I recently stumbled across traceable-time-as-a-service (TTaaS) and found it fascinating, especially as time is purely something we invented.

That's why China - the fourth largest country on Earth - has one single time zone. At 7:00, the sun might go down in Shanghai, but it's still shining brightly three hourse later over Kashi in the west. Meantime, if you enter China from Afghanistan, you have to put your watches forward three and a half hours.

This has been picked up on by various people, and is even used in a UK advert for insurance today.

However, in financial markets – which we also invented – time is a critical factor, particularly in trading and investments. That’s the reason why colocation proximity data centres became a big thing for investment banks over the past two decades. On the one hand these led to flash trading disasters whilst, on the other, it enabled JP Morgan Chase to move from a lagger to a leader. Today, they’re the #1 investment bank in the world whilst, just over a decade ago, they were losing the plot. Time makes a difference.

In fact, this is the reason why colocation – where investment banks place their servers as near to the trading platforms and exchanges as possible – became key. The first bank to get the trade a nanosecond earlier than the next wins. That’s why TTaaS is a critical factor – to prove that trades happened when you say they happened.

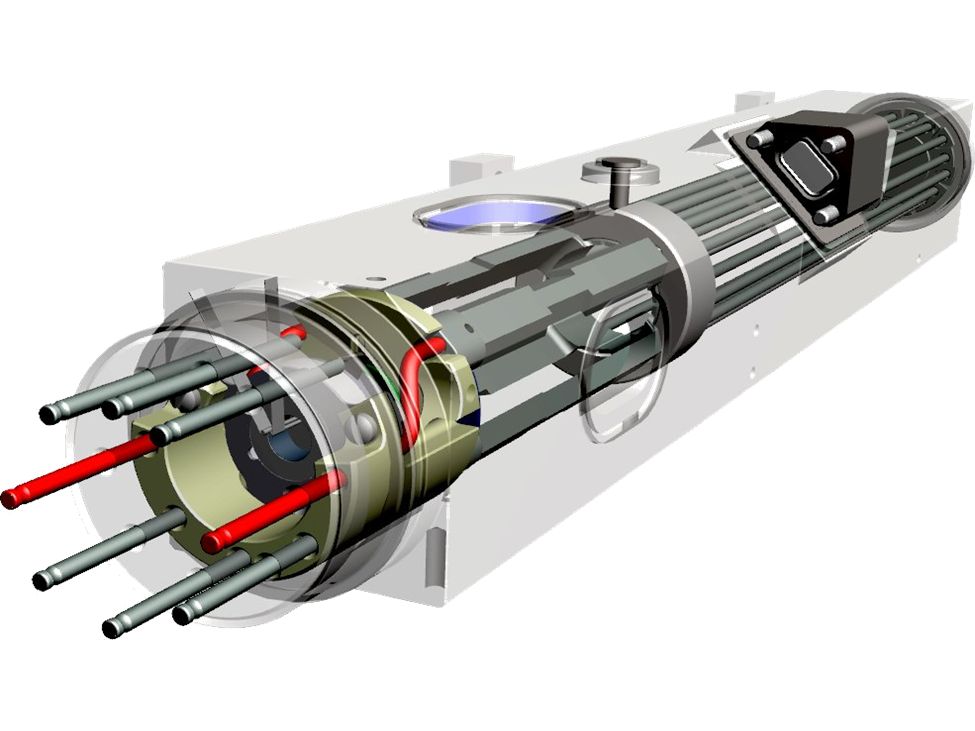

The core of what makes it work is the use of atomic clocks. Atomic clocks are a little bit different to the clock in your home or on your wrist. This is because most normal clocks use quartz crystals. These vibrate at an exact frequency when voltage is applied to them. Atomic clocks use quartz crystals but combine them with atoms to achieve greater accuracy and stability. The result is that they can identify time to a very exact level.

For example, NASA use atomic clocks to measure time and distance in space. Using such techniques and technologies they can work out wherever a spacecraft is and its distance from Earth to a massive degree of accuracy.

This is why NASA has a program called the Deep Space Atomic Clock (DSAC), which launched in 2019.

After launch, the clock becomes accurate to within a nanosecond after four days and will continue to maintain accurate readings for a long time to come. For example, it will be just one second off the right time after 10 million years.

On Earth, we don’t have so many atomic clocks, just a mere 400 or so, and using these clocks you can accurately track and trace time at a micro level across the world. This is why atomic clocks are now being used by banks.

Rather than buying the clocks however, you use the time stamping the clocks offer through cloud-based service providers, of which there are several. This is why it is called traceable-time-as-a-service.

To find out more I reached out to Richard Hoptroff, founder of TTaaS company Hoptroff to find out more about what TTaaS is all about.

Chris:

What exactly is TTaaS, and how did you get into it?

Richard:

Well, through a series of accidents, I've actually been doing tech startups all my life that are related to time. So my first business was an artificial intelligence forecasting software company. That was back in the nineties. And then I went back to university, ended a postdoc in archeology, developing dating techniques for measuring the age of buildings. I then got into smart watchmaking and ended up making the most accurate watches in the world. However, I didn't particularly like selling to consumers, so when the Markets in Financial Instruments Directive (MiFID II) and the Consolidated Audit Trail (CAT) regulations came in and banks had to start timestamping their transactions to millionths of a second, I decided to pivot to business and provide timing services to the financial services industry. So that's basically how it led to here.

Chris:

And why is it so important?

Richard:

Being able to establish what happened when is incredibly important. If you take something like the flash crash, what was it, 6th of May 2010, you had automated trading robots that had gone into a crazy feedback loop. Accenture's share price went to one cent and for one glorious moment Hewlett-Packard's market cap was $114 trillion. I mean, it just went crazy, and then half an hour later it went back to normal. Which was embarrassing enough, but the real problem was when they tried to unpick what happened. They couldn't, and still to this day, don't know what happened because all the clocks on all different machines were different, so you couldn't establish the sequence of events.

