A key to invisible finance is a digital identity and this is the hardest thing to crack. It’s been tried many times and failed often. Equally, there are many companies and institutions trying to solve this, but no-one seems to have succeeded. Having said that, Digiwatch estimate that governments will have issued about 5 billion digital IDs globally by 2024. A majority of governments that have issued digital IDs are in low and middle income countries in Africa and Asia.

Currently, the best example is Aadhaar in India. Launched over a decade ago when, at the time, India had no formal government ID system (like Social Security numbers in the US), and over a third of the population lacked a birth certificate. 60% didn’t have bank accounts.

Ten years later Aadhaar, the government sponsored and managed system, had onboarded a billion people and raised financial inclusion from 35% of the population to over 80%. A 2019 survey of nearly 150,000 households found that 95% of adults use their Aadhaar ID at least once a month and that 90% were somewhat or very satisfied with the program. The program, which had a budget of about $1.5 billion was credited in 2018 by UIDAI with saving more than $12 billion by reducing fraud.

It’s not all rose-tinted glasses however. There are instances where people are still excluded: a widow who was unable to receive rations and her pension, because she had lost her Aadhaar card; lepers denied access because they lacked all ten fingers; and deaths from starvation because problems with the system meant people didn’t receive food rations (source: UCLA Andersen Review).

Having said that, the Indian government with its India Stack is a leader in showing how to revolutionise a country, and a sizeable one to say the least, to be a digital leader. There’s a lot to learn there.

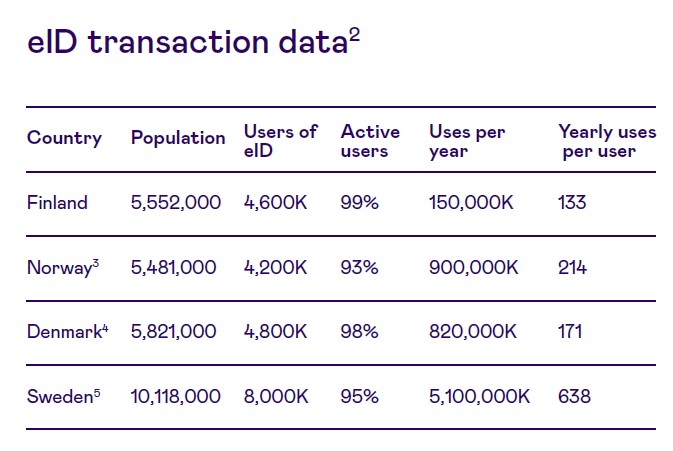

I used to think the Nordic region was a leader in this space, and they are. The Nordic countries represent one of the most advanced markets when it comes to the adoption of digital identities in day-to-day life.

According to Signicat.com, “citizens in these countries are able to conduct day-to-day activities like checking their account balance, do their taxes and book a medical consultation through simple interfaces that are as common as taking the bus. At the same time, the widespread use of digital identity in combination with digital signature solutions allow for efficient and secure handling of high-value transactions like signing a deed for a house, taking out a mortgage, signing a last will and testament or founding a company to name but a few use cases.”

All well and good, but you have issues when you move across borders. An eID from Sweden might not work in Denmark and vice versa. That’s why, in 2022, a multi-country consortium was announced. The aim is to deliver a large-scale, cross-border identity and payments system that could become the basis of the European Commission’s EU digital identity wallet program

The thing is that there is competition here. For example, also in 2022, JPMorgan announced Onyx

The idea of Onyx is to provide a solution that allows people to choose the identity credentials they want to share in their interactions across Web3, the metaverse and DeFi protocols. As the video says:

“As digital asset portability and ownership become more prevalent, you’ll need a digital identity that puts you in control over your identity credentials, enabling you to prove who you are, wherever you are by sharing only what you want to share. Imagine using only your credit score to take advantage of buy-now-pay-later options without revealing all of your personal information.”

The bank claims to be “the first global bank to offer a blockchain-based platform for wholesale payments transactions, helping to re-architect the way that money, information and assets are moving around the world”.

Talking of blockchain, and not used by Onyx, there’s Evernym. Evernym is a company I’ve been friendly with for a while, and now have over 1,000 clients.

They focused upon open sourcing digital identity abilities using blockchain years ago:

“Evernym was founded in 2013 to solve the digital identity crisis. We envisioned a world where consumers are in complete control of their digital identity, where privacy is a basic human right, and where consumers and organizations can foster a new relationship rooted in trust. We’re pioneering a new paradigm called Self-Sovereign Identity (SSI) that puts individuals in control of their data and enables people and organizations alike to benefit from a safer and more trusted Internet.”

It’s a great idea but, when I look at their website, the news seems to have dried up. What’s the problem? The problem is that everyone is trying to create a solution to a problem they cannot solve.

India has a solution for India; the Nordics have a solution for the Nordics; JPMorgan has a solution for JPMorgan; Evernym has a solution for their clients; but what we need is a Global ID system that works across borders, across the metaverse and is accepted by all.

That’s kind of like an impossible dream: could we create a global passport? Like your real passport, but one that works digitally and is accepted by all? Probably not.

The thing is, without such a scheme, you have to ask the question whether invisible finance, informed banking and the metaverse can work?

Finally, the World Economic Forum quotes an estimate that, if designed right, digital identities can provide countries with economic value equal to as much as 13% of their GDP, save hundreds of billions of hours through streamlined e-government, and cut trillions of dollars in costs for businesses by 2030. Surely this is worth trying?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...