Part of the reason why I started debating the point about bank branches is that there are places where you cannot find one for love or money.

In many places in the UK now, customers are being forced to make an hour long round trip to get cash or pay in a cheque. Some face a gruelling round trip of more than three hours to visit their nearest branch, a poll of 2,000 people carried out by Newcastle Building Society showed. In Australia, it’s even worse where, if you are a Westpac customer in the town of Kununurra, you need to travel 1,000 kilometres, or 620 miles, to your nearest branch.

It makes you wonder why they still need to go to a branch? Sure, get cash and pay in a cheque, but why do they need this? You can use digital wallets and who pays with a cheque anymore? In many countries, the use of paper cheques is banned. Equally, cash usage did decline significantly during the pandemic, so why have you gone back to using it?

Well, there are some who just cannot get the digital access. They don't use the internet or mobile telephones, and prefer face-to-face and cash usage. For example, I stumbled over a story about a 91 year old Barclays Bank customer whose joint account was deleted when her husband died and she asked for his name to be removed from the account. The bank assumed they had both died. She made two trips to the nearest bank branch to sort it out - that involved two buses - and the people refused to discuss her account as they said she was dead.

The issue for a 91 year old lady is how to then get this resolved?

Luckily the media picked it up, but pointed out:

“A Barclays customer for 65 years, she is unable to cope with the automated menus on the customer service phone line and, since her local branch closed, she is forced to take two buses to the next town to withdraw money and manage her account.”

As a result of The Guardian's efforts, she has her account back and A Barclays spokesperson said: “We apologise unreservedly for the distress and inconvenience this has caused to our loyal customer.”

Hmmmm ...

So branches are for those are digitally excluded? The old, infirm and digitally challenged?

Well, if you were Barclays Bank's CEO that wouldn't cut the mustard.

But then there's another big question, which is whether branches are there for consumers or business. We often forget that small and large companies need to deposit cash and meet face-to-face to discuss their needs and plans. This is another reason why branches are important. They may not be needed for me and you to get cash and deposit cheques, but they are necessary for trust and human connectivity, as discussed yesterday, and specifically for businesses that have needs to talk about those needs with an advisor.

Interestingly, going back to my Aussie reference of a 1,000 kilometre journey to get to meet with your banker, this was the first country where I was writing about video-banking fifteen years ago (I looked quite young then!). The fact that you live in a country so large, with many customers being farmers in locations that are remote, made sense to try to offer digital connectivity to the customer. Now, we see digital connectivity for all.

The thing is that I always believed you need to also offer physical connectivity. I remember discussing this many years ago, and said that the typical bank would end up with twenty percent of their branch network or less, but they would always have a branch network. Funnily enough, today, that is coming true. Particularly where you have large footfall streets or malls.

This is why Ian Stuart, the CEO of HSBC UK, was taken to task by a government enquiry the other day when he claimed that branch closures are what customers want. Asked whether branch closures were “all about profitability and reducing costs”, Mr Stuart replied: “It's following what the customers want … principally we look at the footfall in branches, we look at the products being used in branches and we work out what are the right channels for our customers … the rate of change in customer behaviours has been quite incredible in the last few years.”

He added that “footfall had reduced by 50% over the past five years” and “that the decline in branch use had accelerated since the pandemic” with some branches serving less than 250 customers a week.

True, but it doesn’t mean customers don’t want branches as demonstrated by the fact that his comments created an angry reaction from many pressure group representatives such as Caroline Abrahams, charity director at Age UK: “bank branches are a lifeline for many older people but their interests are losing out, it seems, to the allure of higher profits.”

Bank CEOs argue that the move to digital, online and mobile banking means it makes sense to close branches, but critics point out that where lenders close the last branch in town, communities are left without access to basic banking services, with older and vulnerable people losing a financial lifeline.

Mr Stuart told MPs “we are absolutely committed to a physical footprint in the UK, but we have to get it scaled properly for the long term.” He said 98 per cent of the bank's transactions in December were 'digital'.

NatWest's Alison Rose said the bank had 678 branches, due to fall to 657. Charlie Nunn, of Lloyds Banking Group said it would have 1,277 branches left after its latest closures. Barclays UK boss Matt Hammerstein said it will have 440 branches. that HSBC UK would have 325 branches left by the end of the year.

Branch trends from Statista for Europe:

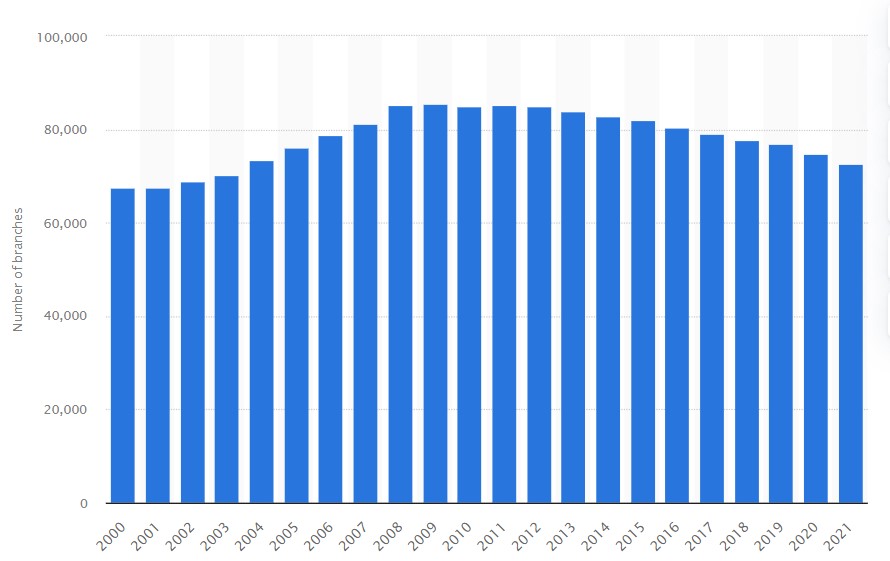

and America:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...