me.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...