I’m talking about KYC and client onboarding again in a February 1st webinar, hosted by American Banker. The onboarding of clients is the worst part of financial services, because it has an overly onerous requirement to gain proofs. Proof of address, proof of identity, proof of existence, proof of life. You name it. It gets worse as you often have to make these proofs when calling the financial firm. Give us your name, account number, date of birth, inside leg measurement, DNA and more.

These things are all well and good in the scheme of things however, as it is ensuring that people with insidious and false agendas are excluded from the system. Well, that’s the idea … but that idea has failed big time.

The estimates vary, but there’s definitely a lot of accounts out there that are false.

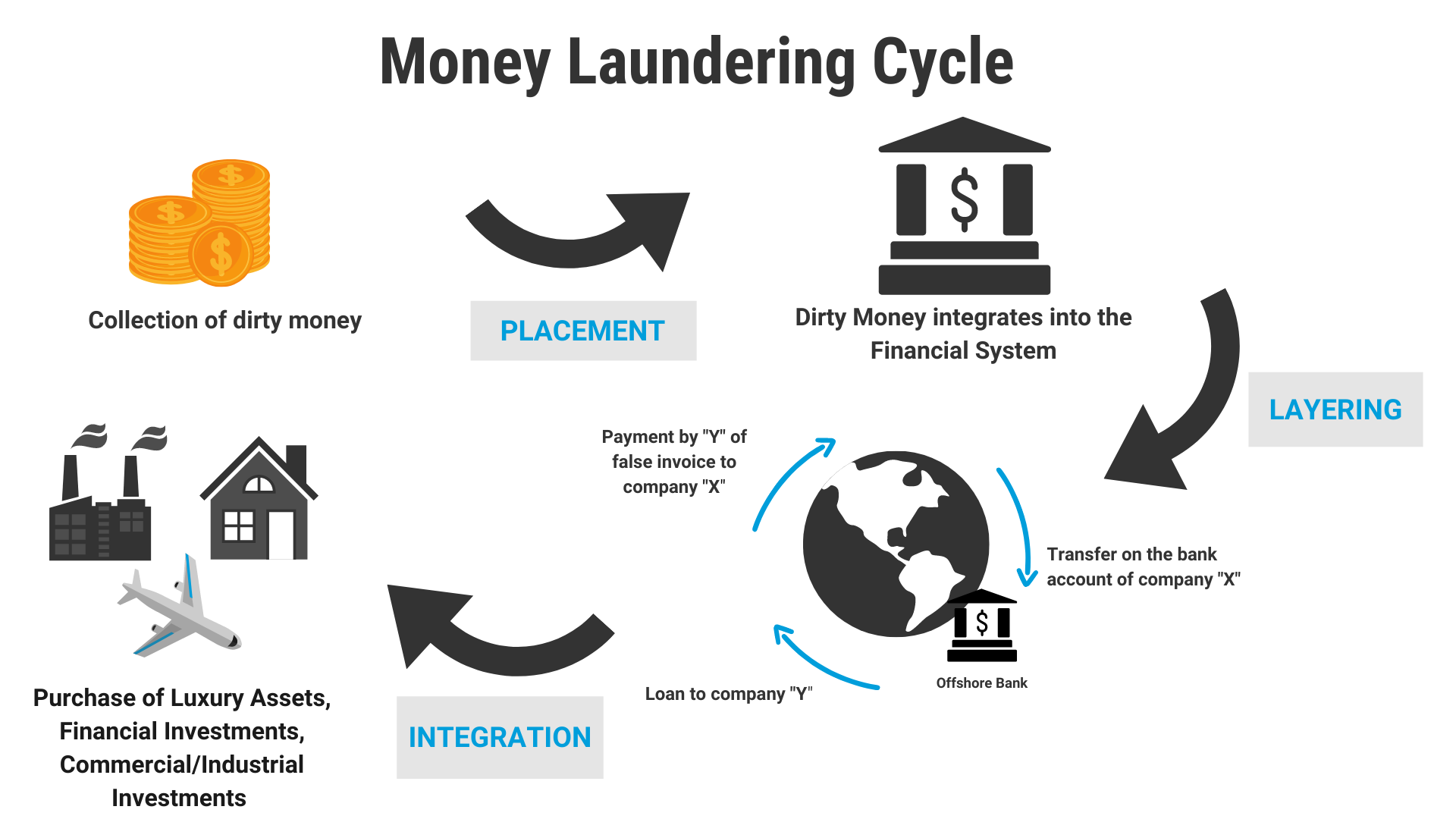

False negative and false positive. A minefield of possible corruption and crime. Now, most of us are not criminals. We toe the line and accept authoritarian controls. But there’s always a small number who do not. They buck the system and use it for nefarious means. Unfortunately, it’s not a small number either. The amount of money laundered through financial markets is estimated to be around 2-5% of global GDP or, in context, $800 billion to $2 trillion dollars (which, imho, is underestimating but hey, it’s the United Nations).

Thanks to Napier for the facts, here’s the picture:

- The average global money laundering risk score – as reported by the annual Basel AML Index - saw an increase in 2021 from 5.22 to 5.3 (out of a maximum score of 10)

- Global financial crime fines handed out in 2021 totalled $9.95bn, down from 2020’s record breaking figure of $22.86bn, according to a report by AML Intelligence

- Corruption, bribery, and fraud accounted for a whopping 69.6% of FinCrime fines handed out in 2021

- FinCrime fines fell by 78% from 2020 to 2021, with just $2.86bn given out compared to $13.15bn in 2020 – $7.2bn of which related to the Malaysian 1MDB scandal

- 22.0% of money laundering offences in the US in 2020 involved loss amounts greater than $1.5 million

- The median amount of money laundered in the US in 2020 was $301,606

- Despite its association with the Silk Road and the dark net, only 1.1% of all cryptocurrency transactions are known to be illicit

- In EUROPOL’s 2020 highlights, they reported the recovery of $22,553,523 in cash; 118 bitcoins, 4 properties, gold and silver coins worth a total of $6.26 million, and $2.39 million worth of asset seizures from criminal finances, money laundering and asset recovery operations

- The NCA estimates that fraud alone causes losses to UK consumers, businesses and the public sector worth around $258 billion every year, and that money laundering costs the UK more than $136 billion a year. Combined, these figures are equivalent to 14.5 % of the UK’s annual GDP

- The amount of criminal funds that are either channelled through the UK or facilitated by UK structures, “can reasonably be said to run into the tens of billions of pounds, and probably the hundreds of billions” (The UK Treasury Select Committee)

- Serious and organised crime costs the UK an estimated $50.4 billion a year

What this means as an outcome is that we are all suspects until we can prove who we are. It comes back to those proofs. Those proofs can be forged however, and then the job is to find the frauds. And to do this ensuring you allow the bona fide into the system and exclude the criminalis.

There’s a balance.

The challenge is to work out that balance. Do you check everyone? Some? A few? Is everyone a suspect or is it one in million? Or a billion?

It reminds me of the airline industry, where we have body scanners and bag checks. Because one shoe bomber boarded a flight, we now have to take off our shoes, belts, coats and jackets, and have everything scanned for the possibility that you are a bad actor. It’s the same in the banking system but, unlike the airlines, I get the impression that more bad actors get through the checks than those who board aircraft. The difference is that, if you buck the banking system, the system doesn’t crash with hundreds of lives … or does it? That is the question.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...