So the primary thing is to be able to establish the sequence of events in such an important industry that moves so quickly. Trading engines in stock markets, they match trades in something like 120 microseconds, so that's less than a 1000th, it's a tenth of 1,000th of a second. So establishing sequence of events to that level is vital to spot activities such as front running by looking at the time sequence of events. So that is why being able to analyze the sequence of events engenders trust in customers that they know that you're not engaged in these practices.

Chris:

Very good. You dropped out for a minute there, Richard. I'm sorry, I don't know what happened. But rather than repeat the question, I guess what interests me is when I was talking with your colleagues, the way in which you do TTAS, if I put it that way, it's been around for quite a while, but she was saying you use atomic devices?

Richard:

That's correct. I mean, most accurate timekeeping uses atomic clocks. We've probably got something like 30, 35 around the world.

Chris:

So what exactly is an atomic clock?

Richard:

Well, it's just like all other types of clocks. There's something that swings backwards and forwards inside to regulate the time, and a pendulum, balance spring, all these things, they set the time, but they're always inaccuracies come in due to temperature. So the idea of using an atom to vibrate takes away that dependency on temperature. So effectively, what an atomic clock is, is a fountain of atoms such as cesium or hydrogen, which you then set to vibrate using a maser, which is a microwave laser, and actually seeing when effectively it goes dark, and then you've got exactly the right frequency. And it's exceptionally accurate, it's so accurate that it's now used to define what the second is.

Chris:

This takes me down a little rabbit hole here, which is purely just because I'm interested in what your view will be. In my presentations I have one slide with Albert Einstein saying that time does not exist, we just invented it. It just intrigues me how you're in an area dealing with something that doesn't exist.

Richard:

Well, time is certainly an abstract concept, which is why we have difficulty grasping it. But if you think about it, if I go at certain speed, I get 10 meters in the time it takes for a pendulum to swing back and forwards, I call that 10 meters a second. The speed is real, the distance is real, but the time is kind of an abstraction to describe the rate of change of one thing compared to another. So in that sense, Einstein was certainly right, time scales can be subjective.

But what is absolute is causality, which means could one event have had an effect on the other? And globally, you can get clocks to agree to about a millionth of a second. And any smaller than that and the sequence of events... Well, the events couldn't affect each other anyway, so time then starts to become meaningless, unless you are dealing with very, very small islands of time.

Chris:

So just bringing it back to financial services, and you mentioned the flash crash and all the other things that go on in finance. Does using atomic clocks and the cloud provide an accurate timestamp on every trade to show exactly to a microsecond when it was transacted, or even more?

Richard:

Well, a microsecond is a millionth of a second. As I said before, time starts to become meaningless if you try to go finer than that, because simply events couldn't have affected each other except at very, very short distances in less than a microsecond.

Chris:

And there are some other companies in this space. How would you say Hoptroff is different?

Richard:

Well, I think the answer to that is our approach, or our elevator pitch if you like, is we'll make sure your clock is right. That's it. Just in the same way that when you flick a light switch, you expect the light to come on and you don't think about the power stations, the power grid and so on that made that light come on. We believe that we should supply time in such a way that you don't have to think about it. Because our customers, they didn't sign up, their job contract doesn't say, you're going to be managing time.

They've got a day job to do. They want this problem just sorted. All other solutions we see out there are things you have to cobble together. So you have to buy software from one person, you have to buy clocks from another, then you've got to maintain antennas on roofs and all of this. So really what sets us apart, I believe, it's we genuinely sell time, not stuff to help solve the problem of time.

Chris:

And I'm guessing that for most banks, this is really to do with regulatory reporting that you need the timestamping to be accurate.

Richard:

No, not at all. Many customers just do it because they need to follow the regulations. But in terms of business performance, being able to measure latencies, to be able to optimize them, do bottleneck analysis to work out where things are going slow and so on, it makes a very big difference where everybody's trading at high speed. And being able to get to the market fastest when the information is released is vital to actually getting the best prices. So it's certainly not just regulatory. At the high performance end of things, people actually use it to a large degree to actually improve what they do. I think it was Peter Drucker said that if you can't measure it, you can't improve it.

Chris:

I used to deal with low latency and proximity server co-location in-depth, and I'm just wondering how that market's adapted and changed in your experience in the last decade because, going back to the flash crash, I guess there's some different things happening?

Richard:

There are. I mean, the regulations have meant that it's harder to get away with shenanigans than it was back in 2010. And also it's getting harder to try and find faster communication routes because we're sort of approaching speed of light in many of them. So I would say a lot of the gold has already been dug in that area. But of course, I don't know everything. If somebody is doing something interesting, they tend to keep it quiet.

Chris:

So if you're looking out to what's next, what do you see on the horizon that's of interest?

Richard:

Well, I think really, the challenge for us as a company now is to take this way beyond financial services. I mean, the most obvious one is the media industry, which is transitioning to sending audio and video content over internet protocol rather than dedicated lines, which is a massive cost saving, but it needs a lot of synchronization along the way.

So that's a big opportunity for us and we're working with several large broadcasters at the moment in developing that technology. And beyond that is, it's just the whole idea that I think it's ARM, Advanced RISC Machines, said that by 2030 there would be a hundred billion devices with realtime clocks in them. Now, that's the market that interests me. How can I synchronize a hundred billion devices? I think we're only at the tip of the iceberg at the moment. There's a lot of clocks that could be synchronized and all agree. And that's a fun challenge and a fun future for our company.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...