This week is Davos week when the mega-rich and powerful gather in a mountaintop miles away from any airport access, apart from private aircrafts of course.

The theme of this week’s Davos is Co-operation in a Fragmented World

“We see the manifold political, economic and social forces creating increased fragmentation on a global and national level. To address the root causes of this erosion of trust, we need to reinforce cooperation between the government and business sectors, creating the conditions for a strong and durable recovery. At the same time there must be the recognition that economic development needs to be made more resilient, more sustainable and nobody should be left behind,” said Klaus Schwab, Founder and Executive Chairman, World Economic Forum (WEF)

Source: WEF Press Release

That’s all business speak. The bottom-line is that the world has moved from globalisation and harmonisation to localisation and isolation. This is what fuelled the Russian invasion of the Ukraine and the sabre rattling of Donal Trump with President Xi. We are in a world of change, and I find it very sad. For the past twenty years, connected via the internet, we have moved rapidly to a globally connected world; now, we seem to be reversing this progress and focusing the other way.

As Gideon Rachman says in The Financial Times: “The fear haunting the WEF is that a long period of peace, prosperity and global economic integration could be coming to a close — just as it did in 1914.”

The problem with this isolationist approach is that it destroys most of the progress of the last century. Instead of having reliable supply chains, the chains are broken. We can see that we the supply of wheat and other materials from the Ukraine creating famine and fights in Africa. We can see that from amazing technologies in China being banned from use in America. We can see this from major companies like Apple, suddenly finding markets blocked from their supply.

The world is fragmented.

As The Economist says: “Mutual benefit is out and national gain is in”.

I guess it always has been but, thanks to communication and connection, I thought we had overcome these domestic agendas to create a more open world. We have Open Banking … can’t we have an Open World?

Maybe or maybe not.

Some see a shift in globalisation. For example Christian Klein, CEO of SAP, said at Davos that we are entering “the next phase of globalization,” with firms shifting their focus to building up resilient supply chains and improving their sustainability credentials.

Nevertheless, I could argue that we will never have an Open World because national leaders and governments create friction. Sometimes on purpose (Putin); sometimes by accident (Xi). Could you ever see a world where America, China, Russia and India could work together in unison? Woah, that’s a difficult question, but I can see a world where I can work with American, Chinese, Russian and Indian friends in unison. In fact, that is the world I live in.

Thanks to social media, cheap travel and easy communication, I have friends in almost every country of the world and, having travelled to most countries of the world, the clear thing that resonates with me is that almost everyone just wants one thing: a happy life.

The things that make lives unhappy are poverty and the actions of national leaders to cause trouble.

Maybe we can create a unified world, and I’m interested to see what Davos comes up with this week to address that question … if they can.

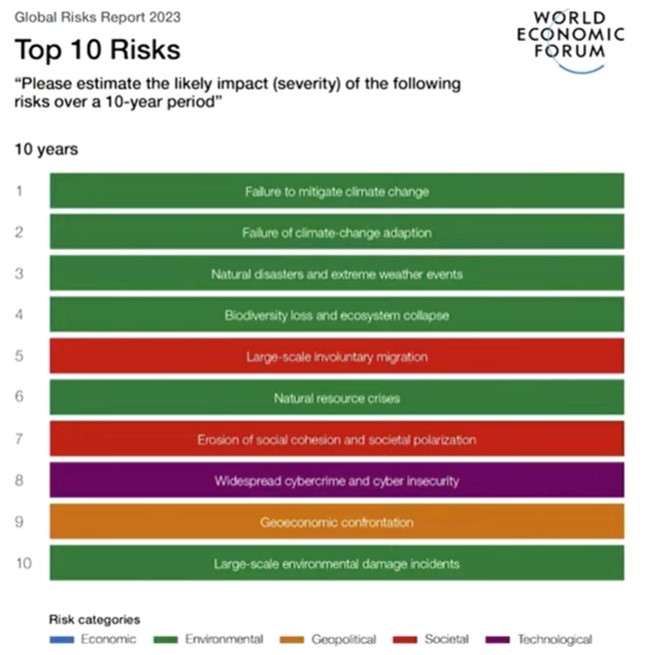

Meantime, returning to Digital for Good, there are other worrying things out there right now.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...