Last year I invited Gail Bradbrook, co-founder of Extinction Rebellion, to write a monthly column explaining her motivations and methods. You can read those, and other climate and ESG related blogs, here.

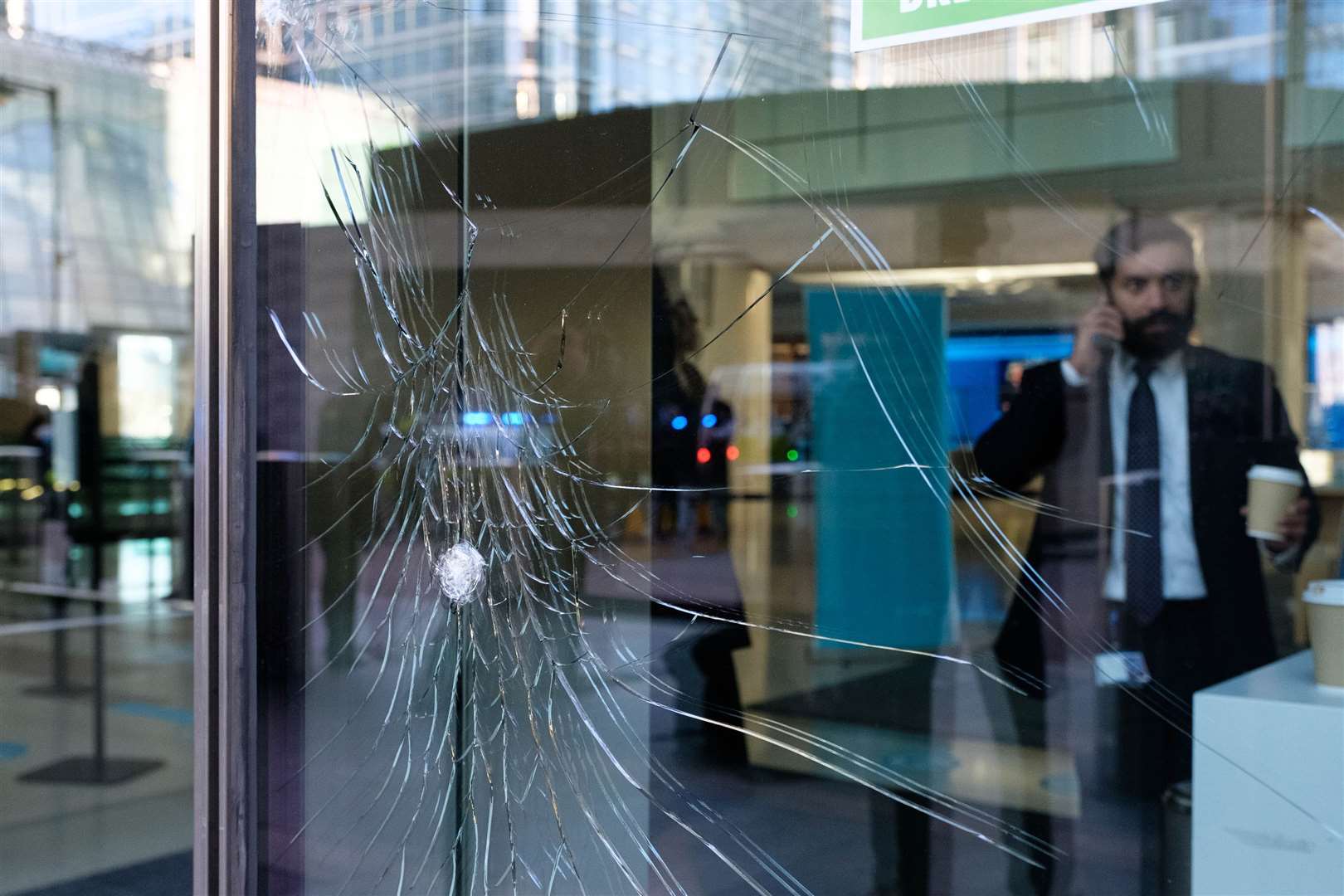

One specific column she contributed was asking how they could justify breaking bank windows. Extinction Rebellion lobbied HSBC and Barclays Bank specifically in 2021, breaking the bank's windows in Canary Wharf. Gail's position is that the action is justified by the fact that you only get real change if you are really heard, and is based upon activist consumer movements like those of the suffragettes a century ago. How do you achieve change unless you wake up the changemakers or, as Emmeline Pankhurst put it, we are not law-breakers but law-makers.

