I blogged the other day about a decade of FinTech failures, but FinTech is not failing, it's flourishing as demonstrated by the numbers. For example I took note of Innovate Finance’s analysis of FinTech 2022 a month ago. The key headlines are:

The total capital invested into FinTech globally reached $92 billion in 2022, a decrease of 30% compared to 2021, when total investment amounted to $130 billion. The capital invested in FinTech in 2022 was spread across 5,263 deals - compared to 6,146 deals in 2021.

Overall, the US received the most investment in 2022, bringing in over $39 billion in FinTech capital, with the UK firmly in second place with $12.5 billion, rounded off by India with $5.5 billion, Singapore with $4 billion and Germany with $2.9 billion.

UK based FinTechs received $12.5 billion in investment spread across 546 deals compared to $13.5 billion across 583 deals in 2021, a decrease of just 8% from 2021. This is notably a much smaller decrease than the global average, with many other countries, including the US, suffering a double digit decrease in investment. London continues to be a leading global FinTech investment hub with $10.2 billion received in 2022, down only 5% from 2021.

The global slowdown comes with some exceptions including Singapore, which recorded an increase in investment of 41% from 2021.

Some countries have witnessed notable drops in investment in 2022 including China and Brazil, both falling down the global rankings with drops in investment of 65% and 57% respectively from 2021. Other countries, on the other hand, have jumped in the ranking, including France from 11th to 6th position and Singapore from 7th to 4th position.

So, it’s not all doom and gloom. Investment is down, but London is still leading the way.

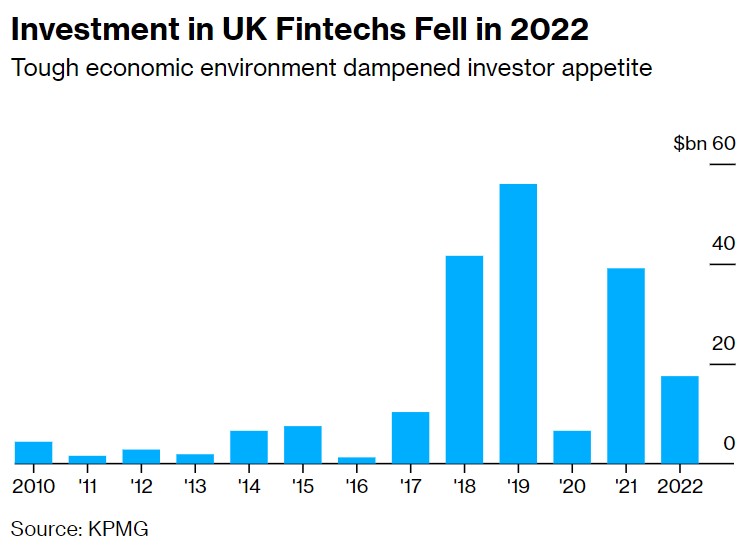

But then we get KPMG’s Pulse of Fintech report and a slightly different picture emerges.

According to their figures, global investment into the fintech market fell from a 2021 high of $238.9 billion to $164.1 billion in 2022. Nevertheless, despite the fall of more than 31 per cent, 2022 was still one of the highest years on record for fintech investment with some areas still seeing growth. For example Regtech, as a sub-sector of fintech, grew in size reaching $18.6 billion.

A little more worrying is that KPMG’s figures showed investment in UK FinTech more than halved in the last year. UK fintech investment fell from $39.1 billion in 2021 to $17.4 billion in 2022, a 56 per cent drop.

Hmmmm … but then there’s lies, darned lies and statistics. For example:

- As of 2021, there are 8,775 fintech startups in the Americas according to Statista; whilst FinTech Control Tower report Asia-Pacific has 4,765 fintech startups (2020) and EMEA 7,835

- As of 2023, the fintech space is worth $179 billion

- There are approximately 30,000 fintech startups

- Fintech bank assets grew by 105% from 2013 to 2022, while traditional bank assets grew by 75%

- Fintech companies acquired $210 billion in global investments in 2021.

- The total transaction value of digital payments is expected to reach $8.49 trillion by the end of 2022

- Insurance fintech companies raised about $15 billion in investments in 2021

- Around 90% of Chinese citizens use fintech banking

- As of October 2022, there were 323 unicorn fintech companies worldwide

On that last note, who are these unicorns?

Well, here’s the Top 10:

| Rank | Company | Value (US$B) | Value Date | Founded | Country |

| 1 | PayPal | $93 | 7 Feb ’23 | 1999 | USA |

| 2 | Ant Technology | 75 | Bloomberg Aug 2022 | 2014 | China |

| 3 | Stripe | 67 | Information Jan 23 | 2010 | USA |

| 4 | Shopify | 65 | 7 Feb ’23 | 2004 | Canada |

| 5 | Adyen | 54 | 7 Feb ’23 | 2006 | Netherlands |

| 6 | Block (Square) | 49 | 7 Feb ’23 | 2009 | USA |

| 7 | Revolut | 33 | July 2021 round | 2015 | UK |

| 8 | Afterpay | 29 | Aug 2021 exit (Block) | 2014 | Australia |

| 9 | Binance | 25 | Bloomberg June 2022 | 2017 | Malta |

| 10 | Chime | 25 | Aug 2021 round | 2013 | USA |

And here’s a list of a few in London:

- Revolut

Since 2015, Revolut has expanded its digital banking services from just money transfers and exchanges, to stock trading, crypto currency exchange or even peer-to-peer payments. With a valuation of over $33 billion, it is the country’s most valued FinTech and Tech start-up in history.

- Checkout.com

Checkout.com provides seamless cross border payments solutions for digital commerce. The company processes payments for big clients such as Pizza Hut, H&M, and even FinTechs like Coinbase, Klarna and Revolut.

- Wise

Formerly known as TransferWise, Wise provides money transferring services to over 10 million businesses and private individuals.

- ZEPZ

ZEPZ, formerly WorldRemit, is a digital payments platform that helps over 11 million users send money abroad through their computers, smartphones or tablets.

- BGL Group

BGL Group offers a range of motor, home and life insurance products to over 10 million customers in the United Kingdom. Additionally, the company also operates price comparison websites such as comparethemarket.com in the UK or LesFurets.com in France.

- Oaknorth

OakNorth received its full banking licence in 2015 and has since been servicing small and medium-sized companies. Since its inception, the FinTech has provided more than $5 billion worth of loans to UK companies such as Leon.

- Bought By Many

Bought By Many is the first pet insurance provider in the UK that offers online claims. Besides insurance, the company also gives its customers access to free online consultations with registered vets as well as a lifeline for pet parents.

- Zilch

Zilch provides a unique over-the-top platform with Open Banking Technology, which is a new way of defining Buy Now, Pay Later (BNPL) to prevent problematic debt. Zilch is known as one of the rapid-growing BNPL in British market.

- Starling Bank

Starling Bank is one of the UK’s largest mobile banking platforms offering current and business accounts. The FinTech has received four consecutive Best British Bank Award from 2018 to 2021.

- Remitly

Remitly is one of the cross-border payments company that leverages digital channels such as mobile phones, to send money across the borders. The company aims to provide faster, cheaper, and convenient money transfer service to its customers.

Sources: Fortunly; Finances Online; Exploding Topics; CFTE; and FinTech Labs

So, there's lies, darned lies and statistics but, whichever way you strip it down, these stats show an industry that is flourishing, not failing.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...