A long time ago – so long ago that most people reading this weren’t born or had just started school – I said to my boss that cash machines were dead. At the time, I worked for NCR which stands for National Cash Registers, the cash machine company. The comment was not a popular one.

But then I’m an optimist and like to be constructive. My proposition was that we should switch from cash machines to multimedia machines. Machines that could provide all sorts of services from ticketing to access to video servicing. Guess that idea was way before it’s time but, today, it is time.

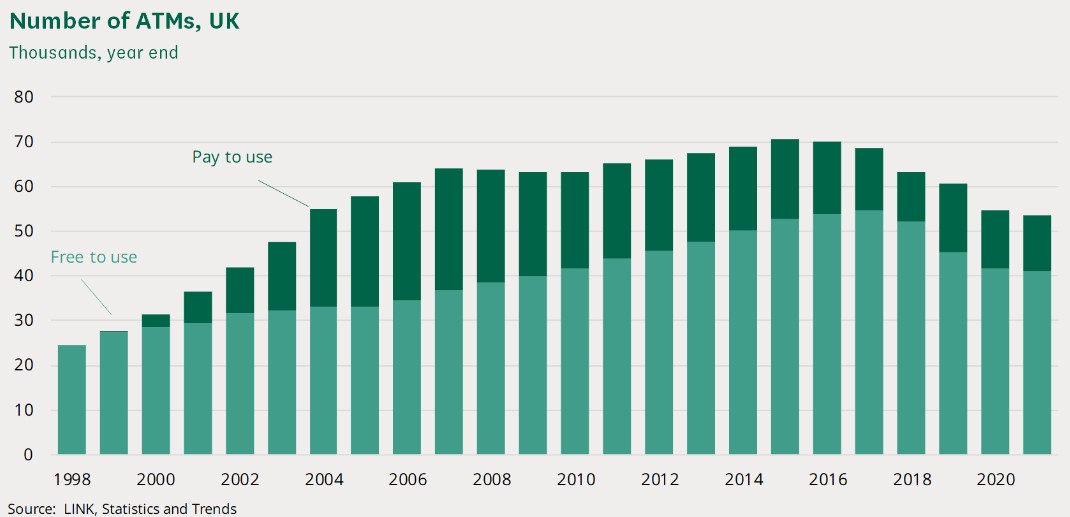

ATMs are declining in the UK:

Source: UKGov

The same is happening in Australia. The Daily Mail reports that ATMs in Australia are dive-bombing:

The number of convenient cash machines across the country have more than halved in five years from 13,814 in 2017 to 6412 in June 2022.

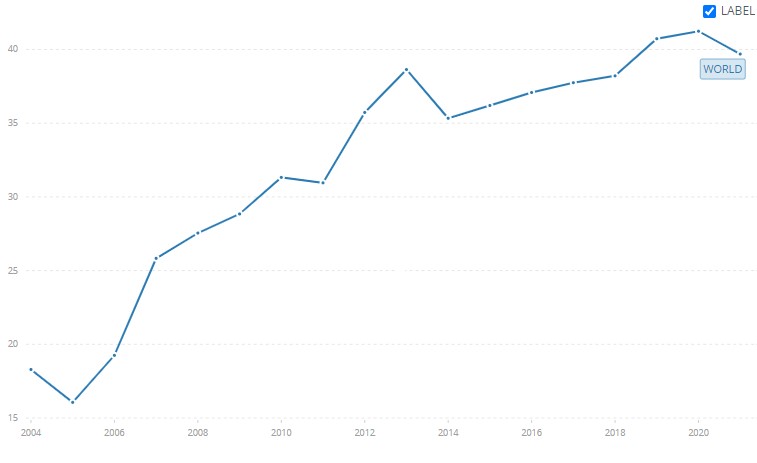

In fact, according to the World Bank, ATMs have reached a tipping point.

The real point is: why do we need a cash machine? When do you use cash anymore? What is cash for?

Most of us don’t use cash these days, as it’s easier to pay by card or, even better, by contactless app. In particular, the pandemic made us cash averse. The idea of using bank notes full of germs became a major issue. The erosion of cash will be interesting therefore.

For me, I would lament the end of cash for many reasons.

First, cash represents countries, history and life. The bank notes we use show our country, its icons and key elements.

Second, cash is the only way to pay that is immediate, trusted and anonymous. There is nothing like it … yet. We are getting there, with cryptocurrencies like Monese, but we’re not there yet. Not, at the very least, in an easy, transactional form.

Third, cash is something that we’ve used for centuries. It was invented in China over 3,000 years ago, and is a stable of society.

Fourth, I like cash. It’s physical and transactional. I even have bitcoin coin. I bought it a few years ago, on recommendation from my friend Jon Matonis, and it’s a coin that – if you broke it open – has the bitcoin address of a real bitcoin.

You may wonder why anyone would want a real bitcoin, but it’s because you can see it, touch it, feel it, use it. What’s the point of everything being digital?

It’s a bit like having everything held in a digital wallet. What happens when that wallet is compromised? What happens when you lose your digital access? What happens if you have no digital access?

Oh … I guess that’s like banking these days. Banking today is all digital. Branches have closed, cash is no longer needed, and cash machines have been dispensed with.

Net:net – yes, digital is great! But physical cash being eradicated means we lose a sense of identity at a national level. We lose the beauty of those notes and coins and, a bit like album covers for vinyl music, we lose something that is important to our humanity. It’s called physicality.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...