Having covered the general economic outlook, let’s take a specific view of the banking sector. Not FinTech. Banking.

According to Bloomberg, there will be six key trends emerging in the banking space:

Big Banks Will Be Fine: big banks are well-positioned to weather what is expected to be a turbulent year. While capital levels are strong, a recession would force lenders to set aside much more in reserves to cover bad loans, which would hurt the bottom line and potentially add to the layoff lists. Other banks are struggling more. Smaller lenders can’t grow, except by acquisitions, and midsize ones are much more sensitive to regional dynamics, and don’t have as much capacity to invest in technology.

Mortgage Pain: the housing market was walloped by rising interest rates in 2022, and the number of new mortgages dropped precipitously. That’s expected to continue into next year, with TransUnion predicting the number of purchase originations at just above 4 million for the year — about half what they were in 2021. As lenders grapple with the down market for mortgages, they should focus on engaging with consumers in other ways, offering a range of banking services well before clients are even starting to look for a home.

End of ‘Fintech Tourism’: financial-technology firms rapidly expanded over the past few years, fuelled by venture capital investments and lower borrowing costs. That’s changing, and fast, as venture capital funding dries up.

Crypto Regulation: with the meltdown of FTX and high-profile investigations into Sam Bankman-Fried’s operations, cryptocurrency is an area ripe for regulation. Financial regulators have already trained their sights on the collapse and its fallout and, over the past year and a half, the SEC has argued that most tokens are just unregistered securities trading on the blockchain and now need to follow the SEC’s tough trading and investment rules.

Culture: there is meant to be more inclusion, diversity and ethnicity in banking leadership, and the big banks are likely to share data on their employee demographics that will reveal how they’ve been doing in the post-Floyd era. So far, there have been signs that progress is choppy. For example, big banks are lending less to black homeowners.

Investment-Banking Revival: some dealmakers are predicting 2023 will feature a rebound from this year’s slump, as they await a peak in the Fed’s benchmark rate.

From a different angle, I quite liked the write-up from McKinsey, who argue that banks need to break themselves up and focus on platforms.

“Banking is facing a future marked by fundamental restructuring. But we also believe that banks that successfully manage this transition will become bigger and more profitable and grow faster while leading to a value creation opportunity of up to $20 trillion.

“In the next era, banks can realign to compete in new arenas, organized around distinct customer needs. These arenas will expand far beyond the current definition of financial services, and they will also be hotly contested by a wide range of tech giants, tech start-ups, and other nonbanks. But this daunting reorganization, or breakup, could also provide banks with a huge opportunity: higher margins, new revenue streams, and loftier valuations. Ambitious banks can break free from stagnant valuations, thrive, and grow if they are willing to embrace the platforms of the future and make a few strategic, informed big bets.

“Why break up? First, economic forces and technology have ended the run of the universal-bank model, and investors already are recognizing radical specialization to be greater than the traditional one-stop shop. By contrast, the future model relies on breaking up into specialized platforms …

“The successful bank of the future will be defined as a network of platforms. Few banks will capture all of the ten platform opportunities described in this article in their regions, but many will participate in multiple platforms. Given the platforms’ enormous value creation scale, getting even one right can unlock tremendous value for shareholders and broader stakeholders alike. But success will come to only those banks willing to move beyond their traditional operating models. Banks should be prepared to evolve through multiple stages on their way to becoming a platform network.”

If you like TLAs then this Credit Suisse report on the banking sector in general is interesting.

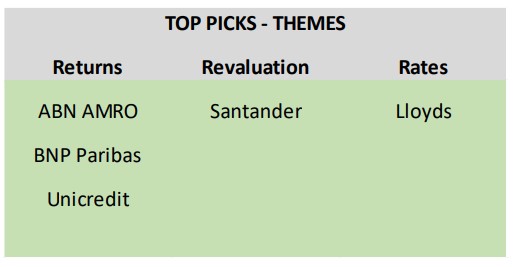

If you don’t like TLAs, then just take note of their top five picks:

Drilling down further, much of the banking outlook in 2023 seems geared towards further technology and digital change. For example, Sudhir Pai, EVP, Chief Technology & Innovation Officer, Financial Services Global business at Capgemini, looks forward to these six key changes:

Balancing Digitization With Evolving Risks And Sustainability: Sustainability is becoming a KPI of the degree of digital transformation.

New Levers For Operational Efficiencies: there are nine levers for cost transformation such as product rationalization, IT modernization and the hybrid workforce, that can be measured through business outcomes other than just cost savings.

Shaping The Future Of Regulated Markets: bridging the gaps between decentralized finance and traditional finance to unlock business value.

From Open Banking To Open Finance: we will see the emergence of many open finance ecosystem partnerships such as [banks] and automotive for the future of mobility, banks and energy companies toward sustainability, and sports and banks to finance the creator economy.

Instant, Frictionless And Interoperable Cross-Border Payments: silos of token networks emerge

The Expansion Of The Regulatory Compliance And Reporting Solutions Market: the complex data demands of the financial industry require firms to look out for suitable financial crime technology and software solutions to detect the threats they face

Mambu – a SaaS provider – surveyed lots of experts and their report is a mixture of business and technology predictions. In this blog, I’ll share their business views and, later in the week, the tech and FinTech ideas. From a business perspective, here’s a good view from Miguel Amaro, Partner at Deloitte Portugal:

“The global economy is in a fragile and fractious state. While most banks are on sound footing, Russia’s invasion of Ukraine, ongoing supply chain and energy shocks, persistent inflation, and tightening monetary policy will be felt unevenly across the industry.”

Interestingly, quite a few of the other expert commentatorsa focused upon small businesses (SMEs). Jeff Parker, Head of International at Marqeta, makes a good point about this area:

“As if being historically underserved by traditional lenders wasn’t enough, in recent years small businesses have had to contend with a raft of new headwinds which began with COVID-19 lockdowns and supply chain disruptions and now evolved into soaring inflation, high energy costs and now a historically weak pound.”

Mihaela Babici, Business Development Manager at Salt Edge, agrees:

“In a highly turbulent and tense environment, traditional financial actors alongside fintechs are focusing on meeting the exact expectations of SMEs, a sector that symbolically represents the challenges faced by financial services as we know them.”

It is clear that financing SMEs is a major growth opportunity for 2023.

From a techie view, Javelin research predicts three big things for banks in 2023:

“Online-optional parity”: Financial institutions are rethinking the meaning of digital banking parity. The industry is entering the era of “online-optional parity” – and it is forcing digital strategists not only to question the assumption that the two channels should match but also to rethink the future of online banking.

“In your face” security: The coming year will also force FIs to shift the narrative by making security an “in your face” topic; create one-stop security centers that address detection, prevention, and resolution; insert “speed bumps” in Zelle flows; and build the use of empowering features such as card controls, notifications, and gamification.

The purpose of automation: 2023 will call for bankers to reset their goals for search, chatbots, virtual assistants, and other automated features. Going forward, automation will be measured by its ability to deliver more satisfying digital experiences, deepen awareness and engagement with digital features, and deliver personalized experiences and coaching.

I am aware that there is a lot more commentary out there, and predictions for banking in 2023. Equally, as stated, I haven’t commented here about FinTech or general Tech, as those are areas to cover later this week. Anyways, trust you found this of interest.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...