Unfortunately for Gail and her supporters, they got charged with criminal damage and were in court last week about to be sentenced. The sentence? Six to eight months in jail ... suspended for two years.

The key here however is their methods have resulted in action. For example, HSBC recently agreed to stop funding new fossil fuel projects. That's some progress as they invested £81 billion into fossil fuels between 2015 and 2021, the second highest of any bank in Europe (Barclays Bank is #1).

Now Barclays is under the microscope and Extinction Rebellion’s collegiate have drafted a letter they urge all of us send to the Chair of Barclays Bank, Nigel Higgins. Feel free to cut and paste as you see fit ...

TO: Nigel Higgins, Group Chairman, Barclays Bank PLC, 1 Churchill Place, London, E14 5HP

SUBJECT: Concerning the sentencing of 7 women for nonviolent direct action: 1 Churchill Place in April 2021

Dear Mr Higgins

I hope you are well. I am writing to you concerning the recent sentencing of 7 ordinary women (including mothers and a grandmother) in relation to their action and the subsequent damage to the windows of the headquarters of your organisation. The motivation behind their actions was to raise the alarm about your organisation’s investments in fossil fuels, ecosystem destruction and global plastics supply chain. The purpose of my letter is threefold;

- to ensure you are aware of their action, the rationale behind it and the resultant sentencing;

- to ask if you would please reconsider the company’s strategy in relation to your investments in fossil fuel projects, ecosystem destruction and plastics supply chain; and

- to ask if you would share the contents of this letter and your response to it with your employees;

In terms of the first point, on 27th January 2023, 7 women were sentenced at Southwark Crown Court for causing “criminal damage” to the windows of your headquarters, following their action in April 2021 and trial in November 2022. The sentencing ranged from 6 to 8 months custodial prison sentence with court costs. The judge in the summing up heard of the personal contributions each person is making to society through their roles and voluntary work, their character references and he noted that climate change is a major crisis affecting humanity. He decided to suspend the sentences for 2 years. As I'm sure you can imagine, the stress of waiting 21 months between the action and the verdict with the potential penalty of up to 4 years imprisonment hanging over these women and their families, as well as the stress of the actual trial and verdict was significant. None of the individuals taking the action had anything to gain from the action and indeed a lot to lose. They felt that they had no alternative because other actions such as demonstrations outside Barclay’s buildings, and voting in shareholder meetings, appear to have had no effect.

And so, my second point is to ask you to please reconsider your investment strategy in fossil fuel projects, ecosystem destruction and the global plastics supply chain. According to various trusted sources, the organisation which you lead has invested around $166bn since the Paris Agreement, making Barclay’s the largest investor in fossil fuels in Europe. This is in addition to Barclay’s being highlighted as one of the biggest funders of the global plastics supply chain and ecosystem destruction. Perhaps you don't fully understand the relationship between fossil fuels, ecosystem destruction and plastics on climate breakdown and you and the board would benefit from input from leading scientists?

I am asking you to do the right thing - be on the right side of history and show the leadership and courage to stop funding these destructive activities. Such a leadership stance from you would have a huge ripple effect across the industry and beyond. I appreciate this isn’t easy, but then very few important decisions are easy, especially when a moral imperative is in conflict with a profit/shareholder motivation.

Thirdly, I ask you please to publish this letter together with your reply, to all your employees to ensure that they understand why ordinary women have been willing to take such action in respect of your organisation and what your reaction to it is.

Thank you for your time in considering this letter and I look forward to hearing your response.

Chris Skinner, CEO, The Finanser

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...